Have you ever felt the sting after a bad trading month?

It’s natural to feel disappointed and frustrated when things don’t go as planned.

I know, because I’m coming off one of my worst trading months in years.

But what separates the successful traders from the rest is their ability to recover and come back stronger.

A bad month can feel like a major setback, especially if you rely on trading for your income.

It can make you doubt your abilities and question if you’re cut out for this.

But the truth is, we all go through some bad stretches, it’s just part of the trading journey.

However, what sets successful traders apart is their ability to turn their losses into learning opportunities.

They use their failure as a chance to analyze their strategies, identify what went wrong and adjust their approach for the future.

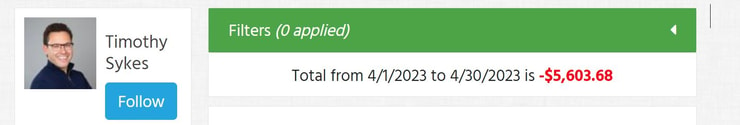

That’s why I want to go over my losing month of April with you.

And explain the mindset shift I’m making. Plus, the steps I’m taking to evaluate my performance, and the tools I’m using to get back on track.

If you’re in a similar boat or feel like you’re not performing at your optimal level then you’re gonna want to hear this.

April’s Disaster Month

Now, as bad as I traded, if you take out my worst trade, I would have been break-even.

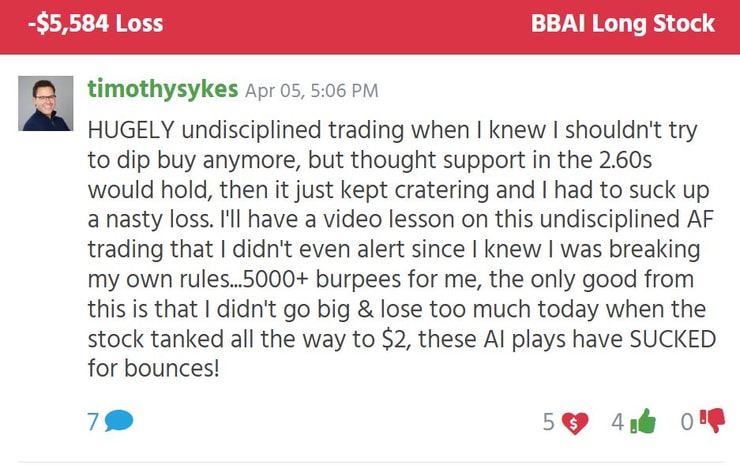

On April 5th, I lost -$5,584 in the ticker symbol BBAI.

I wrote an entire post about that trade, you can read about it here.

But despite that being my worst loss…I consider it my second worst trade of the month.

My worst was in the ticker symbol HCNWF, where I lost -$2,045, five days after my BBAI loss. My entry was off, my sizing was too large, and I failed to cut losses quickly.

On the other hand, my largest winner was a trade in the ticker NLST, where I made a profit of $575 (a 5,000 share position where I put $21,600 in).

Of course, it’s hard to be profitable if your worst trade is almost 10x larger than your best winner.

So what caused those two outlier losses?

A buildup of frustration.

You see, I’ve been right on the money on a few plays.

For example, I got in relatively early in ticker symbol GFAI at around $6.60. However, my profits were modest, and the stock eventually ran to nearly $40.

I was in HCNWF when it was around $0.60 and that thing shot up to +$4…but I wasn’t there for the big move…

And that’s just a few examples.

There were probably 3-5 symbols I was in that produced monster Supernovas that I missed.

The combo of frustration and FOMO led me to get overly aggressive and undisciplined.

After those two big losses I slowed my trading down, focused on better trade selection, and chipping away at my deficit.

Other Mistakes I Made

All of a sudden we started to see a lot of plays. There were a ton in the AI sector, and most recently in scammy Chinese stocks.

For example, the Supernova in the ticker TOP, which saw the stock go up 1,000% in 24 hours.

I found myself overtrading.

To get out of this bad habit I try to remind myself to think like a retired trader. That is, a person who isn’t looking to trade.

But willing to jump back into the market ONLY if they see a play so compelling they would have MAJOR regrets for not being involved.

For other traders, that means reviewing their best trades and finding out what patterns work for them.

It’s easier to make better trade selection once you know what your best and most profitable setups are.

The Man In The Mirror

I own my losses.

I don’t blame my hectic schedule, the markets, anything or anyone else for my poor performance.

You can’t run away from your problems and sweep them under the rug.

My issues have been overtrading, overaggression, and letting FOMO get the best of me.

You can’t fix your issues if you don’t know what they are.

I know what mine are, and I’m working on fixing them by trading smaller, being more selective, focusing on protecting my capital and risk management.

But what about you?

Are you holding onto your losers too long? Not finding quality plays? Getting too cocky or what?

You must review your trades and analyze your decision making if you want to improve.

Final Note

One of the biggest problems I see from traders after suffering a big loss or having a bad trading month is their need to get those losses back quickly.

But that can be a dangerous game, and lead to even more significant losses.

That’s why I tell my students to just take it one day at a time…and one trade a time.

It’s MUCH better to correct your issues by trading smaller. Once you regain your confidence, then size up again if you believe there are good opportunities.

Don’t make excuses…and study hard.

If you want to see how I can help you…click here for the details.

Leave a reply