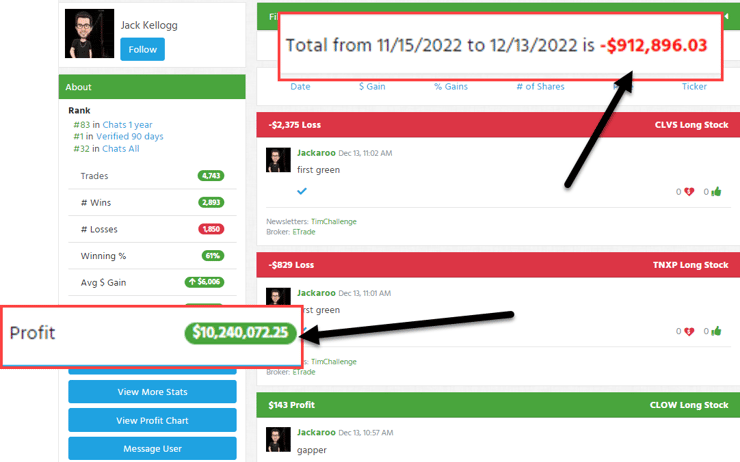

Imagine making over $10 million in lifetime trading profits.

Other than a few drawdowns on bad trades, you’ve been relatively consistent…

That is until recently…

Where you lost almost $1 million in the last month.

Jack Kellogg is one of my top-earning students.

And he knows how many opportunities exist right now with the Winter Glitch.

But his need for green pushed him into a space where he wasn’t as consistent.

I asked him why not stick with OTC stocks rather than play with triple-leveraged ETFs.

Like many traders, Jack sees stocks popping off and wants to ride the wave.

Because let’s face it, why would he settle for a 10% win that nets $10,000 when he could swing for $50,000 wins?

Yet, the results speak for themselves.

FOMO and greed are two sides of the same coin.

They push into aggressive trades in an attempt to score big.

Rarely does this ever work.

Every year I reset my trading account to $100,000, with all my profits going to charity.

Long ago, I learned I don’t do well with large accounts.

My sweet spot is sticking with the 7-Step Penny Stock Framework and trading OTC stocks.

It’s not always the most exciting.

But it’s allowed me to trade consistently year after year, achieving an incredible +76% win rate overall.

Look, I can’t tell you how to turn $100 million into $500 million.

I CAN show you how to take a small account with just a few thousand dollars and generate tangible results.

But let me prove why consistency is more with small account trading and how it can help you make real gains faster.

The Math of a Small Account

2025 Millionaire Media, LLCAssume I have an account with $2,000 in it.

There are two strategies I can use to trade it: small but consistent wins (#1) or huge wins that are sporadic (#2).

Here are some basic stats on the strategies to get us started:

- Strategy #1: 75% win rate, 5% average gain, 5% average loss

- Strategy #2: 50% win rate, 15% average gain, 10% average loss

If you repeated either strategy over and over, they would both yield an average gain of 2.5% per trade.

But there’s a catch…

If I risk my entire account on every trade, there is close to zero statistical chance I would hit a losing streak so bad with the first strategy that I would cut my account in half.

In fact, there is less than half a percent chance I would lose with that strategy four times in a row.

But with the second strategy, there is a 1.56% chance I could hit a losing streak that would cut my account in half. And there’s a 6.25% chance I might lose four times in a row.

When most traders start out, it’s tough to achieve a win rate over 60%, let alone 70%.

Swinging for larger gains automatically means you’ll capture larger losses.

That’s why I favor a more consistent approach, even at the expense of some extra gains.

I tell my students to cut losses quickly precisely because large drawdowns destroy accounts.

Earning small, consistent gains is not only mathematically better for most traders, but it’s also often psychologically better.

Focus on Morning Panics

2025 Millionaire Media, LLC99% of you are not Jack Kellogg trying to trade for tens of thousands of dollars each day.

That means the morning panic dip buy is perfect.

It won’t make you $50,000 in a single trade.

But it can build a few hundred to a few thousand dollars each time with stunning regularity.

All you have to do is find stocks that went Supernova, wait for them to crash down, and then look for morning panics and promoter pumps.

Yes, it will take practice to get a handle on when and where to jump in.

That’s why I offer so much educational content to my students.

There are thousands of videos and commentary to help you learn the tools and how to wield them.

You don’t need to flail at stocks with large moves just because they’re large moves.

Only take the trades that fit the EXACT setup you’re looking for.

Sure, you may miss a few here and there. But you’ll win more trades and profits overall.

—Tim

Leave a reply