People think I spend hours in front of the computer screen every day.

Nothing could be further from the truth.

Quite honestly, I spend more time teaching than I do trading.

The lifestyle I cultivated grants me the freedom to pay it forward.

Between the schools I help build in Bali to the hours of content I create for my students, I can honestly say I may spend 2-3 hours a day trading at my busiest.

I know that seems like a pipe dream for most of you.

But trust me, it’s much easier than you think.

Most traders spin their wheels looking for the perfect setups. They get lost amongst the charts and actually end up missing trades.

I, on the other hand, take just a few minutes to locate the BEST stocks to trade in a matter of minutes.

All it takes is a few simple steps…

Screen for Success

Most stocks I trade are either new Supernovas or former Supernovas.

But you can’t exactly just scan for a Supernova.

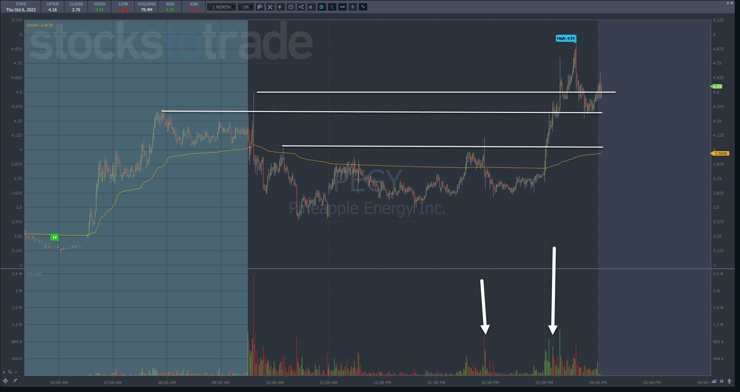

Instead, I use the StocksToTrade platform to screen for stocks that meet the following criteria:

- Up +30% over the last few days

- Volume increased 2x-3x above the average during the same period

- Trade below $5.00

What I love about the StocksToTrade screener is it scans continuously throughout the day.

This is especially important for OTC stocks that often see little to no volume in the premarket.

Let’s use Global Tech Industries Group Inc (OTC: GTII) as an example.

Here is a daily chart for the last year.

If I were scanning for this stock, which sees very little movement and trading in the premarket, I likely wouldn’t see the results until the day denoted by the white arrow.

Oftentimes, stocks pop for a day and then fade into oblivion.

That’s fine. Those aren’t the ones that become Supernovas.

All I’m trying to do here is find stocks that are on the precipice of becoming a Supernova.

I check the screener in the premarket, maybe midday and after the close.

Once I have the stocks populated, I quickly look at their charts to see whether the stock was a former runner or whether it could be forming a new Supernova.

Additionally, I check the Breaking News to see if any of the stocks have catalysts behind the move.

Ideally, I want to see a positive story tied to the price action that can lead to further upside.

Keep a Good Watchlist

Once I run my scan, then I’m ready to move on to my watchlist.

My watchlist contains about two dozen ticker symbols of companies I’m watching for potential trades.

These are stocks from my current and previous scans that I manage every couple of days or even once a week.

Once a stock hits step seven in my 7-Step Penny Stock framework, there really isn’t a need to keep tabs on it.

But, it’s always worth having an old watchlist to keep somewhere safe that you can reference once in a while.

Typically, I narrow my focus down to a half a dozen stocks each day that have shown real promise in the last week or so.

That includes multi-day runners or promoter post Supernova pumps that are perfect for morning panic dip buys

One of the easiest ways to free up your time is to use alerts.

More Breaking News

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- Kyndryl Holdings Stock Shows Mixed Performance Amid Market Turbulence

- Denison Mines Stock Surge Amid Strategic Developments

- GTM Navigates Financial Challenges Amid Key Market Developments

Set them up for breakout levels or percentage changes. That way, you can go about your day and only pop online as needed.

Establish Your Strategy

If you give me a Supernova and tell me what phase it’s in, I can tell you what setup I would choose and how to play it.

I spent the time doing the heavy lifting over the last two decades.

So when a stock reaches those certain turning points, I know what they look like and how to play them.

I literally trade like a machine. Everything I do is second nature.

That’s not to say there aren’t bigger picture things to consider that can help you trade better.

But those are in addition to a structured trading system.

Rather than working your own from scratch, use the same one I developed that helped me earn my first $1 million in trading…

The same system I use to this day.

—Tim

Leave a reply