Every trader wants to start their Monday off with a bang…

Every trader wants to start their Monday off with a bang…

That’s why I’m going to share with you four stocks I am closely watching that have the biggest potential!

So today, I am going to break down why I think these four stocks are closely on my radar….

And how I plan to capitalize on them if the opportunity is right.

If you’re ready to kick start this Monday on the right foot, be sure you are closely watching these four stocks!

Table of Contents

My Watchlist For The Week

Every trader should have a watchlist…

It’s not only good for future trading opportunities but it can be used as a learning tool, too.

What do I mean by that?

Well, I taught all of my students where to start when they are looking for potential trades…

And after studying and practicing, they learned what should be truly added to their watchlist, and what ones shouldn’t be.

Let’s face it, you don’t want to waste your time looking at stocks that really don’t have much potential…

Do you?

Of course not!

But you need to also remember that not every one of these stocks I am watching will end up being trade worthy.

Over the last several weeks, I’ve been providing you with a few stocks that I am closely watching every Monday…

And one that really haunts me is American Battery Technology Company (OTC: ABML).

Due to my lack of discipline, I missed the perfect dip buying opportunity, but now that’s behind me…

It’s time to look forward to what new opportunities the market may give us.

Let’s take a look at what I am keeping an eye on.

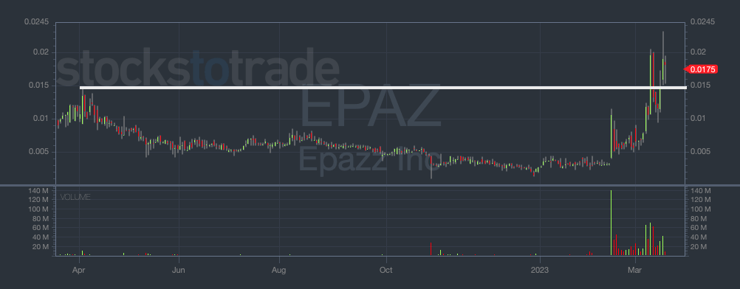

Epazz, Inc. (OTC: EPAZ)

Some traders think once you trade a stock they are done with them and you should forget about them.

Honestly, that’s far from the case.

In fact, I trade a lot of these penny stocks multiple times throughout their life span.

One example is AMBL…

Here are all of my trades for AMBL

And I’ve also traded EPAZ and I am still watchin it.

Why do you ask?

Let’s take a look…

At the time I am writing this, EPAZ had a decent dip buying opportunity on Friday morning given its recent run-up.

The reason I am still willing to trade this is that it still fits in line with my 7-Step Penny Stocking Framework.

Looking back at the history of the chart, I drew you a line that I will be watching closely to see if the stock breaks below the $0.015 level.

So even though I’ve traded this previously, it’s still on my list and it should be on yours, too.

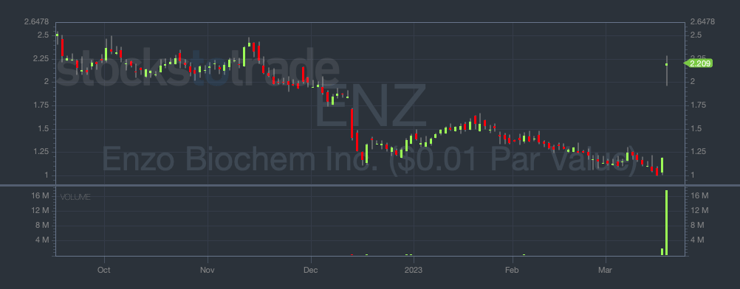

Enzo Biochem, Inc. (NASDAQ: ENZ)

This is the next stock I am closely watching because of its recent run-up.

This is the first thing I tell all of my students to look for when looking for potential trades.

Let’s take a look at the chart…

Notice how this stock has been beaten down over the last several months…

Then suddenly, volume was introduced to the chart and it spiked on Friday.

As this approaches a key resistance level, I will be watching it closely to see if it does one of two things…

Either it could panic or it could be a break-out opportunity.

All of this is part of the thought process you need to understand before considering what your next move is.

ViaDerma, Inc. (OTC: VDRM)

VDRM is another close stock I am watching to kick-start the week…

Just take a look at the chart, what do you see?

I encourage all of my students to communicate in the chat with each other to discuss their thoughts and ideas…

Engaging with other traders can help you discuss your thought process and see things from a different perspective when you are learning.

This stock has been on quite the run-up over the last few days after it broke through a key resistance level…

Now that I missed that opportunity, do you know what my next move will be?

The last stock I am watching is…

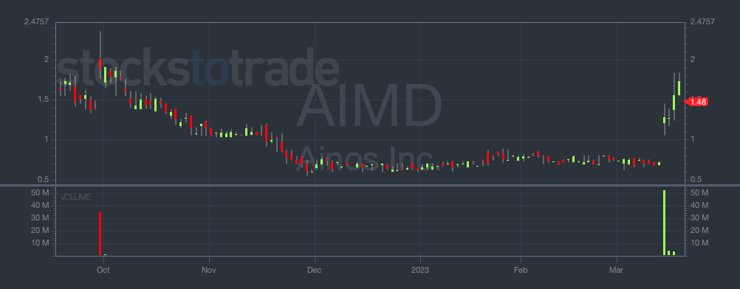

Ainos, Inc. (NASDAQ: AIMD)

This stock was also beaten down, and given its significant jump earlier in the week, I am waiting for it to panic.

At the time I am writing this, it’s approaching a key support area that I will be waiting for it to crack.

Can you spot it?

Make sure you are looking to the morning for these prime panic opportunities…

As you saw last week from my previous trades, intraday panics are not ideal right now and morning panics are way more predictable.

Be sure you know how to master the panic dip buy as it’s one of the first strategies I teach my students as it’s a great way to grow your confidence and trading account.

I’ll see you all tomorrow!

-Tim

Leave a reply