Wow. As I write, the Save The Reef documentary already has 876,814 views!

It’s been on YouTube for less than a week.

By the time this is published, it should be working toward 2 million views. Help us by sharing it. Copy this link to share: 50 Minutes to Save the World. Or click on ‘share’ on the video below.

(See how Karmagawa raises money and gives to charities on the Karmagawa FAQ page.)

This was a Herculean task. Check out the credits underneath the documentary on YouTube. You’ll see over 50 people who helped. I’m planning a dedicated post about the project soon. It’s in the works.

For now, I want to give a MASSIVE thanks to everyone involved. Also a shout-out to four amazing hotels where I and the team stayed during the project:

- Four Seasons O’ahu at Ko Olina located on Oahu’s western coast.

- Sheraton Grand Mirage Resort in Port Douglas, Australia.

- Hamanasi Adventure & Dive Resort in Belize.

- And Raffles Seychelles located on the island of Praslin in Seychelles.

A HUGE thank you to the staff at each of these hotels. Oh, and for you reading this, if you get the chance to visit any of these hotels I recommend them.

Wait, have you seen the documentary yet?

If not, here it is. Please watch, comment, and share. Let’s get this over 2 million views as fast as possible. Let’s get it to 10 million. Then 20 million. The more people we get to watch this documentary, the faster we can save the reefs. It’s such an important issue.

If you’ve already watched it, thank you. Please continue to spread the word. We’re talking about the very air we breathe.

One final thing about the documentary experience and I’ll get to trading…

If you read last week’s update you know I threw my back out three days before the premiere. There was editing left to be done. I could barely walk and at the premiere, I was hopped up on painkillers. It was brutal.

So, if you’re on an airplane and you have heavy luggage in the overhead compartment … be careful. Be meticulous. I wasn’t. I was only half awake after flying from Tokyo to Hawaii and I didn’t brace myself. My back got crunched.

Soon I’ll post a video on YouTube. It’s me presenting a webinar for Trading Challenge students and trying to trade with my back out. It’s about when NOT to trade. I’ll give you a hint now: I was slouched over, my back was killing me, and I was on painkillers.

You shouldn’t trade when you’re on painkillers. And you shouldn’t trade when you’re in pain. It messes with you. It messes with your trades. Not to mention, throwing my back out was the worst timing ever.

Trading lesson numero uno for this edition of the update: Don’t trade when you’re in pain and/or on painkillers.

Which leads me to…

Table of Contents

Lessons From My Trades

Part of the reason why I and my top students show all our trades on Profitly is to give you an idea of what it takes. We don’t want you to copy us exactly. We want to show you what’s been working for us.

We also want to show you when we lose — and why. We want to be transparent about it. We give you a full and clear picture of the risks and rewards.

It’s the same here on the blog. I want you to look at what I’m trading and see my thought process. I want you to see it is possible to turn a small amount into a big amount over time through lots of little trades.* But it requires adaptation to the market.

(Note: it’s not easy. Trading involves risk. 90% of traders lose money. My goal is to help you lose as little as possible while you learn. It takes time and effort to be successful. It’s not guaranteed.)

This is super important — pay attention. It requires you to adapt to what works best for you. Your personality, strengths, and weaknesses all make a difference. My recent trading may not be exciting, but it’s meticulous. I focus on what I do best.

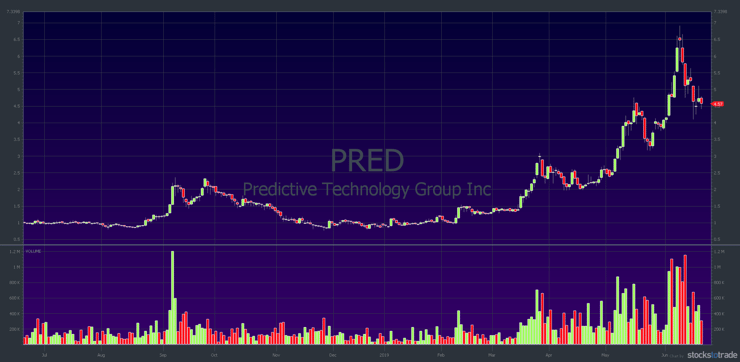

Predictive Technology Group Inc (OTCPK: PRED)

PRED spiked after this press release announcing a collaboration with Thermo Fisher Scientific. (NYSE: TMO) Thermo Fisher Scientific is a $100 billion company.

This trade had some positives and some negatives. One positive was the news. That’s the kind of catalyst I like. Now take a look at the long-term chart:

It’s a perfectly uptrending multi-month chart down off its highs — another positive. My thesis: it should bounce. But the volume was sooo weak. That was the negative. Even after a big partnership announcement the stock barely budged.

This chart shows where I made my trade.

I took small profits. As I often do, I sold a little too soon. I’d hoped to sell in the low $5s but it was meeting resistance. Less than an hour later, it did get there but it couldn’t do much after that. It spiked three times and then faded when people realized it wasn’t going to break the morning highs. Notice the low trading volume — that’s the big negative for this trade.

Overall this is my kind of trade. While it didn’t get a big spike like I wanted, I focused on a pattern I like with a catalyst I like. The lack of liquidity kept it from being a perfect trade for me. I only made a small amount. But, I traded based on my strengths.

And now…

Questions from Students

“Tim, what’s your best tip for avoiding study and trading burnout?”

As always, understand this is a marathon and not a sprint. Also, we’re in summer so remember summers are typically a little slower.

One of the reasons I travel so much and give time and energy to charity is to keep me from overtrading. I love travel and my charity work. But I also need something other than trading in my life.

You should have something else in your life. If you have a family or some other passion, don’t neglect them. Yes, study every day. Yes, put in the time and effort to develop the knowledge and skills necessary for success.

But don’t make trading the only thing in your life. Otherwise you’re just going to become a degenerate gambler like too many people. You’ll be trying to force trades and you’ll actually do worse.

Trading is counterintuitive. The more you want to trade, the worse you’ll do. You should NOT look forward to trading. Think of yourself as a retired trader. Only come into a trade out of retirement. Come into a trade when it’s so good that you’ll feel guilty missing it.

I know its a counterintuitive way of thinking about it, but it helps.

“When studying the past — including patterns and price action — how important is it to keep track of all the nuances?

Studying the past helps. You should know a pattern when you see it. But also know it’s not necessarily exact…

For example, right now morning dip buys aren’t working great. First green days aren’t working great. Shorting isn’t working great — a lot of shorts are getting squeezed.

So you have to recognize that sometimes patterns don’t work perfectly. That’s when you pull back. You trade with smaller position sizes — and sometimes you don’t trade at all.

Learn the patterns and keep studying. Over time, you’ll start to see the nuances and variations. But there’s no shortcut. You have to put in the time … over time. If you keep at it, you’ll gain experience and knowledge. But you can’t cheat success.

The question is: How bad do you want it? Are you willing to dedicate time every day for the next few years to learn what you need to learn? Remember, Tim Grittani — arguably, in my opinion, the BEST penny stock trader in the world — says he wasn’t consistently profitable his first 9 months.* And he’s incredible. So don’t think you’re going to match his time frame. You’re not. He’s exceptional.

All you can do is put in the time necessary to get there. Are you ready?

More Breaking News

- ALAB Stock Soars Amid Whispers of Strategic Partnership

- Coupang Faces Major Legal Challenges Amid Data Breach Fallout

- Deutsche Bank Boosts Coupang with Buy Rating and $25 Price Target

- Boxlight’s Strategic Partnerships and Innovative Initiatives Boost Market Position

If you’re ready, apply for the Trading Challenge right now.

Millionaire Mentor Market Wrap

That’s another update in the books.

Do yourself and the oxygen supply of the world a favor: share “50 Minutes to Save the World” right now. Go post it on one of your social media accounts. Do it even if you’ve already shared it. You never know who might see it this time. Every time someone new watches, it gains power.

Get inspired — not only about your future in trading, but also about changing the world.

Are you a trader? How does studying the past influence your trading? Newbie? Comment below with “I will study the past and I will focus on what works best for me.”

Leave a reply