Ask any of my students, and they’ll tell you I’m a fairly conservative trader.

I cut my losses quickly and lock in profits when I can.

Even before I enter a trade, I know where I want to take profits.

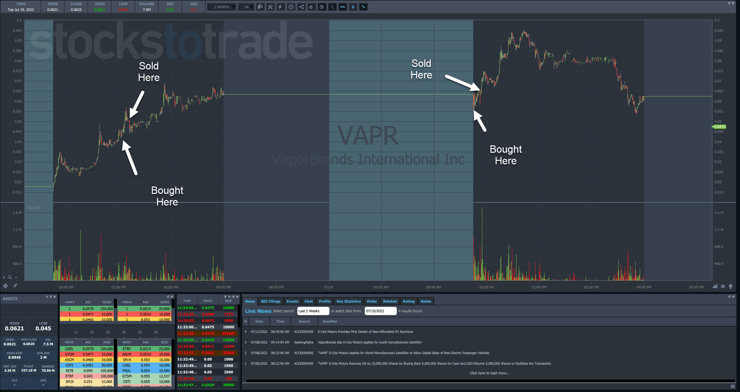

Vapor Brands International Inc. (OTC: VAPR) is a great example.

I made two outstanding trades in this name on Friday and Monday.

All my trades are open to the public right here…

These plays netted me roughly $1,636.

Yet, I know plenty of folks who said, “Tim, you left so much on the table.”

And guess what…they’re right.

They don’t realize that this works out better for me over time than other strategies.

Let me show how a simple shift in risk management could vastly improve your results.

Catch a Penny

2025 Millionaire Media, LLCMy win rate stands at 77.15%. Let’s call it 75% for argument’s sake.

In order for me to break even, I need to make $1 for every $3 I risk.

Now, assume that I let all my trades run a bit longer.

This could lead to three possible outcomes:

- If I can close the trade at a better price, I get same win rate with higher average profits.

- If I take partial profits and then stop out at breakeven on the remainder, I keep the same win rate with lower average profits.

- If I try to ride the entire amount and the stock reverses so I stop out at breakeven, I get a lower win rate.

I won’t force you to do to the math here. But essentially, I would need to be able to achieve significantly higher profit targets on most of my trades to justify a lower win rate.

For example, if my win rate drops to 65%, I now need to make $1 for every $1.86 I risk, almost double what I had to achieve before!

This is a big reason why I don’t try to go for glory most of the time.

Yes, I will do it in the right environment under the right conditions.

Otherwise, the juice isn’t worth the squeeze.

Right Conditions

2025 Millionaire Media, LLCWhy was I so cautious with VAPR?

For starters, we’re in a bear market tha’s slowly bleeding lower with lackluster rallies.

This is wholly different from the risk on environment that took hold of stocks after the bottom in March 2020.

Back then, stocks would climb for days and days.

Although there’s been an uptick in the number of multi-day runners, it’s not as wide spread as it was back then.

Second, we’re in the middle of the summer lull.

This is the time when volume tends to lighten up and stocks chop around more than pick a direction.

Let’s go back to the chart of VAPR.

There’s no way I could’ve known shares would climb level after level for two days straight the way they did.

The stock went from $0.02 to $0.09. That’s an insane move on some fairly benign news event.

But take a look at the highs shares made as they climbed. Most were followed by significant pullbacks.

Trying to hold into those is difficult even for the best traders out there because who wants to risk a stock that’s more than doubled flipping like a pancake and destroying any profits they made?

Plus, this was not a low-float stock with 337 million shares.

More Breaking News

- AG Shares Rally: Buy, Hold, or Sell?

- Nebius Group Stock Jumps Amidst Strategic Partnership Rumors

- DeFi Technologies Expands to Dubai, Shares Surge Over 2%

That lends itself to far more chop than a symbol with less than 10 million shares.

The Bottom Line

Most traders struggle to consistently turn a profit because they want to capture those huge wins.

Trust me when I say base hits add up.

Instead of trying to hit home runs, focus on locking in profits and cutting losers quickly.

Narrow the amount of volatility your account sees and work to streamline your performance.

Only once you obtain a decent win rate should you consider trying to go for more. And even then, you want to be careful and guarded.

But never ignore the context of the current trading environment.

—Tim

Leave a reply