No one wants to leave money on the table.

It’s like getting to a concert halfway through and missing your favorite songs.

While I can’t teach you to show up on time, I CAN help you capture more profits on your winners.

Here’s the thing…

Even after years of trading the market, I still pull out of trades early.

But guess what?

I’m totally fine with that, and you should be too.

There’s always another trade around the corner.

I’d rather take small wins more often than worry about huge losses.

However, that doesn’t mean I don’t learn from missed opportunities.

Global Development Inc. (OTC: GDVM) is a perfect case study.

I bought shares late Friday into a multi-day run on stellar news.

Come Monday, I exited for a tidy $475 profit (starting stake $7,516.80) at $0.037.

Thing is, had I waited until the end of the day, I could have gotten $0.042!

Now, I prefer to take my exits all at once.

However, there’s an incredible concept that many traders use that lets them have their cake and eat it too.

Here’s how it works…

Why GDVM

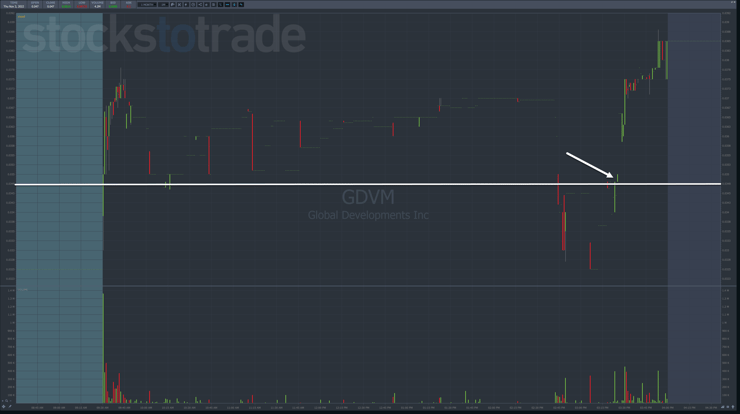

I want to start with a daily chart of GDVM.

The arrow points to Friday’s trading.

I bought shares around 3:30 p.m. EST for $0.0348.

Now, check this out.

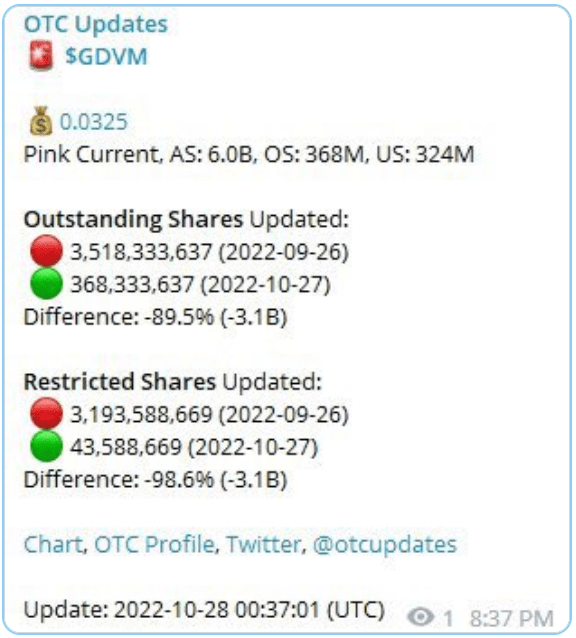

This is the intraday chart of GDVM. I set a white line at $0.0348 and put an arrow where I bought into the stock.

I know I often talk about this, but panic dip buys are fantastic ways to grow small accounts. While that typically happens in the morning, dips can happen in the afternoon.

Going back to the daily chart, I noticed this stock was in a multi-week uptrend.

Recently, the stock got a huge boost from this headline:

The company saw a massive reduction in the shares outstanding, cutting the float by almost 90%.

Smaller floats mean it takes less volume to move a stock.

Plus, profits are distributed amongst fewer shareholders.

There were a lot of reasons to be bullish.

So, my goal was to hold over the weekend for a gap up on Monday, as simple as that.

Cutting Too Early

When Monday rolled around, this is what the chart looked like.

Shares opened lower and immediately sold off into a morning panic.

Luckily, they bounced right back and I was able to make a nice profit.

However, the stock wasn’t done running and in fact kept going for days.

How could I have played this differently?

For starters, I should have taken a portion of the trade off at Friday’s close, which was roughly where I ultimately took my profits.

Locking in profits early means reduces my risk and lets me give the remaining position more rope.

Had I done that, and sold say 75% of my holdings, I probably would have stopped out back at breakeven on the remainder.

Thankfully, the stock never got back down there.

Once a trade is up nicely, I never want to let it become a loser. At worst, I would stop out at or just above breakeven.

Now, let’s say I had sold 75% of the trade at that point, whether it was on Friday or on Monday.

I could then let the remaining position ride with a stop back at breakeven.

As shares push higher, I can scale out of the remainder in pieces and move up my stop.

For example. Say I had 100,000 shares to start. I sell 75,000 at $0.037.

I would put a stop in for the remaining 25,000 at $0.0348.

Let’s say I decide to shoot for another $0.004.

I sell half of the 25,000, or 12,500 and at $0.0041.

More Breaking News

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

- Clear Channel Outdoor’s Strategic Move: Major Acquisition Unfolds

- Huntington Bancshares Misses Q4 Earnings Estimate Amid Turbulent Market Conditions

- HUMA Stock Shows Volatility Amid Speculation and Economic Factors

I can then put a stop for the remaining 12,500 back at breakeven or move it up to the last profit exit, $0.037.

Scale or Scram?

Ultimately, whether you choose to scale out or go one-and-done is a matter of personal preference.

One-and-done’s are easier to manage and free you up from the trade sooner.

But, as GDVM shows, it can leave a LOT on the table.

Context is also important.

As I pointed out in yesterday’s newsletter, macroeconomic events impact penny stocks the same as large caps.

If the market is bullish, then more risk may be appropriate.

If the market is fragile, it’s wise to lock in profits early and often.

—Tim

Leave a reply