Imagine hitting a hot streak after months of studying, feeling like you finally hit your stride…

Only to watch your trades turn ice-cold, vaporizing all your profits and then some.

It’s a painful, frustrating experience most of us know all too well.

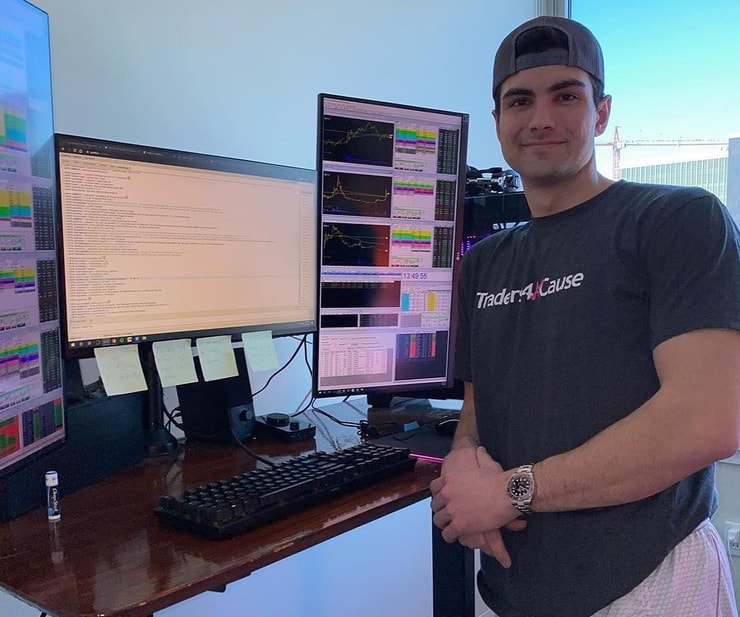

For Jack Schwarze, my Millionaire Challenge trading student, it lasted for years!

So, how can he stand in front of traders today with $2.5 Million in trading profits?

For Jack, it’s all about trading what he knows, which includes:

- Shorting multi-day runners

- Buying morning panics

- Buying multi-day breakouts

He doesn’t often win, only about 53% of the time.

But he keeps his losses small and takes them fast while leaning into his profitable trades.

However, the real key to his success, which turned everything around, was this simple philosophy…

How fast can I fix the flaws in myself and my system?

This feels like something out of a Silicon Valley startup…

But when you apply it to your trading, it becomes incredibly powerful.

I want to take you through some practical examples to help you overcome your obstacles.

Here’s how it works…

Everyone is Different

Before we dive in, I need to acknowledge the elephant in the room.

Many of us face similar problems: overtrading, forgetting a stop loss, too much risk, etc.

How we deal with our problems is unique.

True, you might find a lot of similarities with another trader.

But what works for one person doesn’t necessarily work for another.

That’s a big reason why I load my Millionaire Challenge with so much content.

I can explain a simple concept like Cutting losses quickly. And someone might understand it clear as day the first time I mention it.

However, it could take another person months to study the same concept before it clicks.

The point is not to compare or get down on yourself.

Take each challenge as it comes. Turn it into an opportunity. Work through it the best way for YOU.

Know Your Enemy

To this day, Jack battles emotions.

He feels that tug and pull every time a stock makes a sharp move.

FOMO causes him, like so many others, to jump into trades at bad entries that can turn good setups into lousy ones.

Very few people can will emotions out of their trading.

Instead, you have two options: practice and automation.

Yes, you can practice how and when to take losses. In fact, it’s a good thing, so long as you do it cheaply or even with a simulated account.

That way, muscle memory kicks in when you’re trading for real money, and you don’t succumb to emotions.

However, it’s also important to be comfortable with your trades.

Jack strongly believes in trading what he knows with the size he’s comfortable with.

When you take an oversized position, worries start to creep in. If the trade doesn’t work immediately, you question your judgment, and the setup and eventually get into analysis paralysis.

Any changes you make to your trading, from size to strategy, should be done gradually.

And the more emotional you are, the slower you should go.

More Breaking News

- QuantumScape Takes a Big Leap with New Battery Line

- Strategic Acquisition Expands Momentus Inc.’s Horizons

- Itau Unibanco Announces Q4 Earnings as Investor Interest Grows

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

Be patient. There’s plenty of trading left before the world ends.

Quality Not Quantity

This doesn’t just apply to trading.

It applies to how you study and learn.

You can study 18 hours a day. But if it’s not productive, you won’t get very far.

Instead, limit your focus to one idea at a time.

Review your trades, and especially the decisions you made.

Ask yourself whether they adhered to your strategy and plan.

At first, you’ll spend a lot of time constantly beating back small mistakes.

However, as they decline, you’ll be left with the big ones that cause serious drawdowns.

Deal with those the same way.

Take them apart piece by piece and work on one component at a time.

For Jack, he would oversize his trades on tickers thinking he wanted the extra risk, but mentally, he didn’t.

He pushed himself before his mind was ready, resulting in early stops with extra losses…despite getting the trade setup right!

Trading is an evolution and a regurgitation process.

You move forward while always shoring up the basics.

Take it one step at a time and enjoy the journey.

—Tim

Leave a reply