After a brutal start to the month I’m starting to see some light at the end of the tunnel.

I placed five trades…with four of them being winners as I headed into Thursday’s trading session.

Moreover, my biggest winning trade was more than 6x larger than my only loss.

Despite a hectic travel schedule this month, that’s seen me go to Dubai, Tokyo, Bali, and Turkey to name a few…

My trading hasn’t been negatively affected.

In fact, I could argue I’m trading significantly better…

And it also has to do with making this one mindset shift.

How I’m Approaching Each Day

2025 Millionaire Media, LLCBelieve it or not this helped me out A TON.

And that’s going into each trading session NOT looking to trade.

I know, it sounds counterintuitive.

But check it out…

The overall market action has been relatively choppy as we go through earnings season.

And while I don’t necessarily trade earnings…I’m watching because the majority of stocks move with the market.

So yeah…I go into each day not looking to trade.

Now, that doesn’t mean I’m coming in unprepared. I’m still making my watchlist and have stocks on my radar.

But I’m going back to the mindset of a retired trader. In other words, I’m only getting into plays so compelling that I’d have regrets for not being involved.

This allows me to be selective and takes some pressure off me.

Sometimes we put so much pressure on ourselves. Especially when our account is down or going through a bad streak.

The best thing you can do is take a step back and review what you’ve been doing.

- Are you overly aggressive?

- Are you respecting your risk rules?

- Are you taking only your best setups?

- Are you following your trading plan?

These are all questions you should be asking yourself and finding answers to.

How I’m Approaching My Trades

2025 Millionaire Media, LLCOne way I’ve found that works for me is testing stuff out.

In other words, I’m placing smaller sized trades and seeing if my ideas play out.

Trading smaller allows me to focus more on the setups and less on the PnL swings.

And although this isn’t the best market for trading, I see these trades as me putting my reps in.

I’m going through the motions and it’s keeping me sharp.

For example, last Friday, the ticker symbol NLST announced it won a $303 million patent lawsuit against Samsung.

And since it was announced late on Friday…it made for the PERFECT Weekend Trade.

I missed The Weekend Trade because I was traveling.

But I figured I might have a chance later in the week to trade NLST for a potential dip buy opportunity.

And that’s what I did on Tuesday…

The market was selling off hard at the time and I figured the weakness in NLST was related to that.

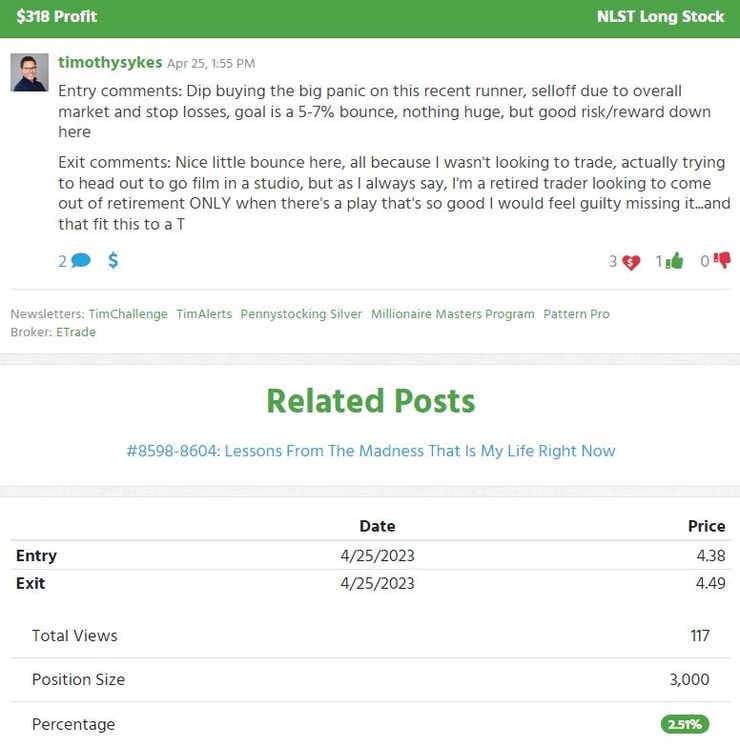

So I “tested out” a dip buy at $4.38…which worked well for a quick scalp.

Not the biggest winner percentage wise…but I’m just trying to stay sharp and lock in small wins.

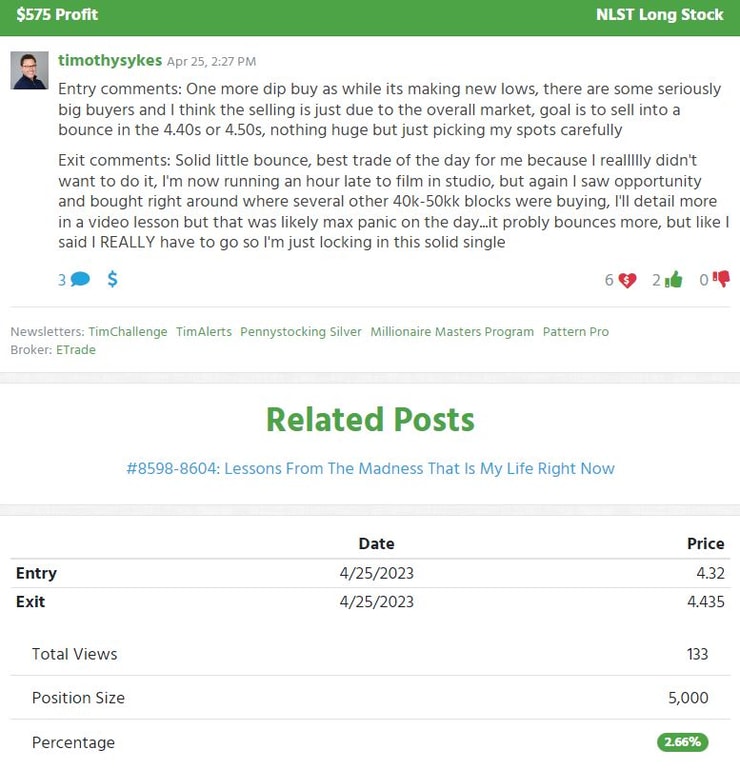

Good thing I did take those quick profits because the stock gave me another opportunity for a dip buy entry a few minutes later.

Of course, you never know if you’re buying the bottom or catching a falling knife. That’s why you should have a trading plan. And not be one of those “deer in headlights” traders.

The second scalp trade worked out great.

More Breaking News

- Growth or Bubble? Examining Archer’s Stock Rise

- ClearOne’s Financial Maneuver: One-Time Dividend Sparks Investor Interest

- NU Stock Soars: Is A Buying Opportunity Knocking?

Normally, I would play for bigger moves but that’s not what the market is giving us right now. That’s why I’m not upset at taking smaller percentage gains.

Final Note

2025 Millionaire Media, LLCSometimes taking pressure off yourself can help in regaining your focus and building up your confidence.

It’s okay to size down if you feel like your rhythm is off. In fact, I do it all the time.

Also, adopting the philosophy of being a retired trader can also be a huge benefit for some…I know it is for me.

And of course, what you want to be doing right now is STUDY…STUDY…STUDY.

Trust me you will be shocked at how much you can earn & how much happier you’ll be when you avoid the rat race full of broke/loser degenerate gamblers & invest more time into studying & truly living life while ONLY coming out of retirement when the best trades present themselves!

— Timothy Sykes (@timothysykes) April 27, 2023

If you’d like to discover what my Millionaire Challenge is all about…then click here for the details.

Leave a reply