Recently, the meal service Blue Apron (APRN) had a massive spike, with shares up 7.34% in the course of a single day. But does that mean you should rush in and buy?

The short answer is no, because this stock is actually a huge loser.

However, there are lessons that traders can learn from short-lived spikes like this. Stock prices experience huge spikes in price all the time, but to be able to take advantage of this phenomenon, it’s vital to understand the catalysts behind the price changes.

In this post, I’ll explore what played into this sudden spike with Blue Apron and how you can learn from it so that you’re better educated the next time you see a similar situation.

Table of Contents

What Is Blue Apron?

Blue Apron is a meal delivery service. You know the deal: Customers place orders online, and then receive ingredients and recipes by mail so that they can prepare the food at home.

This is undoubtedly a trendy sector, but that doesn’t necessarily mean stocks like this are worth your trading time and money.

So … what made shares go up so suddenly? As it turns out, the catalyst was a change in personnel.

Last Tuesday, Blue Apron announced some big changes in its C-suite. They announced that the company CEO Brad Dickerson and co-founder and CTO Ilia Papas had left the company to pursue other opportunities.

Analyzing the Catalyst

This is important: changes in personnel don’t automatically cause a stock to go up. Actually, sometimes it can have the opposite effect — consider the case of Starbucks, where shares plummeted after former CEO Howard Schultz announced he would step down.

However, in the case of Blue Apron, it was a necessary move. While the sector is getting buzz, Blue Apron’s stock hasn’t been soaring, mainly because the company’s financials totally suck.

A Dismal Financial Situation

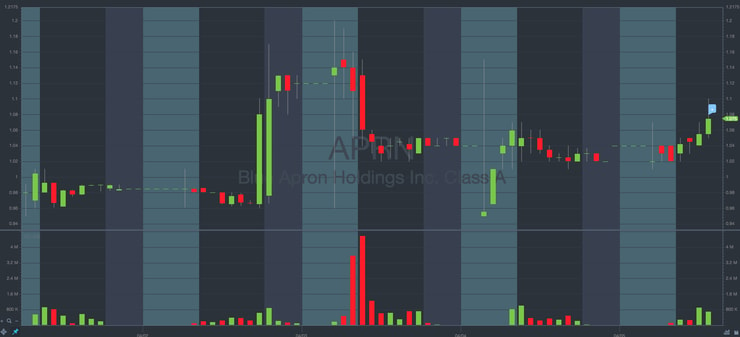

The chart tells the truth about Blue Apron. Share prices have shown a steady downtrend since its IPO in 2017, with shares falling from the initial price of around $10 to just $1. You don’t need to be a genius to know that this is a big warning sign that the company is in trouble.

Additionally, when you look at the company’s financials, they’re not great. The company is not profitable, and doesn’t appear to have ever been profitable. They’re bleeding money, and usually companies don’t reverse that sort of trend.

With companies like Amazon that have more capital and more business acumen taking a bigger stake in the at-home meal delivery sector, it’s not likely that a company like Blue Apron will succeed in the long term.

However, people want to believe the hype.

So when Blue Apron announced that the new CEO will be Linda Findley Kozlowski, who most recently held the position of Chief Operating Officer at the successful handmade marketplace company Etsy, it gave investors some short-lived hope.

The personnel shake-up, and the addition of an up-and-coming new leader, clearly inspired optimism. While the stock closed at about $0.97 on Tuesday, following the announcement, shares peaked at about $1.15 on Wednesday.

More Breaking News

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Insider Stock Sale Raises Questions About Micron’s Market Position

Will it Last?

Plenty of traders rushed in like fools, buying up shares of Blue Apron because they bought into the hysteria. But will it last?

In a word, no. Blue Apron’s stock has already consolidated, closing at about $1.04 on Wednesday and continuing to creep down on Thursday. Given the company’s dire financial situation and the distinct lack of upticks, the stock spike was probably a one-time thing and unlikely to repeat itself.

So if you want to make money from Blue Apron, sorry, but that spike is over and done with.

What Can You Learn From Blue Apron’s Spike?

Even if you weren’t able to take advantage of the spike, there are still some valuable lessons that traders can take away from this experience.

Don’t Believe the Hype

Blue Apron is a classic example of why you shouldn’t take a position with a stock solely based on hype. Plenty of fools rushed in to buy shares after they read that the stock was going up, but a quick Google and a look at the stock’s chart would have told them that this was a bad idea.

After hours spiking does NOT make an earnings winner--it needs to prove itself during normal market hours. And Blue Apron has not been able to do that.

Never trade based on hype alone. Be sure to be calculated in your trading decisions and to prepare by doing plenty of research on the stock in question, including looking at its chart and its fundamentals.

The Importance of Catalysts

However, in spite of the fact that you shouldn’t trade based on hype, Blue Apron does teach a valuable lesson about the importance of keeping track of current events.

Catalysts that can shake stock prices happen all the time, and to be ahead of the curve, you’ve got to stay on top of the news.

By being on top of world events, keeping a close eye on what’s trending on social media, and scouring the business pages on a daily basis, you can be alerted to opportunities before the masses.

Of course, once again, it’s always very important to back up your findings with research so that you can make a better determination about whether the news has merit before executing any trades.

Look for Sympathy Plays

In the stock market, big spikes like this can sometimes inspire sympathy plays. This is when stocks in the same sector experience spikes or growth because one catalyst has a trickle-down effect.

No, this doesn’t mean that you should automatically load up on shares of any and every meal-delivery service, especially if their financials suck as much as Blue Apron’s. You always have to perform careful fundamental and technical research and have a strong trading plan in place.

However, it may be worth creating a watchlist of like-minded companies as you consider future trades, because they could react favorably to big news catalysts too.

What has been your experience with trading based on news catalysts? Leave a comment and tell me your thoughts!

Leave a reply