I’ve made +$7 million trading penny stocks throughout my career.

My secret?

I know how to lose better than most folks.

Now, you’re probably thinking, “Tim, how can you make so much money from stock trading from being good at losing?”

The first thing you’ve gotta understand is, everyone loses money in the stock market. But some people lose more than others.

In fact, there is a right way to lose and a wrong way…

And if you want to join the two comma club in trading, then pay close attention.

Here’s what it’s all about…

Table of Contents

Steph Curry Mindset

Think about trading like playing basketball. High-stakes basketball, like the NBA.

Curry knows how to sink 3-pointers. But he misses every now and then.

Does he throw a fit when it bounces off the rim? Does he sit out the rest of the game?

No! He dials in and tries to make the next one.

That’s exactly what trading is like.

I’m not gonna profit off every trade. But I use every loss as a learning opportunity. And I get right back to trading.

Want to compare failed trades? Keep reading to see what my losses look like. Learn from these mistakes!

Loss #1

First on the list is a failed panic dip buy. Not familiar with my favorite pattern? Check it out here.

The strategy is to find a stock that’s price is falling. I like to wait for it to be at least 20% on the day. Otherwise, there isn’t enough panic for a big bounce.

Then I wait to see a huge green volume candle indicating a change in trade sentiment. You can see it on the chart …

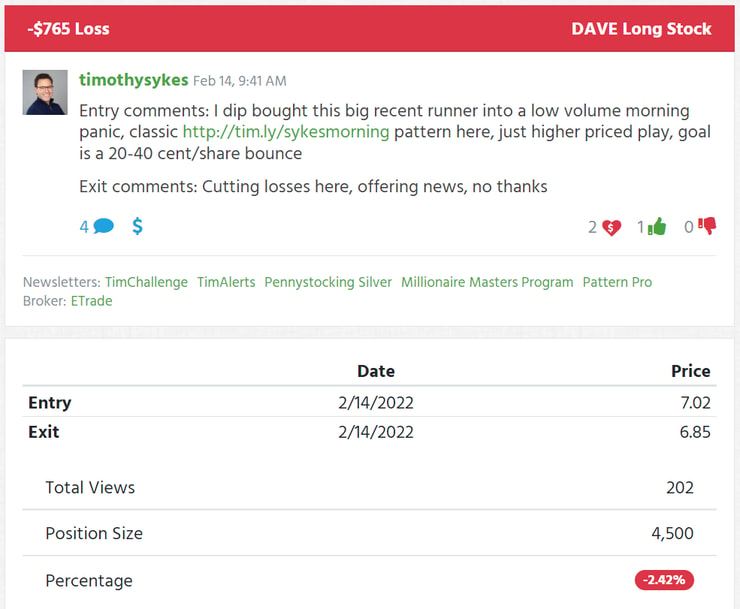

I saw Dave Inc. (NASDAQ: DAVE) start to panic on Monday, February 14, 2022. When it based around $7 and showed bullish volume I bought in.

As you can see, the bounce failed. So I cut my losses like a pro and waited for a bigger panic.

You can read my trade notes here…

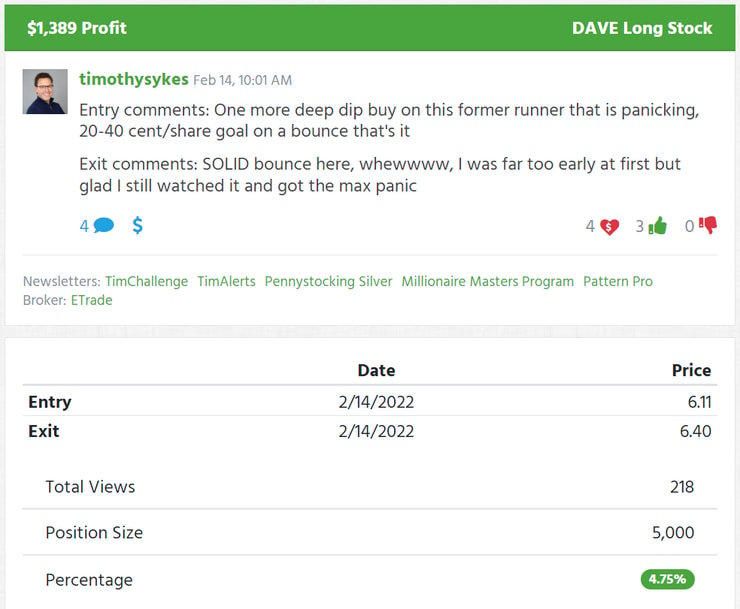

Later in the day, the real bounce came and I got back in for a +$1,300 profit. That completely wiped out my loss!

Let’s review what I did after making a bad trade …

- Cut my losses quickly. Small losses can turn into big ones. Imagine if I’d have kept my position above $7. I never would have made money back on that trade. The best decision is to get out and protect my account.

- Stay cool. I didn’t throw a fit. I didn’t revenge trade. I didn’t find some random spiker to buy because I lost. I kept my head on straight and followed the plan.

- Scan for re-entry. Sometimes I’m early to a trade. That’s fine. But I’d rather take a small loss and get back in later than drag it out for hours.

More Breaking News

- Barclays Cuts Snap’s Price Target Amid Mixed Q4 Results

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- Vale’s Stock Soars Following Significant Price Target Increases

- Needham Upgrades Ichor Holdings to Buy Amid Positive Forecasts

I found the right stock at the wrong time. Turns out I had to wait a bit longer.

Loss #2 and #3

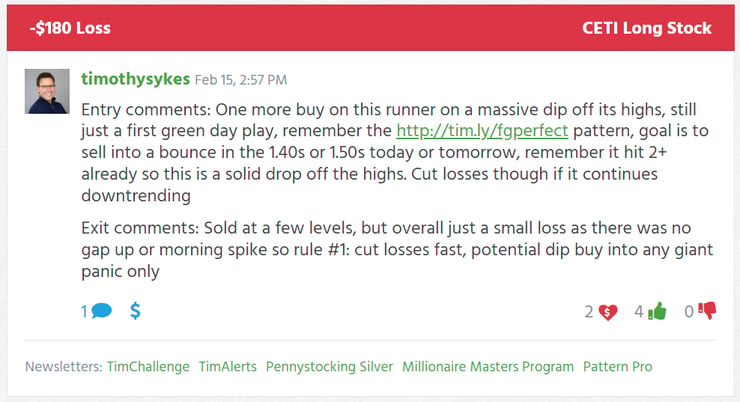

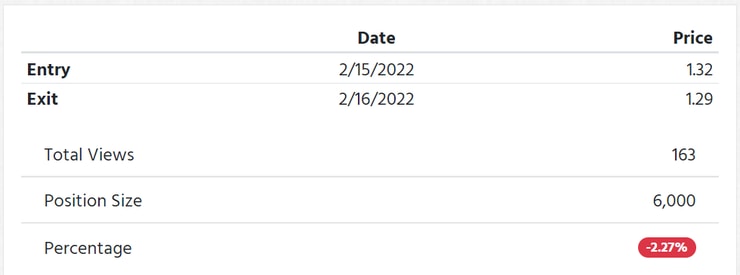

I actually made some money on Cyber Enviro-Tech Inc (OTCPK: CETI) before these 2 losses.

I’m including them in the same section since it was the same day and the same stock.

The price spiked in the morning on oil and water filtration news. That’s when I locked in some profits.

But toward the middle of the day, I thought it could break out again. So I bought on a dip after it touched $2.00. Then I sold for a small loss after weakness.

I bought it a second time on a lower dip hoping for another move towards the day highs. But I saw more weakness and cut it.

It’s a good thing I sold my positions. Look at what happened to the stock later that day. What a snoozefest.

In the end, I made money on this stock. But only because I know how to take losses!

Watch Me Trade Live

Making $1 million in the stock market is no easy task. I’ve done it because I took the time to study and grind.

And I didn’t have a mentor to teach me. A lot of my millionaire students are better than me at day trading. It’s OK, my passion is teaching. I figure if they succeed, I’ve done my job right.

All students get access to is my live trading webinars. I save and catalog them for study purposes. Sometimes people get stumped until they see my screen while I’m trading. Then it all clicks.

I have an upcoming all-day live trading webinar on Thursday, February 24. Mark your calendar, this is the trading opportunity of a lifetime.

You’ll get to see firsthand how I make the sausage.

Walk me through what you’ve learned today. Next time you enter a failed trade, what are you going to do? I want to see this is getting through to you!

Leave a reply