Everyone has a plan until they get punched in the face.

That saying was made famous by former World Champion boxer Mike Tyson, who I’ve had the pleasure to meet and spend time with.

2025 Millionaire Media, LLCTrading has allowed me to travel the world and meet interesting people like Mike Tyson. This is a photo of one of my millionaire students Kyle Williams, Mike Tyson, and myself.

It’s also a great reminder to traders right now, given all the market volatility we’ve been experiencing the last few weeks.

The markets don’t care about your plans or predictions.

You’ve got to be ready to pivot.

And that’s exactly what I had to do on Tuesday…

Despite spotting the perfect setup and putting myself in an advantageous position to book profits…

The market opened up significantly lower, forcing me to change my plan.

Today I want to spend some time talking about that setup and why I liked it so much.

And despite taking a loss, I will trade it again the next time I see it.

Table of Contents

High Probability Setup In Cecors Inc (OTC: CEOS)

Most of my students who join my program don’t have the luxury of trading full-time. They’re still working their 9-to-5, attending college, or caring for their family.

I can relate.

I spend most of my time traveling and working on my charitable foundation. For example, I worked with my charity last Friday in Asia.

The time difference makes it difficult for me to trade the close—however, I saw a setup that I liked and decided to take it earlier than I normally would have.

It was in Cecors Inc. (OTC: CEOS).

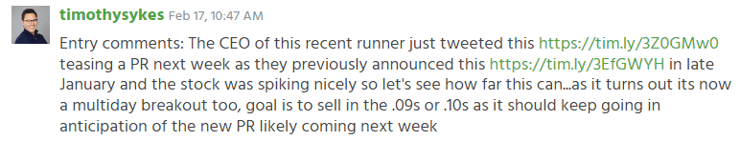

Early on Friday, the company posted this tweet:

Breaking It Down

The company announced it would be issuing a press release shortly. To the naked eye, that’s nothing special. After all, all they said was they were filing legal paperwork.

And in my opinion, the tweet was meant to attract newbie traders and promoters to the stock. A move that would likely pump the stock higher.

If you look at the daily chart, you’ll see the stock has traded well after issuing out press releases.

It’s gone from $0.02 to $0.09 in just a few short weeks.

And if you look at how it reacted following the tweet, you’ll see that the stock reacted positively.

More Breaking News

- WNS Surpasses Market Expectations with Strategic Alliance and Recognition

- BTBT’s Ethereum Strategy Sparks Investor Interest

- Enovix Surges After $60M Share Buyback Announcement

My Thought Process For The Trade

As I mentioned, there was nothing special about the tweet. But by doing my homework, I knew that the stock reacts well to press releases.

When looking at trades like this, I’m not judging the catalyst as much as I’m thinking about how traders will react to it.

You see, most traders who get into penny stocks are not sophisticated. They often react emotionally to stock pumps and have wishful thinking when they get into trades.

But I’m just trying to ride the pump, take profits, and move on to the next trade. From my experience, I’ve learned to expect the worst from these companies.

Ideally, I would have bought the stock much later in the day, but given that I was in Asia, I knew that I wouldn’t be around in the afternoon to trade this, so I decided to take a small position in the morning.

I really liked the price action because the stock was holding up well, despite its massive runup.

In fact, it was consolidating nicely.

Looking at the volume before Friday, you’ll see it was dying down a little. I saw that as a positive because there weren’t that many sellers.

I planned to take the stock long and look for a profit opportunity on Tuesday.

How It Played Out

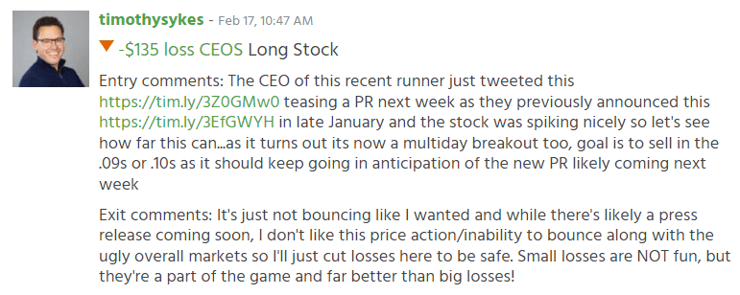

The company didn’t issue its press release over the weekend. And the market opened up sharply lower.

Because I had a small position, roughly 45,000 shares, I decided to add to it in the morning, bringing up to 90,000 shares.

However, the stock didn’t bounce like I thought it would, and given the overall market was under severe pressure, I decided to take a small loss on the trade.

This trade had a lot of good things going for it, but that doesn’t mean it was guaranteed to work.

There’s no sure thing in trading. All we can do as traders are spot opportunities that we believe have a strong likelihood of winning and then manage the risk accordingly.

Despite this trade not working in my favor, I would take this trade again in a heartbeat.

If the company had issued its press release over the weekend, I believe it would have likely pushed the stock higher despite the weakness in the market.

However, it didn’t, and I had to change my plan.

Takeaways

- Expect the worst from these companies. I know that sounds cynical, but after 20+ years of trading penny stocks, I’ve found that to be the best approach.

- Anticipate how newbie traders will react to the press release. Most people trading penny stocks are not sophisticated traders. They often react emotionally to stock pumps and go into their trades based on hope, not a trading plan.

- Ride the pump. These are all speculative plays, never investments.

- Not all good setups work. Be willing to accept a small loss instead of being stubborn.

This Thursday night, I will be hosting a special live training. I’ll be discussing the current state of the markets and going over one of my favorite strategies to trade right now.

Leave a reply