If you’ve ever had the experience of being stuck in a trading slump, then you know the gut-wrenching feeling that comes with it…

Frustration…confusion…helplessness…they’re all there, gnawing at your insides.

But you can’t dig yourself out of a hole by digging deeper…

With over two decades of trading experience and more than $7.4 million in trading profits under my belt…I’ve been there countless times.

In fact, I’ve been in a bit of a trading funk this month.

But I refuse to stay down.

That’s why I made some much-needed changes, and I’m slowly but surely getting back on track.

These steps I took can be applied to anyone who is in a slump.

Table of Contents

Step 1: Be Brutally Honest

Hop on social media, and the main thing you’ll see from traders is them posting their wins.

They falsely suggest that trading is easy and you should make money daily.

But that’s a load of BS.

Most people think "scared money doesn't make money", but I've been trading like a coward for 2 decades & I'm a multi-millionaire, as are 30+ of my https://t.co/occ8wKmT5U students who've made 7-8 figures. The reality is trading is too scary NOT trade like a coward! #safetyfirst

— Timothy Sykes (@timothysykes) March 23, 2023

Real traders know that there are ups and downs to trading. And that losing is part of the game.

When you find yourself in a trading slump, the last thing you want to do is make excuses.

Stop saying stuff like:

- The market is rigged

- My platform sucks

- The market makers are out to get me

You need to take responsibility for your actions…that’s the only way you’ll begin to correct them.

That’s how I teach my students how to think.

Start by looking at your recent trades and dissecting where you went wrong.

Some typical mistakes that traders make include:

- Oversizing their trades

- FOMOing into trades and getting bad entries

- Overtrading

- Trading setups they aren’t good at

Whatever it is, know there is a reason you’re losing money.

In my case, I was overtrading and not patient enough for my A+ setups.

It’s frustrating because I’m investing time to trade, and when I don’t get the results I want, it leads to bad trading habits.

Step 2: Reset

Losing can mess with your emotions. And as I said above, you can’t dig yourself out of a hole by digging further.

Many newbie traders are eager to get back their losses. So they start trading more or even get more aggressive with their position sizing in an attempt to get back to even.

However, that’s a terrible approach because it’s emotionally driven.

What I like to do is reset.

I do that by not trading or trading far less.

I went a few days without placing a single trade. That helped me regain my discipline.

Goooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooooood morning! #letsdothis #letsgo #fridaymorning #tgif pic.twitter.com/MX1IjWnxVM

— Timothy Sykes (@timothysykes) March 17, 2023

More Breaking News

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

- Roblox Stock Surges After Strong Financial Performance Reports

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

- Ondas Leverages Strategic Gains in Defense Sector Expansion

The New York Stock Exchange opened in 1792…its been around before you were born and will be around after you’re gone. The market isn’t going anywhere, and it’s not really a big deal if you miss a few days if that’s what you need to get back on track.

Step 3: Keep It Simple

Returning to the basics is the best way to get out of a trading slump after a reset.

Find out what has been working for you lately and focus on those types of plays.

If you only have one setup you’re confident about… then focus on it.

You want to get the feeling of winning back again. And the best way to do that is by trading setups you feel comfortable with.

That’s exactly what I tell my students when they are in a slump.

In my case, I looked for plays that I believed were low-risk and had a high probability of success.

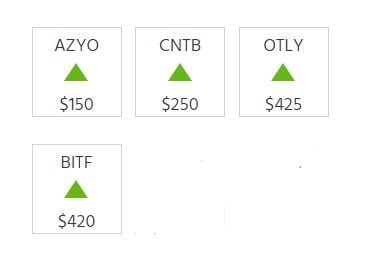

For example, last Friday, I bought the ticker symbol BITF.

Why?

Because I noticed that crypto stocks were moving inversely with banking stocks, and with all the drama pertaining to Credit Suisse and the regional banks, I felt that BITF had a chance to pop on Monday.

Many crypto stocks rallied off the negative banking news, but I saw that BITF had been lagging. I like buying laggards because they seem to offer lower risk.

Here’s another one I thought was a simple play…

I bought the ticker symbol OTLY after a breaking news headline that the company was expanding its partnership with McDonald’s in Austria.

A struggling company making a deal with the largest restaurant chain in the world… seemed like a no-brainer to me.

That same day… I bought shares in the ticker symbol CNTB.

I had seen that biotech stocks were running hot and that this one was a big spiker on solid news.

But instead of rushing into it…I stayed patient and waited for a panic sell-off in the morning to make my entry. I got exactly that and flipped in and out of this trade for a small profit.

Step 4: Start Small

If you’re coming off an injury, you can’t expect to be 100% when you return immediately. You’ve got to ease into it. The same is true with trading. If you’re coming off a trading slump, you want to build your confidence back up slowly.

And the best way to do that is by trading smaller than you normally would.

That’s something I tell my students all the time.

After each winning trade you put on, your confidence grows stronger.

And that’s what I’ve been doing to get my groove back.

So far…so good.

Source: Profit.ly

My last four trades have been small winners. And I’m perfectly fine with that.

Don’t let anyone ever make fun of you for trading small. I know you hear people on social media say things like go big or go home…

Or Yolo…

But that’s dumb.

There’s a reason why I’ve stayed profitable over the last two decades and have over 30 millionaire students.

It’s because these steps I’m sharing with you work.

If you’d like to learn more about how I can help you…click here for more information.

Leave a reply