Near the end of each month, I like to host a live all-day event called the Timothy Sykes Trading Mastery.

It’s an opportunity for my students to watch me trade live, ask questions in chat, hear my play-by-play thoughts on the stock market and what’s in play.

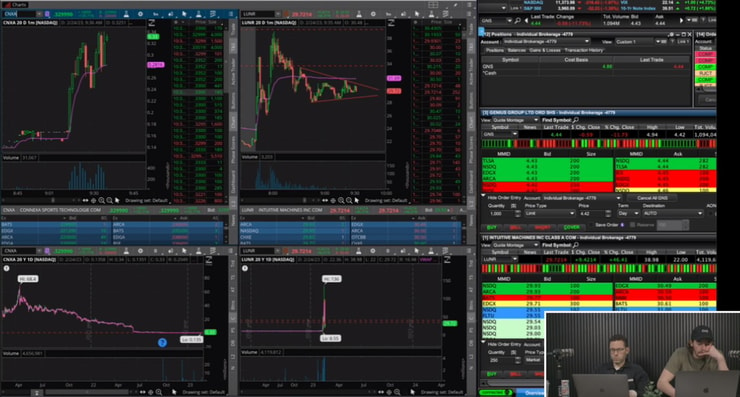

That’s me on the left with one of my latest millionaire students, Bryce Tuohey, live streaming during Friday’s market bloodbath.

It’s a real eye-opener for some folks.

You see, as much as I’m known for my trading prowess, becoming a self-made millionaire by 21, and mentoring 32 of my students into millionaire status…

I’m not one of those day-trading bros.

In fact, I think most traders who sit around their screens all day punching their keyboards and jumping from one trade to the next trying to scalp for a couple of pennies are miserable.

It’s borderline degenerate gambling, if you ask me.

Not to mention super stressful.

Today I want to talk to you about how I like to play this game.

Not only has it made me lots of money, but it has allowed me to travel the world.

And the beauty is you DON’T:

- Need a lot of capital

- Trade all-day to get results

- Quit your day job to get started

Let me show you how.

Your #1 Focus Until You’re Profitable

Believe it or not, it doesn’t matter if you start trading with a small or large account. In fact, I think it’s better you start off small because you’ll likely lose money for the first several months or even longer.

My latest millionaire student Bryce Tuohey says starting with a small account was a blessing because he believes if he started larger, he would have blown out his account.

Most newbie traders get obsessed with making money that they forget to focus on the process.

Not Bryce.

There was even a time during his journey when he decided to risk $2 per trade. He wanted to learn the setups and patterns first.

And that’s what I tell everyone…

Study…Study…Study…

People always ask me which one of your videos I should watch. Do you have like five that I can watch that will set me up for success?

Do you think I made hundreds of training videos over the years for fun?

Watch them all…better yet…watch them all three times.

If you have time to binge-watch Netflix and stupid reels, you should have time to study.

I’m sorry if that sounds harsh. But trading requires skills and knowledge.

Why do you think I don’t trade that much?

Because I know what the best setups are for me…

If you don’t know what to look for and how to trade it, how can you be consistently profitable?

Study hard for your first year…and I believe it will pay dividends in the long run.

What Trading Is and Isn’t

Television and social media portray trading as something glamorous.

No boss…no ceiling on how much you can earn…you can do it from anywhere.

Those are all amazing perks to trading.

But the actual act of trading is rather boring.

And I think that’s one of the reasons why so many people fail at it.

They’re searching for thrills and excitement.

During my live stream last Friday, Bryce and I more or less did nothing for the first two hours.

We watched the market, noted what was moving, and strategized on potential trades.

Successful traders know that sitting on your hands is one of the most important elements to trading.

This game is all about waiting for the right opportunity to strike.

In 2019 I made $125,000 in trading profits. However, when the market sizzled in 2020 I made $1.19 million.

I didn’t suddenly get better, there were just more opportunities, and I knew how to take advantage of them.

The markets have been pretty slow in 2023, but I see that as a good thing if you’re a new trader because it allows you to identify good setups from bad clearly.

When the markets heat up again, you’ll be ready to pounce.

Things change quickly. That’s why patience is so important during those slower periods. You don’t want to hesitate when there’s a greater opportunity because you’re in a hole and worried about adding to your losses.

Many day trading Bros on social media are trying to glamourize trading. Don’t fall into that trap.

More Breaking News

- Valterra Platinum Strengthens Position with Impressive Earnings Surge

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Goodyear Faces Challenges with Earnings Miss Amid Industry Turbulence

- Spotify’s Financial Surge: Poised for Growth Amid Upgrades and Strategic Moves

Your goal should be to make money, not to stuff your broker’s pockets from your excessive trading commissions.

Last Word

When I first got into trading, I didn’t have a mentor to teach me the ropes. But you have an option. If you’re serious about trading and aspire to do great things, click this link to see if I can help you.

Leave a reply