Not everyone has the time to day trade.

Most folks work 9-5 to support families and build up their retirement nest egg.

The good news is I’ve got something for you.

I designed my Weekend Trader for anyone who wants to put a little extra change in their pockets by Monday morning.

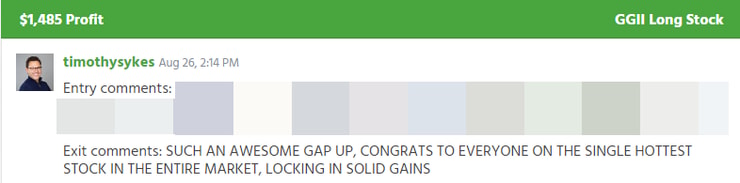

Last week, I sent out an alert mid Friday afternoon that I bought shares of Green Globe International Inc. (OTC: GGII).

My $0.011 entry price turned out to be fire.

Before the day even finished, I started to lock in profits.

When Monday morning rolled around, the stock was up HUGE!

I managed to walk away with a tidy profit.

A lot of you probably want to know why I picked this stock when I did.

Don’t worry baby birds. I’ll feed you.

Plus, I’ll explain how I reduce my risk when I enter these trades.

News You Can Use

All of my trades start with a catalyst. Something that gives the stock an extra punch to get shares moving.

GGII came across my screen courtesy of our Breaking News team on our StocksToTrade Platform.

These guys do a fantastic job of serving up the headlines and context I need to make my trades.

Over the last few weeks, initial public offerings (IPOs) have been on fire.

Just look at the incredible rise and fall of AMTD Digital (NYSE: HKD).

That stock gained over 2,000% in a matter of days!

But it’s not the only one.

That’s why GGII caught my attention.

The company’s IPO spinoff was set for the following week.

Leading into the weekend, there had been a ton of hype with promoters all over this stock.

So, it made all the sense in the world that this could easily catch a bit.

The Setup

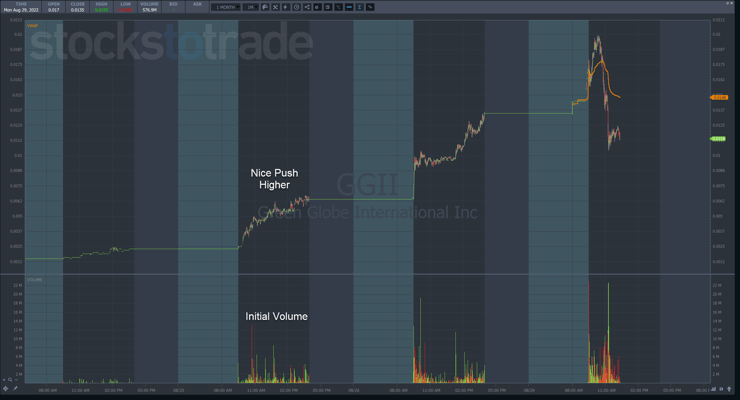

Shares caught a bid starting on Thursday, with a lot of volume hitting shortly after the open.

In one day, the stock skyrocketed almost 200%.

Normally, I don’t like to buy a stock the day after its first big move.

However, I made an exception here for two reasons.

First, the stock fit into the IPO category I’ve seen lately.

Second, stocks like to float into the close on Fridays.

Since shares jumped quickly out of the gate on Friday, I gave the stock time to settle down and show its hand.

A little past 2:00 p.m. Eastern, shares started to break through the morning high.

This put the trade idea at the right time of the day on the right day of the week.

I bought the breakout expecting shares to continue to climb further.

Up until that point, GGII had traded in a fairly narrow range save for the opening minutes of Friday.

As shares climbed, I locked in profits just past 3:00 p.m. and held the rest for Monday.

Many of my students didn’t understand why I did that when I expected shares to keep moving.

The reason is simple – risk management.

The broader market cratered on Friday. While it usually doesn’t impact OTC stocks, it can.

I didn’t want to take the chance of waking up Monday morning to see GGII faceplant.

More Breaking News

- Insider Stock Sale Raises Questions About Micron’s Market Position

- Coty Faces Uncertainties with Earnings Miss and Strategy Revisions

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

Scaling into and out of positions optimizes profitability since we never know where the absolute top or bottom might happen.

The Results

With a nice spike on Monday morning, I closed the rest of the trade by selling into strength.

Between the two exits, I sold a bit more than half on Friday with the remainder on Monday morning.

This setup was dynamite if you knew what to look for.

September and October are the trickiest months to trade. More crashes happen in the next 60 days historically than any other time of the year.

Look for trends and themes within the news to give your trades a boost. Don’t just go for the popular stocks.

Find the ones with the best setups and stick to your guns.

Discipline is the name of the game.

—Tim

Leave a reply