Despite what you may have heard, real money isn’t made by reading chart patterns alone.

Stocks don’t just magically jump because there was “a bull flag.”

And in the world of small caps and penny stocks, that’s especially true.

One of the first lessons I teach my students is how to look for news catalysts.

First, I need to find the RIGHT NEWS at the RIGHT TIME.

Thankfully, the Breaking News group on our StocksToTrade platform has me covered.

Our analysts quickly sift through feeds to deliver relevant, timely stories for traders.

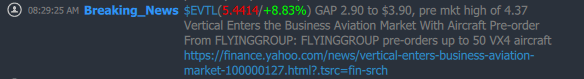

So, when this dropped on Friday…

I quickly dug in.

It turns out that this was an incredible story, one that was different from all the rest I had seen that day.

Now, a lot of traders struggle to decide which stories matter. It almost seems like there’s no rhyme or reason.

But beneath it all, there’s a method to the madness.

I want to show you how to quickly pinpoint the headlines that offer the most potential.

Then, I’ll combine it with chart patterns and price action so you know exactly how to find and execute these trades profitably.

Vertical Aerospace Ltd. (NASDAQ: EVTL)

Let’s start by looking at the news surrounding Vertical Aerospace Ltd. (NASDAQ: EVTL).

With less than 30 minutes until the close on Friday, I got the following headline:

American Airlines to pre-pay for 50 air taxis from Vertical Aerospace.

Reading through the article, it turns out that American Airlines agreed to pre-order up to 250 of UK-based Vertical’s eVTOL aircraft for $1 billion with the option to buy 100 more.

But these aircraft aren’t your typical big jetliner.

These are tiny pods for a pilot and four passengers capable of flying more than 100 miles at speeds of over 200 mph.

Last year, the company reported pre-orders of 1,350 aircraft worth $5 billion from American Airlines and Virgin Galactic.

You can find out more about this company on its website.

This news was significant because it was the first real cash paid by customers for the company’s products.

You see, in order for a news story to have a lasting impact, it needs something tangible like drug companies with FDA approvals, or in this case, a customer paying for preorders.

That’s where most people mess up.

They assume any story about a hot sector is tradeable.

But that’s not always the case.

Some stories have material impacts on the company, but not all of them last.

For example, when the initial preorders were announced, it counted as a material story, but not one with staying power.

Now, I still want a headline about a company with timeliness to it and preferably a hot industry.

Right now, that includes energy, electric vehicles, software, etc.

Then there’s the timing of the news story.

This one broke on Friday.

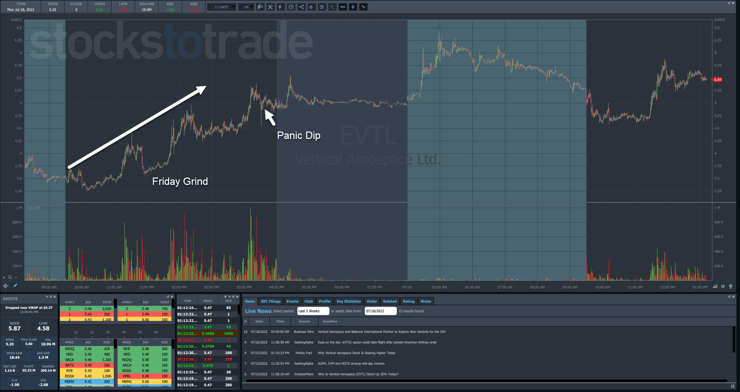

I watched the stock as it grinded higher throughout the day on fairly heavy volume.

With shares set to close near the highs, it left promoters all weekend to hype up the stock, getting people interested in buying shares.

Ultimately, that’s what kept the stock afloat and pushing higher through the weekend and into Monday.

So, I used the panic dip buy late on Friday to grab shares before the close.

As you can see, the stock did pop in afterhours but then settled down.

I used that postmarket pop to lock in a nice chunk of profits, while leaving a portion of the trade to carry into the following week.

When Monday, rolled around, shares lifted well over the highs from Friday as promoters pumped the stock heavily.

Had I been awake early enough, I would’ve sold my trailer in the premarket.

Instead, I exited my final batch at the open.

Final Thoughts

I want to start by pointing out that I didn’t take the trade when the news came out.

Instead, I waited until I saw a setup that matched my strategy.

That’s an important point most traders miss. They see a stock moving and feel the need to jump on without a plan.

Don’t get sucked into the hype.

Even with the best news stories I always wait until I find my setup.

Treat the news story and setup as two independent criteria that both need to be met before you take a trade.

Do that and you’ll be well on your way to profitable plays.

—Tim

Leave a reply