So … my life is kinda crazy.

Last week I went from Guatemala to L.A. for a day. Then I went to Japan — where I’m writing this. Quick aside — if you want to live with total freedom like I do, apply for the Trading Challenge today. Just do it.

Table of Contents

Giving in Guatemala

Back to Guatemala for a second, because while I’m having some New Year fun in Japan, what I did in Guatemala is one of the most important things I can think of.

In Guatemala, we’ve built 12 schools with my charity. In total we’ve built 41 schools. My goal is to build 1,000.

Now, before any of you haters comment about me sharing about my support for charities …

… This is what motivates me.

To be honest it’s what should motivate you. I’m not gonna preach about what motivates you. If it’s my cars or my mansions, so be it. But if you’re gonna be a hater because I share everything on social media, then don’t follow me, because I’m all about sharing.

I share everything. Good trades, bad trades, charity work, travel, everything …

… because I’m transparent, it’s the kind of person I am.

Rant done.

Still here? Cool. Check this out …

I was in Guatemala last week because my charity, Karmagawa, is looking at working with a new charity that’s helping Guatemalan refugees.

While you might see other traders posting on social with wads of cash or big trades they’ve made …

… none of them are posting about what they’ve given to charity.

I’m proud of the donations I’ve made and I’m proud to be a voice for charity. I want to give them a platform. I make noise on social media. Sadly, charities cannot make noise. They’re afraid to piss off donors. They fear losing big corporate donors.

I can be their voice. I can brag for them. I can tell the world what great work they are doing. And I’m happy to be their voice. They quietly thank me for being so aggressive on social media because they can’t do it.

Trading from the Land of the Rising Sun

So now I’m in Japan eating sushi, hanging out with friends, and celebrating the New Year. I’m even hanging out with a few celebrities. I can’t really name them, ya know? It’s a privacy thing.

But I’ll tell you something.

It’s cool I can do all this while still trading stocks in the background.

The Money Making Secrets of a Self-sufficient Trader*

It doesn’t matter if I’m in Guatemala, Japan, or L.A. It doesn’t matter if I’m doing charity work to help refugees or building schools. It doesn’t matter if I’m eating sushi or hanging out with celebrities.

In the background — always — I’m trading stocks.

That’s what it means to be self-sufficient. It’s what I teach my students. And that’s what I want to teach you.

My Best Recent Trades and Why Small Gains Are Your Friend

2025 Millionaire Media, LLCCheck this out …

… because I want you to get a little perspective.

My best end of year trade from 2018 was only $1053 profit.* But that $1053 was somewhere around 12 or 13% gain. Overnight. Not huge money, but if you think about mutual funds making 12% in a year that’s considered good. This trade was in one day, so I think it’s a great example of a good trade.*

What was it?

Puration, Inc. (OTC: PURA). Puration is a cannabis beverages brand. Weed stocks are hot right now — I’ll fill you in on that in another post soon. I bought this on solid earnings news that came out on the December 20th.

This was a nice little overnight gain on a small position of roughly $8000.* It was a first green day on an OTC play, former runner. I love this pattern. It’s one of my classic patterns. I look for former runners to get hot again.

When they get hot again, I look to buy them into the close on the first green day because people start to remember these stocks. Traders sniff around for something with momentum and they usually spike up or gap up on day two like this one.

Rebalanced Trading Account to Start 2019

Every January I rebalance my trading account to $12,000. Why? Because that’s where I started nearly two decades ago and I trade the way I teach my students to trade. I want you to know it’s possible to build an account from a small starting position.

One of my first trades of the year — and another successful weed stock play — was General Cannabis Corp. (OTC: CANN) for a $1,080 profit.* If you want to learn how I do this, join the Trading Challenge.

Word of warning: the market is still going through wild swings. I sold shares for small gains into the gap up on this one because the overall market was reacting to Apple’s earnings warning. I didn’t want to risk it — safety first in this environment.

Know what? Small gains make me happy right now. I’m back to trading with the pattern day trader rule (PDT) in mind because my account is small again after the rebalance. Small gains keep you disciplined. A small account means you have to cut losses quickly. Rules to live by. Practice makes perfect.

How My Students Are Surviving This Nasty Market

2025 Millionaire Media, LLCThe last couple of weeks my students and I have been doing one thing above all else: protecting ourselves. It’s been a very nasty market lately. You need to remember, it’s not always about making huge money. It’s not always about being aggressive.

Sometimes the best trade is no trade.

Sometimes it’s good to play strong defense. As the whole market crashed in December — most market indexes were down around 10% — we were on the sidelines. We stayed in cash, we protected ourselves, and we stayed safe.

Don’t feel like you have to go big or always have to be making money. A lot of the time you just have to wait for the right trade. That’s what’s been happening in this tough market. Too many traders are fully invested all the time. And remember those mutual funds I mentioned earlier?

Check this out …

… A mutual fund’s charter says they have to be at least 65% invested (some even stipulate 75%) at all times. Even if they think the market’s going to crash or there’s gonna be a war, they still have to remain 65% invested.

As an individual trader or investor, you don’t have those BS limits. You can go to cash, you can protect yourself, and you can outperform most funds and the overall market. Stay safe. It’s a good time to study. It might even be a good time to stay in cash.

What’s Hot Right Now?

The hottest sector for the last few weeks — the last few months, on and off — is weed stocks and CBD plays. Weed has been legalized in Canada. Recreational and medical marijuana laws were passed in several states over the last few years.

A lot of these weed stocks spike 10%, 20%, 30% …

… Even 50% in a day!

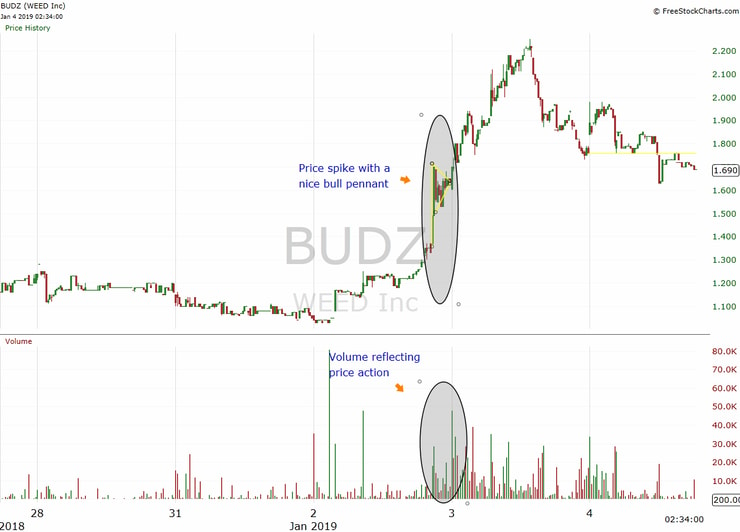

I’m looking at weed stocks right now when they start to heat up. I’m not interested when they are gradually declining — I want those volume spikes and price spikes. Check out the chart below. This is the CANN chart (my first trade of the year) showing both volume and price spikes.

You can see the pattern clearly on that chart, right? That’s the kind of action I’m looking for. You can see it with CANN and BUDZ. The other day, Weed, Inc. (OTC: BUDZ clever ticker symbol, eh?) was up like 55% in one day.

Here’s the BUDZ chart:

CRON is another weed stock that had a strong first green day recently. Weed is the hot sector right now and at the very least you should be watching these stocks. Sign up here for access to my weekly watchlist.

One thing to consider: three out of four stocks follow the overall market. So pay attention to what’s happening with the big boys like Apple. Apple’s first quarter revenue guidance rocked the entire stock market the other day.

Pay attention to the Dow Jones Industrial Average (DJIA) and the S&P 500. When the market, as a whole, is unsettled it can affect the penny stock price action.

So even though weed stocks as a sector are hot again, it doesn’t mean you can be aggressive. Now is a time to be safe.

Millionaire Mentor Market Wrap

That’s a wrap on the weekly update. Are you ready to make 2021 your best year? It starts with your daily habits. If you’re serious about trading, you need to study every day.

More Breaking News

- Olo Stock Soars as Red Lobster Relaunches Partnership

- Symbotic Inc. Gains Momentum

- Datadog’s Surge: What Lies Ahead?

Trading Challenge: How to Make 2021 Rock!

Better yet, join our trading community. Network with other traders and my top students. Become self-sufficient with skills you can use for life.

Ready to get serious about this? Apply for the Trading Challenge today.

Are you a trader? How have you been trading the recent whipsaw markets? Comment below. I want to hear from you!

Leave a reply