If you’re new to the stock market, you may have no clue as to how stocks work…

That lack of knowledge can be scary. And if the thought of investing or day trading scares you, you’re not alone. Honestly, that fear can be good. It can make you want to trade safer.

The stock market is the single greatest creator of wealth in history. People have made (and lost) millions of dollars buying and selling stocks.

Can you get rich from the stock market? Absolutely…

But I’ll be the first to tell you it’s not easy. You won’t randomly wake up one day, buy a stock and become a millionaire next month. That’s not how this works.

There’s no get-rich-quick button … no legit way to make millions overnight … no secret strategy to double your account in a week. Don’t take the ‘easy’ road. I guarantee you won’t see the results you want.

Today I’ll jumpstart your education. But this is just a tiny nugget.

New to penny stocks? Read this post, then access my FREE penny stock guide here.

And when you’re hungry for more, get the book by my student Jamil, “The Complete Penny Stock Course.” Jamil’s done an amazing job of organizing my penny stock rules and lessons in this book. Keep it on your desk. Refer to it as often as you need.

And if you’re ready for a full stock market education — apply for my Trading Challenge today.

For now, I’ll break down what stock are and how trading them works. Please, read on.

Table of Contents

What Are Stocks?

Stocks are essentially tiny portions of companies. If you’re like most people, you don’t have billions of dollars available to make huge investments in private companies.

Stocks allow average, everyday people to invest in some of the largest and most successful companies in the world. So why would companies want to sell random people shares of their company?

First, the average investor or trader can only buy shares of a company once it goes public. That’s called an initial public offering (IPO). Most companies start small and are privately owned by the founders…

As the company continues to grow, it needs to raise money to support that growth. An IPO allows companies to raise money by selling shares to the public. Thanks to the internet, it’s easier than ever to buy stock. You can open an account on your phone in less than a minute and start buying shares.

But just because you can buy shares doesn’t mean you should.

How do you know when is the best time to buy a stock? How do you know what to buy? And, why would you want to risk your hard-earned money?

Those are big questions … Let’s slow down and take one thing at a time, starting with…

What Is The Stock Market?

You can’t buy or sell shares of companies just anywhere. This is where the stock market comes into play.

When you hear people talking about the stock market, they’re likely discussing the market as a whole. Within the stock market, there are major stock exchanges where traders can buy and sell stock shares.

Those exchanges include the New York Stock Exchange (NYSE) and Nasdaq. And there are other exchanges, like the OTC Markets. That’s where smaller companies that don’t meet the listing requirements of the major exchanges can trade their shares. The two most common criteria for listing on major exchanges are market capitalization and liquidity.

For example, Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN) and Ford Motor Company (NYSE: F) all trade on the two major exchanges. But some of the hottest runners my students play, like OWC Pharmaceutical Research Corp. (OTC: OWCP), trade on smaller, lesser-known exchanges — that’s where I think the best opportunities are.

The stock market operates kinda like an auction. Buyers and sellers from around the world can place orders to buy and sell shares. If there’s an agreement on a price, a company’s shares exchange hands.

How Do Stocks Work? (A Guide for Beginners)

Now that you know what stocks are and where you can find them … here’s a beginner’s guide to how stocks work.

Earlier I talked about IPOs and why companies have them. Once a company goes public, they probably need more capital to grow. If you choose to purchase that company’s shares, the value could increase as the company expands and profits…

Keyword: could.

In 2019, we saw a lot of “hot” IPOs. But most of them underperformed. Early buyers are left holding the bag, hoping their investment will pay off … someday. And maybe it will eventually. But there’s a key lesson there: don’t immediately jump on any hot IPO you hear about in the news.

There are better and safer ways to make money with the stock market.

Once a company is public, you can buy its shares during standard stock market hours — 9:30 a.m. to 4 p.m. Eastern. Most advisors recommend people invest in well-established companies that have a proven track record. These companies, commonly referred to as blue-chip stocks, might have lower returns than a hot technology company, but there’s less risk.

Most of the time companies’ share prices trade at a future expected value. If the company is expected to do well into the future, the value of its shares will increase. But if a company starts to decline, its stock value will decrease.

Some people are scared of the market — they think stocks move randomly. But price action is generally FAR from random. People just don’t have a solid market education. Once you begin to understand the basics and some trading patterns, the market won’t seem so random.

I’ve been trading for over 20 years and teaching for over 10. I have over 6,000 videos on the market. And history matters when it comes to understanding how it all works. Subscribe to Pennystocking Silver for access to all my videos.

How Do Penny Stocks Work?

Penny stocks — or low-priced stocks — are defined as any stock under $5 a share. Most of the stocks under $5 are highly volatile and speculative companies.

This is my favorite niche in the stock market. Wall Street and big traders don’t bother with these stocks … They just don’t think they’re worth their time. Maybe that’s true if you have a $50 million account…

But if you start trading with a small account, it can be a great place for you to learn to take singles and grow your account slowly. But you gotta focus on your education and learn patterns. You gotta find what works for you.

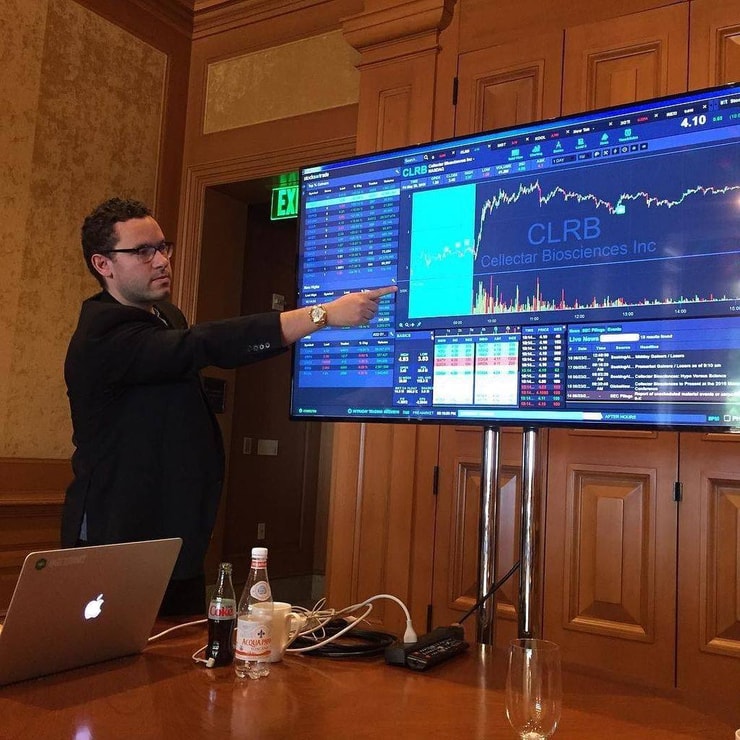

I don’t invest in penny stocks — I day trade them. Sometimes I buy and sell them within a few minutes or an hour. Other times I may hold the stock overnight. These stocks can have crazy volatility and some can run over 100% in a day.

How Do Taxes Work With Stocks?

When it comes to trading, investing, and stocks, taxes can get complicated. There are many loopholes and special clauses in the tax code. But it’s far too much to get into in this post.

Don’t play ignorant here. Consult a professional. Talk to a licensed accountant or tax advisor about any income or losses from trading stocks. For more on trading and taxes, check out this post.

There’s no exact science for setting share prices. If there was, we’d see a lot more millionaires.

Share prices can move on emotions, hype, and fundamentals. In penny stocks, it’s not uncommon to see a single news release spike a stock’s price for one, two, or three days. The same principle applies to the overall market.

The stock market is an auction. So people (yep — you and me) set the prices of a share. It’s the price buyers are willing to spend and sellers are willing to accept. And when millions of people are constantly buying and selling shares, a stock can make big moves.

So pay attention to the news … Do your research. A lot of factors come into play for every company. And no two companies are the same. I warned you this wouldn’t be easy…

But you can learn to spot patterns. You can study the past to better understand how to adapt to the markets.

Is It Possible to Make Money With Stocks?

YES!

The main reason traders and investors buy and sell stocks is to make money. And investors can make money off the shares they own in two main ways:

- Appreciation: As the price of the stock goes up, the investment value increases.

- Dividends: High-growth stocks like technology companies usually don’t pay dividends. Outside this sector, many stocks pay dividends — that’s the shareholder’s portion of the company’s income.

Historically, the overall stock market returns 10% annually. That’s closer to 8% once you adjust for inflation. In other words, if you invest $1,000 in the market today, it could be worth $1,100 in a year.

Obviously, it’s not that simple. But if you hold for a long enough period of time, your returns should average out to 10% a year. Some years you’ll have larger returns, some will be stagnant, and others you’ll have negative returns.

And that 10% average annual return doesn’t include dividend payments. Some companies may pay a 5%–6% dividend. It’s up to you what to do with that money. Some will reinvest into more shares — that can create a snowball effect. Others may need the money or stash it in savings for a rainy day.

Personally, I’m not an investor. I like more action. And so do my students. That’s why we love penny stocks.

My student Tim Grittani turned $1,500 into over $8 million. Many of my other students have made six and seven figures. For us, it’s about focusing on penny stocks and the massive moves they can make in a short period.*

More importantly, my top students understand that it’s about finding a process and strategy that works for them. They work their butts off to become self-sufficient traders.

All of my top students learned my patterns. They studied my 6,000+ videos and watched the Trading Challenge webinars. Join them — apply for my Trading Challenge today.

[*Students’ results are NOT typical. It takes time and dedication to build exceptional trading skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

What Is a Broker?

Another common term you’ll hear is broker. You need a broker to trade. That’s how your buy and sell orders are executed … through a brokerage firm. Not too long ago, a broker was an actual person. Today, thanks to the internet, most brokers are online platforms.

You can enter orders to buy or sell shares yourself through your broker’s online platform.

There are a lot of brokers that serve different needs. Some are better for short selling but charge higher commissions. Some are based overseas and offer people higher levels of margin — but these brokers aren’t regulated by U.S. regulations. Watch out for sketchy brokers.

Today, most discount brokers offer commission-free trading. Is it worth it? You gotta read the fine print. I’m happy to pay commissions for better execution and customer service. Check out this post for more on how to choose a broker.

More Breaking News

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

- Mattel Faces Market Concerns: Shares Tumble Amid Revenue and Earnings Miss

- Spotify’s Financial Surge: Poised for Growth Amid Upgrades and Strategic Moves

- Upstream Bio Faces New Strategic Challenges Amid Latest Developments

Do I Need a Broker to Trade Stocks?

Yep. The first step to buying stocks is to get a broker. Which broker you choose depends on your needs, your strategy, and your account size. Do your research. Choose wisely.

You want to choose a broker that suits your needs and that has a solid foundation.

Origins of Stock Trading

The stock market dates back to colonial days when explorers were searching for the Americas. People traded goods, profit shares, and ownership of ships at ports. As economies around the world grew, more companies started to sell part of their shares to the public to raise money.

Until about 25 years ago, most of the trading was done manually by individuals on exchange floors. Computers had yet to make it into Wall Street … people feared computers would disrupt the market dynamic.

Starting in the mid-1990s, stock exchanges like Nasdaq integrated computers into their systems. This was a critical step to making stock trading accessible for everyday people.

Then, the late 90s gave rise to a day trading boom due to the dot-com bubble.

Types of Stocks

There are so many types of stocks … Too many to explain them all here.

I mentioned blue-chip stocks already. These are often considered safer investments because of their long history of consistent profitability. Then you have large tech companies like the FANG group, which can be more volatile.

There’s also healthcare, service, finance, and consumer goods. You can find stocks for all these kinds of companies. Each stock type comes with its own risk level and returns. What’s right for you? That’s something only you can answer. But always do your research. And if in doubt, consult a licensed professional.

How to Invest in and Trade Stocks in a Few Simple Steps

There’s a lot of information in this post. Trading isn’t something you can pick up today and suddenly be good at tomorrow.

The first step you should take to become an investor or trader is to save up money. Never trade or invest with money you don’t have. If you need the money you’re trading with for next month’s rent, don’t use it.

It’s OK to start small. I trade with a small account along with my students to help them learn the process and show them that small wins can add up over time.

Once you have money to trade with, open a broker account. This shouldn’t take more than a few minutes. Once you have an account, you’re free to buy and sell stocks. It’s easier than ever to get started in the stock market.

👉🏼Get my FREE weekly stock watchlist here.

But before you make a single trade, invest in your knowledge account. I think it’s the smartest investment you’ll ever make.

Ready to be a self-sufficient trader? Apply for my Trading Challenge today. But only if you’re really ready to work. No lazy losers, please.

Conclusion

Here’s something I tell my students all the time … It takes eight years — or longer — to become doctors. Why would you think you can become a successful trader overnight?

You can’t. Even after 20 years, I still learn. I still make mistakes. This is never something you’ll be perfect at. You have to continue to work at it. You need to have the drive and passion to last in the markets.

So take it slow. Read this article again. Check out all the links and resources. Digest it all. One of the beautiful things about learning to trade now is how much FREE information you have access to.

Is the market scary? Absolutely! If you don’t know what you’re doing, you can lose big. There’s a HUGE learning curve … but my goal is to help you reduce your learning curve.

Learn from my experience — my wins, losses, and mistakes. You can learn from my top students too. We’re all about transparency. You can check out every trade we make.

Don’t waste your hard-earned money and years of your life stumbling blindly through the marketplace. Start your education today.

Tell me what YOU think of this post … Do you trade stocks? Leave a comment below!

Leave a reply