The term “fake news” is something we hear about a lot…especially as we enter election season.

But if you trade penny stocks like me…then you never stop hearing “fake news.”

You see, most penny stocks are horrible companies with weak fundamentals and slim chances of becoming profitable.

Most analysts refuse to cover them because they’re so bad.

That’s why these companies turn to the “dark side.”

They hire a marketing agency to send out “investor awareness” and marketing emails to help bring attention to their company and stock.

These promoters will try their best to get readers excited to pump the stock price up.

It happened on Thursday in the ticker symbol HCNWF.

A blatant pump that flew close to the sun and got away with it.

Understanding how pumps work has helped me immensely throughout my trading career. I can’t tell you how much of my +$7.4 million in trading profits were made from penny stock pumps…but I bet a bunch of it.

Table of Contents

How The Game Works

Crappy companies need money. To raise the capital, they will do stock offerings. But why would anyone buy their crappy shares if the company sucks?

This is where marketing and promoters enter the picture.

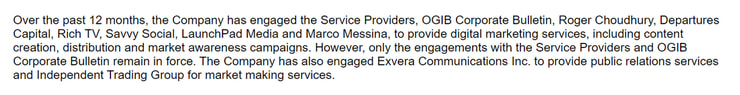

The company will pay the promoter either cash or stock, sometimes both, to write favorable things about it.

These promoters have email lists and chat rooms they can send the marketing material to.

They’ll typically say stuff like the company is disruptive, revolutionary, has developed some breakthrough technology, or how it’s the next Amazon, Apple, or Tesla.

It’s mainly just a bunch of hype.

However, if the promoter does their job correctly…they will have brought a ton of new eyeballs to the stock…creating volatility and opportunities for traders.

I always tell my students never to believe the hype. And that most of the companies involved in pumps suck, and their stock will go to zero.

But if the promotion is successful, the promoted stock will have experienced a surge in price… allowing the company an opportunity to raise capital through a stock sale.

Once shares get diluted, the stock will then dump…

And a few weeks or months later, when the company needs a capital injection…they’ll play the game again.

Why I Love This Game

Promoters and the companies that play this game aren’t that smart. They’re fairly easy to read. And the traders who play these stocks are led by emotions– fear, and greed. After all, most of these stocks have zero fundamentals.

If I’m going to play a poker game…I want to play against players who aren’t as skilled as me and/or are bad.

This is why I rarely trade large-cap blue-chip companies. I would compete against sophisticated players with an information, execution, and capital edge over me.

And that’s why I’ve always stayed in my lane.

Moreover, the penny pump stock cycle doesn’t change much. It’s been the same for years.

For example, we typically know why the stock is pumped. The company needs money.

But here’s something else that most people forget.

Some promoters get paid in stock.

What would you do if you were given free shares of a crappy stock?

You’d dump your shares right when the market opens and exchange them for cash…

More Breaking News

- QuantumScape Takes a Big Leap with New Battery Line

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

- Vale S.A. Stock Soars as Goldman Sachs Raises Price Target

That’s why I like to buy “morning panics.”

So What Happened in HCNWF?

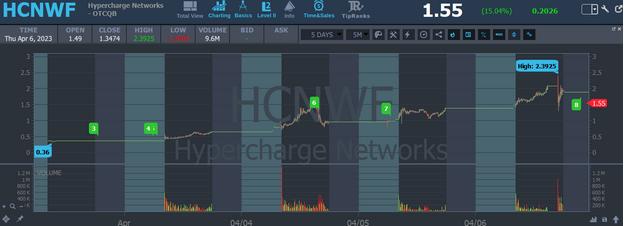

In just five trading days, HCNWF went from a low of $0.36 to a high of $2.39.

Source: StocksToTrade

That’s a move of more than 600%!

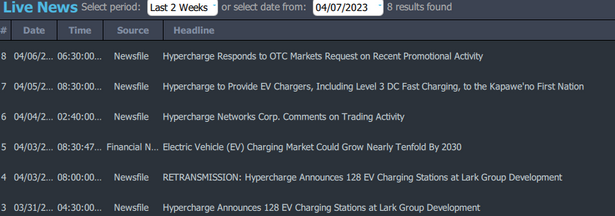

The company was going hard in the pain starting on Mar 31, 2023.

It issued these six press releases:

Source: StocksToTrade

On April 3rd, the company received a request from the Investment Industry Regulatory Organization of Canada and the OTC Markets to comment on its recent stock price surge. The company announced it was unaware of any material, undisclosed information that could have impacted its trading volume and stock price.

If/when $HCNWF ever reopens, expect similar $MMTLP like conspiracy theories floated by promoters who annihilated all the dumbest/most naive people in the world, nothing ever changes. They don't want you to learn https://t.co/KhqHFIwfik & https://t.co/p9G37ZSgwT & its why I teach

— Timothy Sykes (@timothysykes) April 6, 2023

However, despite being tapped on the shoulder regarding its stock price…HCNWF continued to pump.

The next day the company came out with another press release:

“Hypercharge to Provide EV Chargers, Including Level 3 DC Fast Charging, to the Kapawe’no First Nation”

These press releases usually lack specifics. They just want to show that the company is moving in the right direction and trying to make things happen.

As blatant and obvious the pump was…it didn’t stop traders from trying to ride the momentum up.

Yes, the stock $HCNWF will likely get hit on this financing at $1.05/share, but it's pretty impressive they can raise any $ at all given the amount of blatant promo emails being sent…hopefully this inspires more shady companies to start up promo campaigns, bring them back JB!

— Timothy Sykes (@timothysykes) April 6, 2023

And the company got exactly what it wanted:

Hypercharge ⚡️🔌 (NEO: $HC.n, OTC: $HCNWF) is pleased to announce a non-brokered private placement of up to 4,761,904 units of the Company (“Units”) at a price of $1.05 per Unit (the “Offering”), for aggregate gross proceeds of up to $5,000,000. https://t.co/sbMItqPbME pic.twitter.com/HY0kAUONOf

— Hypercharge (@hyperchargeco) April 6, 2023

It raised nearly $5 million at $1.05…a considerably lower price than what it was trading after the runup.

But that’s how the game is played.

And now that the company got what it wanted…it’s likely to cool off its promotional activity.

What You Should Be Aware Of:

HCNWF shares halted on Thursday for pending news.

The news was that it raised $5 in a private placement stock offering.

It went from $2.30s down to $1.30s pretty fast.

And that is always a risk when you’re trading promoted stocks.

You never know when the stock will halt and the company will announce a stock offering.

I was warning traders in my chat room about the risk in HCNWF.

A stock offering creates dilution, which is a major negative for shareholders. And because you don’t know when they’ll be announced, holding shares overnight on a stock that’s been getting pumped is risky.

There are several strategies I teach on how to trade these plays. As I said earlier, many of my 7-figure profits have come from trading penny stocks.

If you are ready to learn more about my program and how I can help, do yourself a favor and click this link.

P.S. My account is down after the first week of April. To get back on track, I’ll be focused on this strategy.

Leave a reply