Promoters will tell you that only they can make you money.

According to them, there’s no process you can follow that works for everyone.

They are all 100% wrong!

It’s absolutely possible to learn a profitable trading process.

My 30+ millionaire students are proof.

I recorded a YouTube video with six of my Millionaire Challenge students a year ago.

Each of them had crossed that 7-figure threshold.

If you listen closely, you’ll find remarkable similarities in their stories.

Every single one of these traders started in the same place.

They studied the 7-Step Penny Stock Framework, learned how to pair it with the right setup, and practiced.

Kyle Williams fell in love with short-selling.

Matt Monaco did a lot of swing trading and cryptos.

All of them began with the same foundation, the same rules, and the same principles.

And yes, it is that simple.

But I get that you might be skeptical…

…which is why I want to walk you through a trade I took last week in Cloudweb Inc. (OTC: CLOW).

It’s a simple setup that combines the framework and morning panic dip buys.

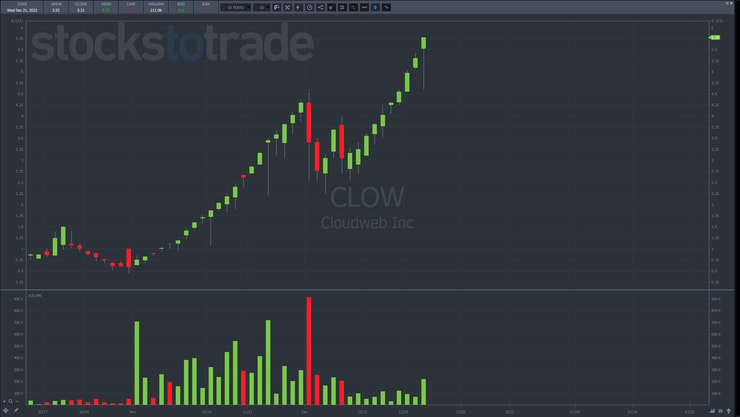

Cloudweb Inc. (OTC: CLOW)

This is the daily chart of CLOW.

Other than a short period from December 1st to the 8th, this stock has been in a perpetual uptrend.

Nearly every day closes in the green.

I want to highlight three areas on this chart.

Notice those long tails?

Those are intraday panics that got bought up.

Right after the open is the best time to scoop those up.

That’s exactly what I did when I traded the name last Wednesday.

People asked me why I didn’t buy breakouts as the name went higher.

Quite honestly, the stock didn’t rise all that much from one day to the next.

Sure, it went up. But it never really went parabolic…yet.

And in terms of percentage moves, it wasn’t enough for me to jump in.

So, instead, I waited for the right setup to develop just like you see above.

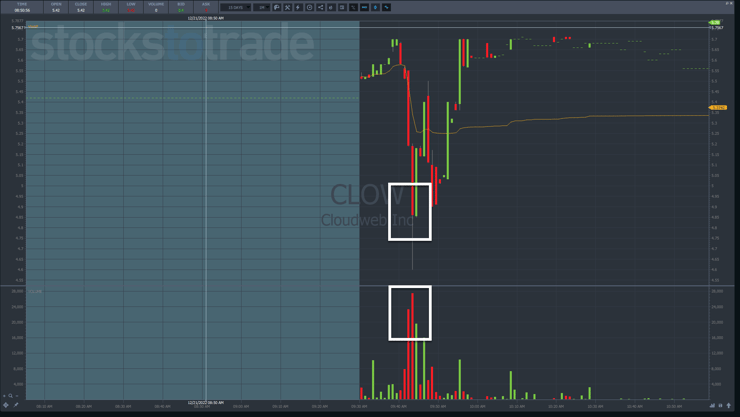

In my mind, I like to see morning panics that drop a stock +10% from the previous day’s close.

That triggers the short sale restriction which prevents shorting the stock without an uptick.

In layman’s terms – it tends to lighten the downward pressure.

After that, I use the skills I developed and teach to read level 2 data and look for volume capitulation where the selling is exhausted.

That part takes practice and can seem daunting at first. However, if you know what to look for and when it becomes easier to spot.

I love the morning panic dip buys because they can work on the front side of a Supernova and the back side.

Plus, as a long-side trader, I don’t have to worry about getting punched out by a massive short squeeze.

Now, not every setup works. I only win around 75% of my trades.

But I teach my students to lose small and fast by cutting losses quickly.

When you study these morning panics, you’ll realize that they don’t need a lot of time to work.

It either happens fast or it’s unlikely to happen.

Knowing this, I don’t need to sit around, waiting to see if buyers will step in.

If the trade isn’t moving within 5-15 minutes, I cut it and move on.

Doing this does not help prevent large losses, one of the most common problems traders face.

Ebbs and Flows

Like any strategy, there are hot and cold markets.

That’s why I like to say there are markets for learning and markets for earning.

If you study hard, practice, and prepare for the bonanzas, you’ll be able to capitalize on the moment.

On the flip side, you need to have the patience to wait for setups and not force them.

CLOW was a great stock for these setups. But, it could have crashed any day.

I trade cautiously.

If there isn’t enough volatility, I’m not going to press a breakout just because the stock has had a nice run.

My trades ONLY happen when the timing is right.

Patience is something you need to learn if you want to earn.

—Tim

Leave a reply