Over the years I’ve exposed a ton of pumps and promoters. A lot of people think it only happens in penny stocks. While it is more common for OTCs to get pumped, it happens with listed stocks, too.

How does it happen? And how can you recognize it? Keep reading as I expose one of my tricks for knowing when a pump’s a pump. This might surprise you…

First, let’s look at last week’s big news to put things in perspective…

Table of Contents

Another Pump Exposed

You saw the headlines, right? On July 29, Nikola (NASDAQ: NKLA) founder Trevor Milton appeared in a Manhattan federal court. He pleaded not guilty to three counts of fraud.

According to the indictment, he made “false and misleading statements regarding Nikola’s products and capabilities.”

Trevor Milton is, allegedly, the fraud version of Elon Musk. I can’t say he’s definitely a fraud, but the evidence so far seems to point to him doing something … not very good. (Keep in mind, I’m not a lawyer.)

And it’s not just “Oh, I might have gotten one fact wrong.” It was “nearly all aspects of Nikola’s business.” And it seems crazy to me that he could post $100 million bail. But he has properties and still owns stock, so it seems he has enough.

The Curious Story of Trevor Milton Blocking Yours Truly

A lot of people congratulated me when the news came out. That’s because I was calling out the BS not long after Nikola went public through a SPAC deal.

In September 2020 there were rumors that Trevor Milton got arrested. It turns out the rumors were false … Or the rumors were about nine months early, depending on how you look at it.

The funny thing is that I tried to tweet him but he blocked me…

Wow Trevor Milton, just got arrested per @sttbreakingnews and I would tweet at him but he blocked me LOL, I wonder if the $NKLA promoters are next to get arrested! pic.twitter.com/8RJbhD6NiT

— Timothy Sykes (@timothysykes) September 21, 2020

We’ll see how far this court case goes. For me, it’s nothing new. But a lot of people messaged me last week and said, “Tim, I didn’t believe you.”

So why did Trevor Milton block me? Because I got in a tiff with the promoters behind Nikola when the stock was in the $70s, $80s, and $90s.

One promoter was saying, “If you sell, you’re weak.”

That’s SO wrong. It’s so reprehensible, irresponsible, unethical, and shady. It makes my blood boil. The reality is…

Selling Into Supernova Spikes Is a Sign of Strength

You’re not weak if you sell into a supernova spike like this…

If you’re fortunate enough to invest in a play like this and it goes supernova…

Take profits into strength. Who cares if it goes to $150 or $200?

Take a good look at the chart again. The high on June 10, 2020, was $93.99. As I write … it’s trading in the mid $10s. Guess what? The majority of times that’s how supernovas play out.

This isn’t my first rodeo…

More Breaking News

- AppLovin Gains as Analysts Highlight Growth Potential Amid E-commerce Boom

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Coca-Cola’s CEO Sells Shares: Market Reactions and Financial Insights

- FMC Plans Debt Reduction and Strategic Growth Initiatives for 2026

It Feels Like I’m Taking Crazy Pills

All you have to do is study the past. It’s not an exact science, but the past serves as a pretty good guide. And this is happening again and again.

Anyone with a little experience and the desire to dig for clues could have seen this coming a mile away. There were a ton of red flags.

And this isn’t the first time I’ve battled promoters…

A Brief History of Exposing Pumps

You might remember Martin Shkreli. He’s serving jail time for securities fraud. But most people think of him as…

The Bad Boy of Pharma

In 2015, he and a group of investors took over failing KaloBios Pharmaceuticals. (KaloBios traded on the Nasdaq as KBIO.) Shkreli became the CEO. When the New York Post asked me to comment, I predicted it would crash.

Then he was giving comments on a livestream and a viewer asked him about my New York Post warning. He said something like “I don’t know who Tim Sykes is.” It was pretty funny.

It makes no difference to me — I don’t care if you know me or not. Nor do I care if you agree with me. And I don’t care if you love this stuff or hate it.

I’ll keep teaching based on my 20+ years of experience. Sometimes I’ll be wrong. But I’ll be right more often than wrong. Why? Because preparation meets opportunity and I’ve been preparing for two decades.

And my exposing pumps goes back even further…

Sponge Tech CEO Arrested for Fraud

In 2010, the CEO of Sponge Tech announced he was suing me and the New York Post. He claimed it was a short-selling conspiracy. I never got sued by him. He was probably preparing his lawsuit when he got arrested for fraud a week later. He ended up in jail.

Then there was the Justin Bieber pump…

Superstar Hate Campaign

Justin Bieber’s team started a hate campaign against me because I warned about his pump, Options Media Group (CVEM: OPMG). (Note: CVEM refers to stocks with Caveat Emptor status on OTCMarkets. In other words, the worst of the worst. For the most part, they’re untradeable.)

The crazy thing is, it was actually a useful product designed to disable your phone when you drive. Unfortunately, the company didn’t own the intellectual property.

It was licensed by another company, China-based NetQin Mobile. So Options Media didn’t even own the actual product. Anyway, Beiber was promoting it and he got a ton of shares.

But the company had an annual loss of $10 million and only enough cash to last for 45 more days. Then, just as I warned, it crashed.

Here’s another pump exposed…

The Infamous Cease and Desist Letter

In 2010, NXT Nutritional Holdings Inc. (OTCPK: NXTH) was a big promotion. I called it out for what it was. And I mentioned that Shaq was a compensated spokesperson. His attorney sent a cease and desist letter.

As noted in this article, it was a ‘tough’ letter. But it didn’t point out a single inaccuracy in my claims. Again, it’s the same pattern. Welcome to the gutter.

It’s easy to look at those historical examples and think it doesn’t happen often. But it does. Here are more recent examples of my 7-step pennystocking framework. Focus on how the pattern plays out…

Burn This Pattern Into Your Brain

The more you see it, the more you’ll realize that it keeps happening. Every one of these was a promotion…

Ozop Energy Solutions, Inc. (OTCPK: OZSC)

Study the pattern…

Here’s another…

Enzolytics, Inc. (OTCPK: ENZC)

Burn it into your brain…

And another…

Optec International, Inc. (OTCPK: OPTI)

Memorize the pattern…

Are you starting to see how this plays out again and again? Yes? Good. Now study another chart…

Artificial Intelligence Technology Solutions Inc. (OTCPK: AITX)

AITX is another recent example of my 7-step pennystocking framework…

One last example…

HUMBL Inc. (OTCPK: HMBL)

Over several trades, this was my biggest winner in years. Note: most of my profits came before the ticker changed from TSNP to HMBL. See my TSNP trades here.*

Hopefully, by now, you recognize the pattern. If you want to go deep and learn the nuances of the pattern, start with my…

**PennyStocking Framework Part Deux**

But even if you recognize the pattern, you might wonder…

How to Recognize Hype and BS

First, the more times you see it, the easier it gets. That’s why I tell people to start studying now because it takes time. But here’s a tip…

If you see promoters lying about me and/or claim I’m short selling something…

It’s a promotion … a pump. Whatever you want to call it, it’s BS.

Why would they lie? Because they don’t want people buying and selling — aka trading — their stocks. They want diamond hands. They want people to believe their BS then hold and hope. Which means my exposing them is a threat.

The irony is…

When promoters lie about me, it exposes them. I’m grateful they’re so incompetent. They don’t even realize that their lies help me see how full of crap they are. It literally alerts me to their promotion.

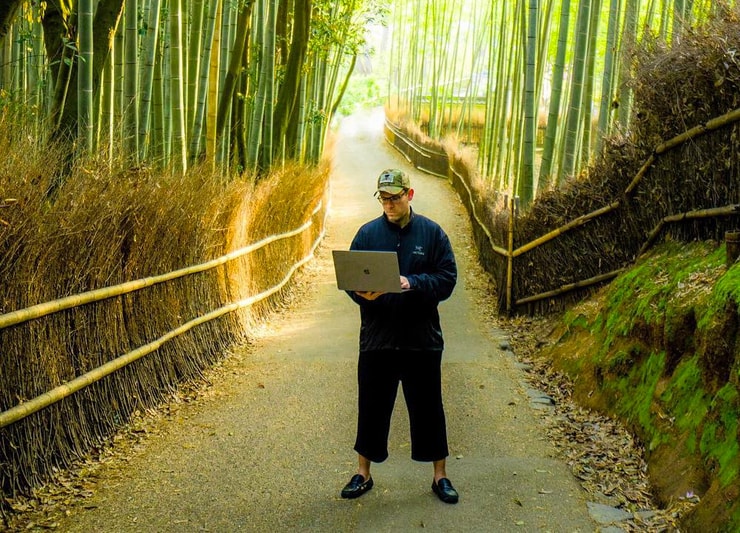

Why I Teach and Donate Trading Profits

A lot of people ask why I don’t go bigger and why I no longer short sell. Especially when I recognize the BS and hype.

It’s because I love to teach. Yes, I make my living as a teacher.** I’m not trading to make profits for myself any longer. I donate all my trading profits to charity.**

So why am I doing this? Because I want to create more millionaire students.* It’s not easy and it takes time. All I can do is continue to expose the BS and show how to buy the patterns. That’s it.

But this is exactly why so many promoters don’t like me. It’s not whether I’m right or wrong. It’s my stance on selling into strength. And my stand on short selling.

I probably should short sell… I could clean up. But again, it’s not good for newbies.

When I was a short seller, I‘d have a big profit and be excited about it. Then 30 students would be saying, “Nah, I don’t think trading is for me, I couldn’t find shares to short.” Or they’d take losses because they didn’t have enough experience.

So I decided to focus on teaching what I’ve seen work for newbies with small accounts.

Pumps, Patterns, and Profits?

I’m not perfect. But I lock in small profits. More importantly, I show what I consider to be the best stocks to trade. Note the difference — I don’t mean the best long-term investments.

But somehow, out of tens of thousands of stocks, I trade the hottest stocks in the market on any given day. It’s not luck, and it’s not random.

It’s also not an exact science, so don’t think like that. But if you study, learn the patterns, and how to ride the hype train … Over time you can start putting the pieces together.

It really is a matter of preparation meets opportunity. Again, my gains might not be huge, but they’re meaningful for people with small accounts.

This is what I know…

I don’t believe in any of these companies. But I see the opportunity because the pattern is hot.

Love it, hate it, ignore it … I don’t care. I’ll keep trading the patterns and teaching. If there’s a pump, I’ll call it out. If there’s a hot play… I’m gonna call it out.

I’m looking for more dedicated students…

Trading Challenge

How bad do you want it? Everything I’ve written about in this post is online. You can read the SEC filings and use StocksToTrade Breaking News.*** You can learn the chart patterns and rules. (I trade using these rules.)

Just remember it’s not easy. It’s crazy how much work goes into this. Jack Kellogg didn’t magically go from his first $1,000 month to $8 million in profits.* (See Jack’s Profit.ly chart here.) He dedicated himself over years to get to this point. And he did it as a member of the Trading Challenge…

**Apply for the Trading Challenge Here**

Again, how bad do you want it? Are you willing to study? Are you willing to put in two, three, maybe even five years before it all starts to come together? Jack didn’t make any money for 20 months. It’s not for everybody, and that’s OK. But if you have what it takes, apply today.

What do you think of this post? Comment below, I love to hear from all my readers!

Disclaimers

*This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform. I’ve also hired Jack Kellogg to help in my education business.

**While Tim Sykes has enjoyed remarkable success trading stocks over the years, his primary income derives from the sale of financial education products and subscription services offered by various businesses and websites in which he has an ownership stake.

***Tim Sykes has a minority ownership stake in StocksToTrade.com.

Leave a reply