Among penny stocks, one in particular sticks out like a sore thumb.

It has brand recognition across the globe, boasts a $35 billion market cap, and currently has some of the richest bets in the entire options market placed upon it.

If you’re a millennial, you’re likely familiar with this company from burning hundreds of hours in high school playing “snake” on their devices.

Without further ado, let’s take a brief at a nostalgic retail favorite … Nokia (NYSE: NOK).

Earnings Surprise

Nokia reported surprisingly strong Q1 earnings last Thursday, with net sales up 9% and gross margin up 37.8%. They also disclosed a net cash position of EUR 3.7 billion ($4.4 billion USD) and a comparable operating margin of 8.5%.

Yet the most explosive beat was seen in the number every shareholder cares about most, earnings per share, which came in at a whopping $0.08 versus analyst estimates of $0.01.

The company’s stellar quarter can largely be attributed to the growth of 5G, an area within which Nokia aims to be a leader, and so far is proving as much. While they no longer make telephones (instead opting to license their well-known brand name to handsets produced by HMD) Nokia is still developing critical infrastructure tools for the future of 5G.

The follow-through in the price action has been strong so far, with the stock up 17% in three days, but a deeper view into NOK’s option chain reveals evidence that the meteoric rise may just be beginning.

Million-Dollar Option Bets

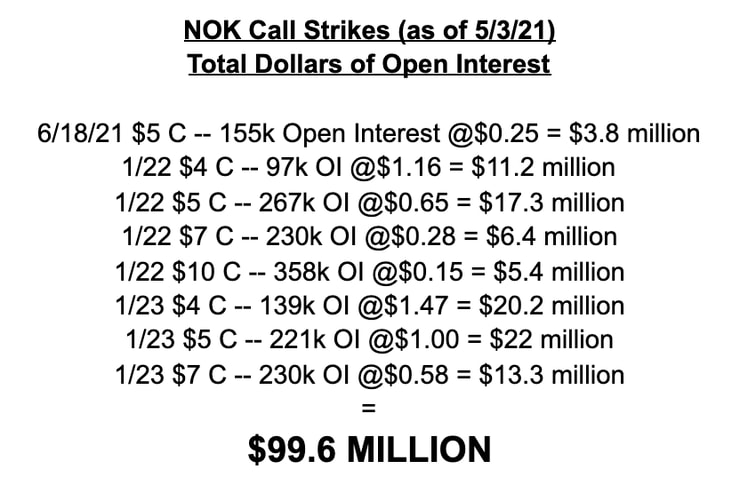

Outsized option bets, illustrated through large open interest (OI) on contracts, can provide traders with an indication as to where market whales believe future price action will be heading.

While no one has a crystal ball, and open interest is never a guarantee of an impending move, it is certainly a notable denominator when looking at the trajectory of a share price.

NOK certainly stands out from the crowd in the options market. For months, call buyers have been pressing their advantage, purchasing hundreds of thousands of out-of-the-money contracts (worth tens of millions of dollars) while the stock was languishing and implied volatility was at rock bottom.

The sheer volume of the contracts, coupled with the dollar value of the positions, is truly remarkable when viewed in tandem:

You don’t need to know a thing about the options market to see how strong call buyers’ conviction is in Nokia.

These contracts are depreciating assets, with the possibility of expiring worthless, yet traders are still laying out nearly $100 million behind their belief that NOK shares will exceed $5, $7, or even $10 by their respective expiration dates.

We can consider the possibility that a massively levered hedge fund is behind these trades, however, they could also be partially explained by retail traders’ fascination with the stock.

For several months, traders on WallStreetBets have been pointing to Nokia as an undervalued recovery play, ripe for monstrous gains.

Is it possible that the astute “autists” of #WSB are behind these massive bets? Will they use this spectacular earnings catalyst as a bludgeon to punish option sellers?

While it would certainly be on-brand for the subreddit, for now, we can only speculate.

Now that Nokia has delivered spectacular earnings, just as share and call volume swells to near-term highs, the table is set for a captivating game of tug-o-war.

Grab your popcorn, do your due diligence, and keep a close eye on Nokia in the coming weeks and months.

Posts contain affiliate links. Timothysykes.com may get compensated for affiliate posts and purchases through links.

Featured Image credit: rafapress / Shutterstock.com

Leave a reply