Every year, something unusual happens.

While folks start to check out for the holidays, OTC and penny stocks start to heat up.

It’s a phenomenon I like to call the Winter Glitch.

Once dormant stocks start multi-day runs that create EPIC trade opportunities.

But here’s the thing…

Even the best stock runs come to an end.

Unfortunately, traders get caught up in the moment and forget about gravity.

Time and again folks buy at the top only to watch the price plunge the very next day, wiping out any gains they made on the way up.

I ALWAYS treat penny stocks like hot lava.

After getting burned myself numerous times, I developed my 7-Step Penny Stock Framework.

It’s remarkable how ACCURATE it is nearly two decades later.

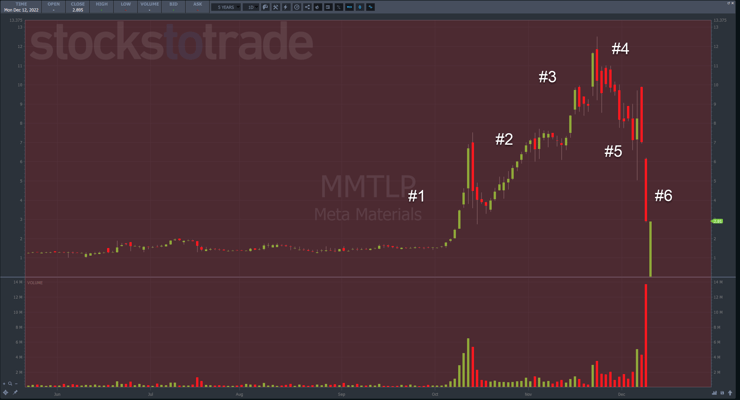

In just the last few months, I used this framework to win 8 of 11 trades in Meta Materials (OTC: MMTLP) for a net profit of $4,144 since early October.

Yet, I always remained wary of the crash I knew was coming.

Sure enough, shares crashed, and FINRA halted the stock, angering the Twittersphere.

I was accused of short-selling, which I haven’t done in years.

As I explained in this YouTube video, MMTLP shouldn’t have surprised anyone.

Every (almost) penny that goes Supernova will crash.

The 7-Step Penny Stock Framework can tell you what to expect.

However, choosing the correct setup makes the whole thing work.

Thankfully, you don’t have to memorize a huge list.

Just a few ideas are all you need to know.

Let me walk you through a few examples, including MMTLP, demonstrating this incredible framework in action.

The Correct Mindset

Carvana (NASDAQ: CVNA) was a Wall Street darling through the pandemic and beyond.

At one point, the stock traded at $376.83.

Today, it’s on the cusp of bankruptcy.

99% of the time, investing fads and trends fail, whether it’s electric vehicles, cryptocurrencies, dotcoms…you name it.

Heck, in 1908 there were 253 auto manufacturers in the U.S.

By 1929 that dropped to 44.

At the beginning of 1940, 90% of all U.S. car sales came from three companies.

Bubbles aren’t anything new. They’ve been around for hundreds of years.

I intentionally look for stocks that I form a bubble and pop, which I call Supernova.

These penny stocks go parabolic, jumping tens, hundreds, and sometimes thousands of percentage points in days.

I expect everyone to fail.

Most investors hold shares in a company never knowing what malfeasance lurks around the corner.

Instead, I find companies with promoters pushing the stock, knowing shares are manipulated, and trade accordingly, because they all follow my 7-Step Penny Stock Framework.

Let me show you what I mean.

The Framework in Action

After you review the 7-Step Penny Stock Framework, take a look at the chart above.

It’s incredible how accurately MMTLP followed the framework.

During phases #2-#3, I traded breakouts as the stock made new highs.

But I was ALWAYS cautious, never trying to extend my gains more than appropriate.

Most winners were 5%-10% gains.

And I was always quick to cut losses.

The last trade I took was on December 6, that last long green candle near #5.

That’s the spot where I like to look for morning panic dip buy opportunities.

As long as I manage my risk and toss trades at any signs of failure, I ensure I don’t get caught in a major downdraft.

Now, sometimes stocks don’t follow the framework cleanly and provide tradeable setups.

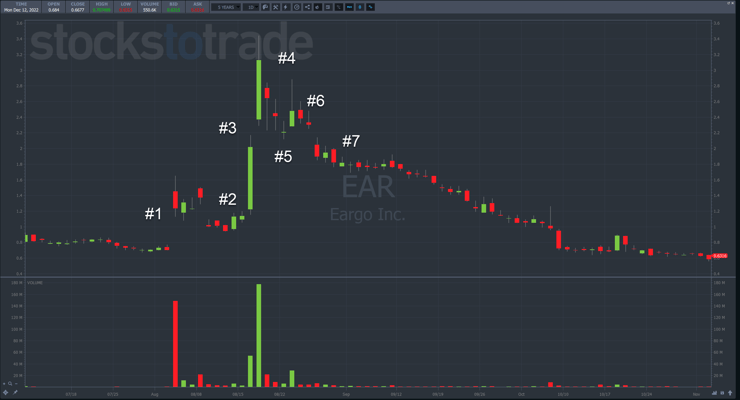

Eargo Inc. (NASDAQ: EAR) is an example from late summer.

When price began to go Supernova, it did so in just a couple of days. That didn’t leave much time to play breakouts.

On the other side, the dip buy areas weren’t deep enough to interest me.

The framework still applied. However, the stock didn’t offer up any trades.

Here’s another example using Cosmos Holdings Inc. (NASDAQ: COSM).

Here, COSM didn’t provide much in the way of breakout trades on the front side.

However, when shares plunged, they definitely came down enough to create possible dip buy opportunities.

The point is that the framework tells you what to expect.

From there, you select the setup that matches the phase of the framework.

After that, the stock will either provide you an opportunity or it won’t.

However, when you study these patterns and know what to look for, you find more of these. And the more you find, the greater the odds of a tradeable opportunity.

—Tim

Leave a reply