Table of Contents

Why Investing in Bitcoin Isn’t for Me

Bitcoin might be buzzing, but you won’t catch me buying it any time soon.

Yup, I know what you’re thinking … But Tim! Bitcoin is hot and only getting hotter! Get in now!

In my opinion? This type of FOMO is exactly what makes fools of traders.

Yes, Bitcoin’s been getting a lot of press lately. For one thing, it’s been spiking like crazy.

For another, the President recently trash-talked it publicly. But that didn’t bring down public opinion (or more importantly the price) of the most famous cryptocurrency.

It’s almost like his anti-Bitcoin tweets actually reinforced the idea that Bitcoin matters … and even more people started buying.

True, there are traders out there who are successfully investing in Bitcoin — some of my students are among them. And I think that’s great. But personally, I’m not interested.

Why not? Here, I’ll talk about my personal opinions on Bitcoin, and why, in spite of the fact that I watch its progress, it’s not on my personal watchlist.

What Is Bitcoin?

Bitcoin is arguably the most famous cryptocurrency out there.

What’s a cryptocurrency? Well, let’s start there…

A cryptocurrency is a type of digital currency that’s regulated via encryption techniques. Thanks to the magic of encryption, the units of digital currency and transfers can be operated without the involvement of a central bank.

Cryptocurrencies are maintained through a sort of ongoing digital ledger that records all cryptocurrency transactions. It’s called a blockchain.

The blockchain can’t be changed, and every purchase and transfer is recorded without the need for external verification. It’s a way to cut out the middlemen. And this system has the potential to revolutionize and change the banking system forever.

Read more about cryptocurrencies in my post about ICOs (initial coin offerings).

The History of Bitcoin

Bitcoin is kind of shrouded in mystery. Here’s a brief synopsis of its unusual beginnings:

In 2008, the domain name bitcoin.org was registered, and soon after, a paper detailing the bitcoin software called “Bitcoin: A Peer-to-Peer Electronic Cash System” was released by someone named Satoshi Nakamoto. Soon after that, Bitcoin software debuted in January 2009.

The weird thing? To this day, nobody knows who Nakamoto actually is. He was a big online presence with Bitcoin at its inception. But then in 2010, he handed over the source code to someone else and basically … disappeared.

Did he go off-grid because of CIA pressure? Could it be that it’s not even a real person but a group of people? Is he actually Banksy? There are plenty of theories, but not much that we really know for sure.

Even without Nakamoto, Bitcoin gained traction. Early adopters were black markets — famously the dark web site Silk Road.

While Bitcoin as a payment method didn’t and still hasn’t become the norm, it’s created some huge moves in the market.

Bitcoin Trends

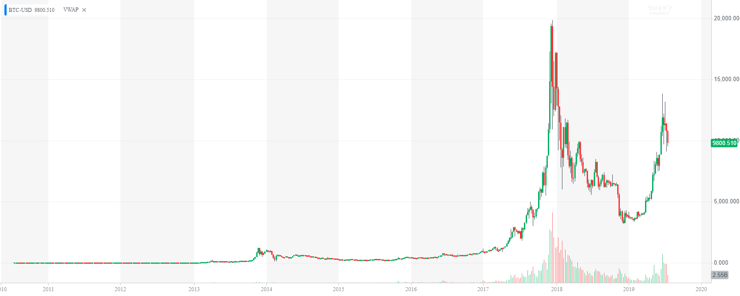

There’s a trend with Bitcoin: peak, then crash. It follows this pattern over and over.

In the early days, you could buy a Bitcoin for about 30 cents. But once the idea of a decentralized currency caught on, Bitcoin’s value went up in a BIG way. By 2013, it reached a price of over $1,000 for the first time.

And then it crashed in 2014 following a hack, and the prices remained low for a few years. But in 2017, it started to explode.

In January of 2017, Bitcoin was selling in the $900s. On December 17 of the same year, it peaked at over $19,000.

But not everyone was ready to embrace Bitcoin. For example, China banned cryptocurrencies in 2017.

Then, a series of hacks from crypto exchanges brought prices down due to fear. In the first part of 2018, there were a ton of crypto thefts. Even though they weren’t from Bitcoin, they left investors shaken. Prices dropped.

Check out the chart:

But now, Bitcoin mania is back. Several of my students have been trading it, and for some, it’s considered the hottest momentum play in the market.

More Breaking News

- QuantumScape Takes a Big Leap with New Battery Line

- Spotify’s Financial Surge: Poised for Growth Amid Upgrades and Strategic Moves

- GTM Stock Falls Amid Latest Earnings Report and Market Reactions

- Vale’s Stock Soars Following Significant Price Target Increases

My Historical Take on Bitcoin

Bitcoin has definitely been a hot asset class. But it’s also surrounded by plenty of controversy.

In 2017, the mania was spurred by people convinced it was the future of currency. But just as many people thought it was a scam or at least overvalued. That indecisiveness can cause volatility.

There’s also a lot of fear-based decision-making when investing in bitcoin. For example, after a series of massive crypto hacks in 2018, the price of Bitcoin went down — way down.

Honestly, I think that Bitcoin can be a lot like penny stocks. A lot of what happens with Bitcoin feels like a large-scale pump and dump.

But Tim, you may be thinking, you love penny stocks! So if Bitcoin is like a penny stock, why not jump in?

Why Investing in Bitcoin Isn’t for Me

Based on Bitcoin’s past performance, I’m not super inclined to buy in. Why not? Here are some of my personal reasons:

5 Reasons Why Bitcoin Isn’t for Me

1. Not Enough Information

I’m not just a trader — I’m a detective. I’m a huge fan of stock research. I take the time to perform detailed technical and fundamental research to make the most educated decisions about a stock.

So it’s not uncommon for me to look at stock charts on StocksToTrade and watch for patterns.

Then, I back up my theory about potential patterns by looking at the company’s earnings reports, balance sheets, and company news that can help tell me if a stock might go up or down.

Thing is, you can’t do this quite as thoroughly with cryptocurrencies. They’re incredibly hard to value, and there are no standard documents or metrics. All that you can really find is the number of transactions and how fast they go through.

This really doesn’t tell us much about the cryptocurrencies at all, and it makes proper research impossible.

2. It Hasn’t Changed the World Yet

People keep saying Bitcoin and cryptocurrencies will change the world. Well, other than making a splash in the stock market, it really hasn’t changed the world yet.

You don’t see huge chains accepting it, because it hasn’t proven itself. So, any talk about it changing the world at this point is cheap.

Yes, there’s potential. But there are no guarantees that an investment in Bitcoin won’t just crash and burn.

3. The Emotional Rollercoaster

Cryptocurrencies are primarily popular with retail versus institutional investors. This means it’s mainly individuals rather than market influencers who are buying Bitcoin.

Unlike the so-called pros, individual investors frequently trade based primarily on emotions. So, when people see crypto prices going up, they rush to buy in. When prices crash, they’re quick to get out.

There aren’t any of those big, steady investors to keep the Bitcoin market waters from getting too choppy. And that causes a TON of volatility in the Bitcoin market. So it can experience huge gains — but also swift and painful losses.

I love volatility with penny stocks, but since there’s so much that’s unknown with Bitcoin and so little research you can do, it can get pretty scary.

4. No Protection

Even penny stocks have to meet certain standards to be listed. True, penny stocks are held to less rigorous standards than major-exchange stocks, like Amazon or Starbucks, but there are still rules and regulations put in place to help prevent fraud.

With cryptocurrency, not so much. Since decentralized exchanges are anonymous, they aren’t protected as assets within the U.S. borders. That means in the case of theft … you could have a loss that will never be recouped, and there’s not much you can do about it.

And as we know, there have been crypto heists. For example, in 2018, there was a single hack that resulted in a $500 million theft.

5. The Price Has Gotten Ahead of Itself

It’s possible that the price has gotten ahead of itself with Bitcoin. Yes, Bitcoin enthusiasts will probably hate on me for saying that. You can hear me defend my point of view on a recent YouTube video with Tim Bohen!

To buy a single Bitcoin, the cost is now over $10,000.

Of course, unlike stocks, you don’t have to commit to an entire unit. For example, you could invest $500 and score a tiny percentage of one Bitcoin.

If that’s what you want to do, go ahead. Me, I prefer to stay safe and stick to what I know.

And that’s low-priced stocks.

When I have a profitable trade, it’s usually not a massive profit. But those small profits have a way of mounting over time.

Similarly, with low-priced stocks, I can keep my losses low. And this can be one key to long-term trading success.*

Final Thoughts on Bitcoin

Bitcoin may be the hottest thing in the market. But that doesn’t mean I’m buying it.

Bitcoin mania kind of feels like a modern-day gold rush. Fools rush in. I don’t wanna be a fool. I don’t feel like it’s proven itself, and the risks are too great for me.

Personally, I choose to stick to low-priced stocks. With penny stocks, I know that I can look at the fundamentals and the technicals and make a detailed trading plan. I’m not afraid of having smaller wins, because those can add up over time.

Trading Challenge

The market is constantly evolving. Bitcoin is just proof of this: In a relatively short amount of time, it’s created a whole new way to invest.

Do you want to learn to grow and expand with the market? If so, you need a solid foundation of knowledge of trading, market mechanics, and what to look for in stock patterns.

Learning as you go is one option, but you’ll probably learn a lot of things the hard way. You’ll probably lose money learning those hard lessons.

Why make it harder than it has to be?

My Trading Challenge is the culmination of my trading experience gained over more than two decades. It’s a way for me to teach traders all the things I wish I’d known when I was starting out in the market. Basically, you get to learn from my success … and learn how to avoid the same failures I experienced.

I want you to become a self-sufficient trader. You can learn things like how to recognize patterns and how to take advantage of them, and techniques for performing targeted technical and fundamental analysis.

By learning how to formulate a strong watchlist and trading plans, you’ll be better primed to take advantage of opportunities when you see them.

Ready to become a self-sufficient trader? Apply for the Trading Challenge today.

How do you feel about Bitcoin? Love it? Hate it? Leave a comment and tell me what you think!

Leave a reply