Right now is one of the BEST times to trade in 2022.

There’s a seasonal phenomenon at work I like to call the Winter Glitch.

And it’s creating so many potential plays that I have to remind my students and myself this isn’t Pokemon…

You don’t have to catch them all.

In fact, all you need is a handful of high-quality charts to find all the setups you need.

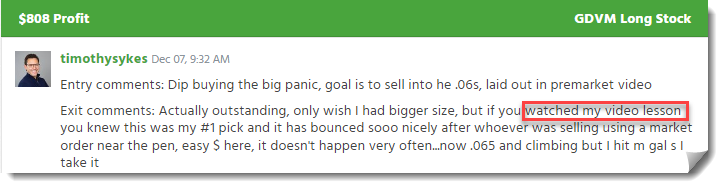

That’s EXACTLY how I called out my Wednesday trade in Global Developments Inc. (OTC: GDVM) nearly 24 hours prior.

All my trades are posted for EVERYONE RIGHT HERE.

The earlier you can identify potential setups, the easier and more robust your prep work becomes.

That’s why I want to take you through each step in my process…

From identifying the setup to execution…

So you know what to look for as stocks progress through my 7-Step Penny Stock Framework.

Seasonal Selection

Some markets are for earning and some are for learning.

2021 was an earning market.

With meme stocks popping off left and right, there were dozens of penny stock multi-date runners to choose from.

That all evaporated in 2022.

Only recently, as we enter the ‘Winter Glitch’months, has the tide shifted.

In the last several weeks, several names went Supernova, from Cloudweb Inc. (OTC: CLOW) to Meta Materials (OTC: MMTLP).

Those who studied my 7-Step Penny Stock Framework had the blueprints for what to expect.

You might wondering, is it just the number of multi-day runners that makes this such a great seasonal trading period?

Yes, but also, it’s their quality.

Stocks can go Supernova and not provide a decent setup.

AMTD Digital Inc. (NYSE: HKD) is a great example.

Yet, as you’ll see in a moment, one stock can provide multiple trades over weeks during the different phases of the framework.

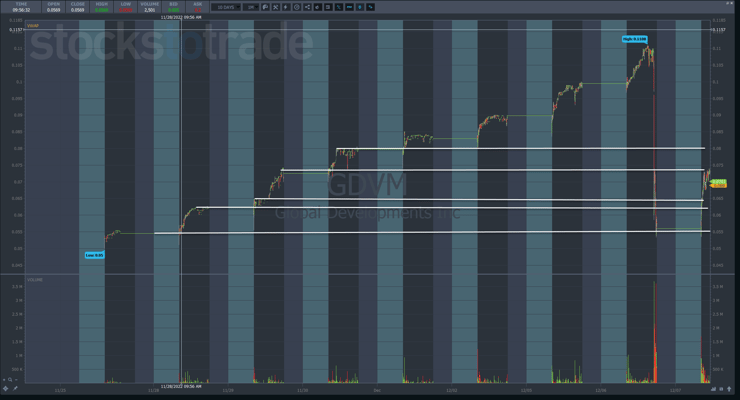

Before I dive into the details, take a look at the daily chart for GDVM and see if you can’t identify the different phases from the framework.

Tuesday’s Preparation

The chart above clearly says GDVM is a multi-month runner.

It’s one of the strongest OTC stocks that’s steadily climbed since late August.

On Tuesday, GDVM traded well for most of the day. It wasn’t until just before 3:30 p.m. that it completely fell apart.

Shares plummeted in minutes from $0.11 to $0.06, a nearly 50% drop.

The initial question to ask is was there a panic dip buy opportunity?

If I was completely disciplined, then no. I would only panic dip buy in the morning.

However, since this was the first major red candle in months, it sometimes gets a decent bounce off the first crack.

And if you were fast enough, the green candle with the largest volume of the day could have been a nice entry for a small run higher…by small I mean $0.065 to $0.07-$0.073, which is still 5%-10%.

Taking a step back, I knew there were several areas where the stock might find support.

A lot of traders make technical analysis more difficult than it needs to be.

Most of the time, I just look for spots where price struggled to get through and spent time moving sideways.

With two spots near one another around $0.060-$0.065, that seems like a reasonable area for a bounce.

When I execute, I look both at the price action and level 2 data to time my entry.

But keep this in mind…as I stated in my trade notes, I would exit the trade by the close.

I fully expected a morning panic the following day.

More Breaking News

- ABP’s Stock Movement Signals Market Concerns Amid Broader Trends

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- Robinhood Appointed Trustee for Trump Accounts, Stock Rises

- Dingdong Sells China Operations to Meituan Subsidiary, Retains Global Presence

And that’s where I saw opportunity.

Why Expect a Morning Panic?

I know this is the question on your mind.

To start, I don’t know whether the stock is likely to open flat, higher, or lower.

That’s a tough call.

What I do know is there are bag holders that will look at their losses overnight, get mad, and sell at the open.

At the same time, promoters don’t want the stock to drop any further. So, they’ll be in their pumping buyers to scoop up shares.

In this case, I watched level 2 data and noticed the initial drop came from one big seller.

After that order cleared, there weren’t many sellers left.

Essentially, the selling pressure was exhausted.

That’s when I bought into the stock, not five minutes into the day, and rode it for some quick gains.

Trading is part science part art.

For me, it’s also about reading people’s behaviors through the tools at my disposal.

That’s why I encourage my students to study hard.

Some of this stuff isn’t intuitive and sometimes it is.

Once you learn enough information, the What, Why, Where, When, and How of a stock becomes clearer.

It’s a process and a skill. One that requires drive and hard work.

And ANYONE can get there.

—Tim

Leave a reply