Albert Einstein said it best, “Two things are infinite: the universe and human stupidity, and I’m not sure about the universe.”

Traders waste so much time chasing strategies that don’t work.

They refuse to set their ego aside, instead toiling at marginal setups.

Some of them ignore my 7-Step Penny Stock Framework just because it appears too easy!

Yet, with 20+ millionaire students and counting, what more proof do you need?

That’s why I get so excited to see my students succeed.

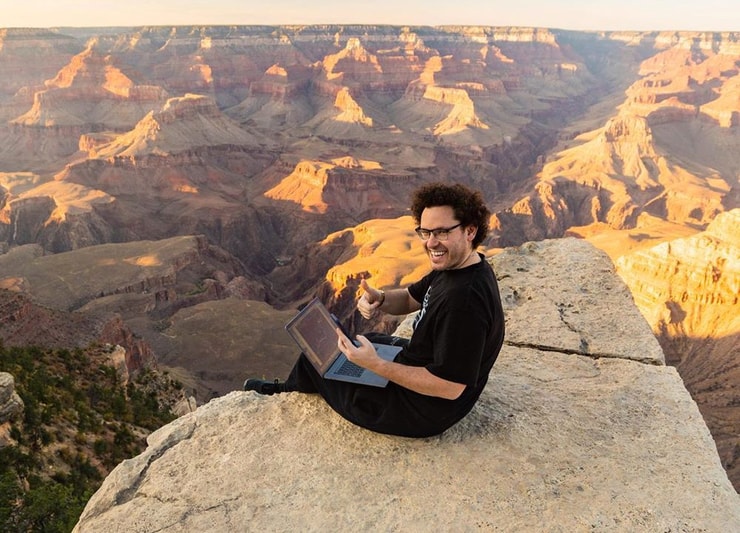

Eduardo Briceño is one of my favorite stories.

Last year, I interviewed him as crossed $600,000 in trading profits.

Today, he’s closing in on the big $1 million mark and I couldn’t be prouder.

Eduardo started my Millionaire Challenge back in 2016.

Initially, he lost a few grand in the first year and broke even in the second year.

It wasn’t until the third year he turned a profit, and it was only around $24,000 or so…but it was something.

Yet, it wasn’t until he changed his mindset that things really took off.

You see, Eduardo moved to the U.S. from Venezuela.

Like most folks, he wanted to trade full-time.

However, as he pointed out in the interview, trying to make $5,000 off a $5,000 account regularly isn’t a recipe for success.

So, what did Eduardo change that put him on the path to profits?

And, more importantly, how can it help you on your journey?

Let’s find out…

Table of Contents

Full-Time Isn’t For Everyone

Mark Croock, one of my most successful students, quit his accounting career to trade full time.

Jack Kellogg worked as a valet while learning the ropes.

Mariana spent an entire year studying after high school without placing a single real-money trade.

These folks dove in with both hands.

That may not work for you.

Eduardo needed to provide for his family first before learning to trade…which is very common.

Most people aren’t willing to quit their day job, or it’s simply not practical.

That’s fine.

It doesn’t let you off the hook when it comes to study time.

Even if you work a solid 9-5, you still need to review the charts, watch the videos, and learn the basics of the 7-Step Penny Stock Framework.

A lot of people choose to go with my Weekend Trader as a way to get their feet wet and start building their account.

You have to do what’s comfortable and achievable. Don’t try to be something or someone you’re not.

Everyone’s journey is different.

All that matters is you set aside the time to study and use it productively.

Learn About Short Sellers

It’s been a long time since I took a short position.

But, I know all about short sellers…how they act… where they cover…when they’ll pounce.

This information is invaluable to long-side traders.

Think about it…

If you know where a short squeeze is likely to occur, what can you do with that information?

When a stock is in the initial ramp phases of a Supernova, this creates awesome breakout trade opportunities.

Conversely, once a stock peaks and then drops hard, you know short sellers will lock in profits along the way.

Combined with the knowledge of promoters, we can determine where shorts are likely to take profits and where promoters might step in to support a stock.

More Breaking News

- CleanSpark Inc. Stock Leaps: What’s Driving the Surge?

- Warner Bros. Discovery Inc. Faces Troubling Investigations: What Does This Mean for Investors?

- Herc Holdings’ Stock Rally: A Surge Fueled by Strong Q3 Performance and Upgraded Guidance

When this happens on the backside of a Supernova, it sets up awesome morning panic dip buy opportunities.

Understand Your Profile

In my interview with Eduardo, he said something very interesting…

“35% of my trades give me 50% of my profits.”

Generally, profitable traders fall into two categories:

- Consistent winners

- Home run hitters

I’m in the first group.

My win rate is +75% and I tend not to ride trades very far. I take my profits and losses quickly.

Other folks like Matt Monaco run lower win rates. They take small losses, but when they win, they win big.

Some traders fall in between the two.

It’s important to understand where you fall and align your strategies and execution.

For example, a panic dip buy isn’t as likely to gain +30% as a breakout trade.

Swing trades tend to have lower win rates and larger gains.

Knowing what to expect can help you determine if and where you need to improve.

Don’t Give Up

Most traders are WAY better than they realize.

All they need is the right training to bring it all together.

Do yourself a favor…

Take my Millionaire Challenge and start making your time count.

—Tim

Leave a reply