Energy penny stocks refer to shares of small-cap companies in the energy sector, typically trading below $5 per share. These stocks can be highly volatile but offer significant growth potential, especially in emerging areas like renewable energy. They are popular among traders for their low entry cost and the possibility of substantial returns, although they come with higher risks due to market fluctuations and dependency on geopolitical factors

With the Trump administration pivoting away from green energy to focus on fossil fuels, these stocks are trading lower than they were during the Biden years. But the framework I teach can be applied to stocks trending up or down.

One thing is sure — these penny stocks will stay volatile! Read on for setups to watch for and sector trends for 2025.

I’ll answer the following questions …

- What Are Energy Penny Stocks?

- Why Should You Invest in Energy Penny Stocks?

- What Types of Energy Penny Stocks Are Available?

- How Do You Choose the Right Energy Penny Stocks to Invest In?

- How Do Government Policies Affect Energy Penny Stocks?

- How Do You Manage Risks When Trading Energy Penny Stocks?

- Are Energy Penny Stocks in Oil and Gas or Renewables?

- How Do You Use a Stock Screener to Find Energy Penny Stocks?

Table of Contents

- 1 What Is a Green Energy Stock?

- 2 What Qualifies a Stock as “Green”?

- 3 Green Energy Sector Trends in 2025

- 4 Green Energy Companies You Should Know About

- 5 What To Consider When Investing in Green Energy Penny Stocks

- 6 Green Energy Industry in the US

- 7 7 Top Green Energy Penny Stocks 2025

- 7.1 1. VivoPower International PLC (NASDAQ: VVPR) — The Subsidiary Spin-Off Green Energy Stock

- 7.2 2. KULR Technology Group Inc (AMEX: KULR) — The Contract Winner Lithium-Ion Battery Penny Stock

- 7.3 3. FuelCell Energy Inc (NASDAQ: FCEL) — The EV Battery Stock With the Exxon Deal

- 7.4 4. Plug Power Inc (NASDAQ: PLUG) — The Hydrogen Stock That Might Not Survive 2025

- 7.5 5. Mullen Automotive Inc. (NASDAQ: MULN) — My Troll Meme Stock Pick for the Bagholders Out There

- 7.6 6. Nikola Corporation (NASDAQ: NKLA) — The Hydrogen Fuel Cell EV Stock

- 7.7 7. American Battery Technology Co. (NASDAQ: ABAT) — The EV Battery Penny Stock Spiker

- 8 Green Energy Stocks Under $5

- 9 Best Online Brokers for Energy Penny Stocks

- 10 Risks of Investing in Renewable Energy Penny Stocks

- 11 Are Clean Energy Stocks Worth Watching?

- 12 When To Buy Clean Energy Penny Stocks

- 13 Green Energy Penny Stocks Watch List 2025 FAQs

- 13.1 How do I trade green energy stocks?

- 13.2 What are the best energy stocks to trade?

- 13.3 Can you get rich quickly with penny stocks?

- 13.4 Are energy penny stocks in oil and gas or renewables?

- 13.5 Are energy penny stocks volatile?

- 13.6 What investment opportunities exist in green penny stocks?

- 13.7 How do dividends and revenues factor in?

- 13.8 Can I trade these stocks on OTC markets?

- 13.9 How are these stocks countering fossil fuels?

- 13.10 What types of firms are listed in this category?

- 13.11 What does the financial media say about green penny stocks?

- 13.12 What should you consider for portfolio addition?

- 13.13 How can sales performance impact stock value?

- 13.14 What role do partnerships play in green penny stocks?

What Is a Green Energy Stock?

A green energy stock is just what its name implies: stock sold by companies in the green energy sector.

As a refresher, stocks are divided into several sectors or industries. Certain sectors get hot all at once — this means that all stocks in the sector can run on catalysts like the Biden grants.

Sympathy plays are also something to look for. When sector leaders run, their success can boost other stocks in the sector.

The green energy sector has sector leaders like Brookfield Renewable Partners (NYSE: BEP), First Solar (NASDAQ: FSLR), and Plug Power (NASDAQ: PLUG). The stocks I trade are less prominent, cheaper stocks — they can make big gains fast!

What Qualifies a Stock as “Green”?

A stock qualifies as “green” if the company works in the renewable energy sector — basically, anything related to environmentally-friendly efforts and renewable energy sources. Some companies that fall into the green energy sector include:

- Electric vehicle battery makers

- Solar panel manufacturers

- Wind power providers

- Renewable power plant operators

- Biodiesel producers

Green Energy Sector Trends in 2025

With the 2020–2021 run on green energy in the rear view mirror, the market has been waiting on real results — big contracts, government grants, and high earnings. There are also some less publicized green energy trends to watch for in 2025:

Wind and Solar Power Growth

As the push to cleaner energy continues, wind and solar companies will keep getting investors and grants. We’ll likely see some spikes from this sector in the coming year.

Increased Energy Storage Demands

When you generate power, you need a place to store it. That’s why energy storage businesses like battery companies are getting government grants, and running in response.

More Breaking News

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

- Ondas Leverages Strategic Gains in Defense Sector Expansion

Rise in Cleantech

Cleantech is a catch-all term for renewable energy, carbon capture, recycling, and other technologies meant to reduce carbon consumption and reverse environmental damage. As regulators demand more sustainable and environmentally-friendly business practices, companies will likely follow suit and invest in more cleantech initiatives.

Green Energy Companies You Should Know About

The renewable energy sector is large, so you shouldn’t keep every company on your watchlist. But it does make sense to keep these sector leaders on your radar as we enter 2025.

Brookfield Renewable Partners LP (NYSE: BEP)

Brookfield Renewable is a renewable power asset company from Canada. It owns and operates various hydroelectric, wind, and solar power plants worldwide.

First Solar Inc. (NASDAQ: FSLR)

First Solar is a solar power system design and manufacturing company. It uses thin-film semiconductors to create its products and sells them to customers worldwide.

Enphase Energy Inc. (NASDAQ: ENPH)

Enphase creates clean energy solutions that merge solar generation, energy storage, and power management on one platform. This California-based company is one of the fastest-growing residential solar providers in the U.S.

Ormat Technologies Inc. (NYSE: ORA)

Unlike most companies in the sector, Ormat Technologies specializes in geothermal energy. Compared to solar and wind power, geothermal power has a more predictable power output since it comes from heat produced from inside the earth. However, it’s expensive — and can cause earthquakes!

SPI Energy Co., Ltd. (NASDAQ: SPI)

SPI Energy made its name in the renewable energy industry in the solar power, energy storage, and electric vehicle fields. It’s a jack-of-all-trades player with high potential. And it’s a penny stock, so you know I’ve got my eye on it.

What To Consider When Investing in Green Energy Penny Stocks

When you’re looking to invest in green energy penny stocks, there are several factors to consider. First, you need to understand the company’s financials. Look at revenue growth, profitability, and stability. Don’t just go by what analysts are saying; do your own research. I’ve been trading for years, and I can’t stress enough the importance of due diligence.

Next, consider the growth potential in the sector. With climate change becoming a global concern, alternative energy is gaining momentum. Companies involved in solar energy, nuclear power, and other forms of alternative energy have a lot of room to grow. Finally, look at the geopolitical landscape. Policies in countries like China and Europe can significantly impact the green energy sector.

After you’ve done your due diligence on a company’s financials and sector growth, consider the role of technology. Artificial Intelligence (AI) is becoming increasingly important in the green energy sector, from optimizing energy storage to predictive maintenance. Companies leveraging AI could have a competitive edge. If you’re intrigued by the intersection of AI and green energy, check out this guide on AI penny stocks.

Green Energy Industry in the US

The green energy industry in the U.S. is booming, thanks in part to a shift in policies and growing awareness about climate change. Solar panels, wind turbines, and other alternative energy projects are popping up all over the country. From my experience, this sector offers a lot of trading opportunities, especially for those who keep their risk tight and cut losses quickly.

However, it’s essential to understand the role of utility companies and the supply chain in this industry. Utility companies are increasingly investing in renewable energy, which can be a good sign for green energy penny stocks. Also, keep an eye on the supply chain, as disruptions can impact production and, consequently, stock prices.

While we’re talking about the booming green energy industry in the U.S., it’s worth noting the significance of where these stocks are listed. Nasdaq-listed stocks often come with a certain level of credibility and are subject to stringent regulations. If you’re looking to add some Nasdaq-listed green energy stocks to your watchlist, here’s a comprehensive guide.

7 Top Green Energy Penny Stocks 2025

My top green energy penny stock picks for 2025 are:

- NASDAQ: VVPR — VivoPower International PLC — The Subsidiary Spin-Off Green Energy Stock

- AMEX: KULR — KULR Technology Group Inc — The Contract Winner Lithium-Ion Battery Penny Stock

- NASDAQ: FCEL — FuelCell Energy Inc — The EV Battery Stock With the Exxon Deal

- NASDAQ: PLUG — Plug Power Inc — The Hydrogen Stock That Might Not Survive 2025

- NASDAQ: MULN — Mullen Automotive Inc. — My Troll Meme Stock Pick for the Bagholders Out There

- NASDAQ: NKLA — Nikola Corporation — The Hydrogen Fuel Cell EV Stock

- NASDAQ: ABAT — American Battery Technology Co. — The EV Battery Penny Stock Spiker

Before you send in your orders, take note: I have NO plans to trade these stocks unless they fit my preferred setups. This is only a watchlist.

The best traders watch more than they trade. That’s what I’m trying to model here. Pay attention to the work that goes in, not the picks that come out.

1. VivoPower International PLC (NASDAQ: VVPR) — The Subsidiary Spin-Off Green Energy Stock

My first green energy penny stock pick is VivoPower International PLC (NASDAQ: VVPR).

This is a solar-energy company.

The price spiked 580%* after the company announced on April 2 that its subsidiary, Tembo E-LV would merge with Cactus Acquisition Corp. Limited (NASDAQ: CCTS).

CCTS is a shell corporation that exists for the sole purpose of merging with a private company, thereby taking it public.

Now that VVPR has shown us its ability to spike after an obvious catalyst, there’s a decent chance we’ll see another spike in the future.

Plus, StocksToTrade shows that VVPR’s float is only 1.3 million shares. Here’s why that matters: When a stock has a float below 10 million shares, it’s considered a low float stock. The low supply helps the stock spike higher when demand increases — like when the company announces bullish news.

2. KULR Technology Group Inc (AMEX: KULR) — The Contract Winner Lithium-Ion Battery Penny Stock

My second green energy penny stock pick is KULR Technology Group Inc (AMEX: KULR).

This run started in March 2024 after the company announced a new contract worth more than $865,000 with Nanoracks for the development of an advanced space battery.

But that’s not all …

Later that month, it announced a contract with Lockheed Martin Corporation (NYSE: LMT) to improve missile construction.

The total spike from March to April measures 540%*.

Prices dipped due to a bad earnings report in April. But it’s just as well — I don’t want to buy shares of an overextended stock.

Now that the price dipped a bit, it’s easier to identify strong support to build a position off of.

Take a look at the chart thus far, I included a screenshot below.

For new traders, this can look confusing. Try reading the chart left to right as if the price was trading in real time. Every candle represents 30 minutes:

Support and resistance levels are a BIG part of our trading process.

The levels help traders choose when to buy and when to sell. And it’s especially important when the trade doesn’t go as planned.

Nothing is a 100% guarantee in the stock market. Anything can happen at any time.

Support and resistance levels help us identify a failed trade with enough time to get out.

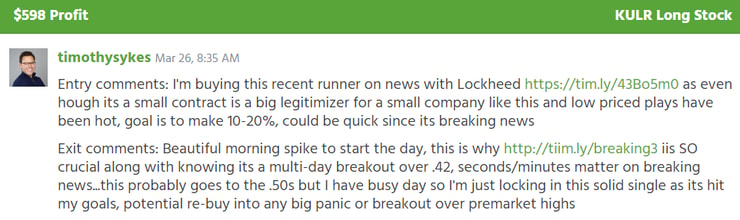

I traded KULR twice during its 2024 spike…

Once for a profit, with a starting stake of $3,400:

Once for a loss, with a starting stake of $21,925:

Thanks to support and resistance I can keep my losses smaller than my gains.

Watch me and my students trade LIVE!

KULR is still in play. I’m waiting for my next trade opportunity.

3. FuelCell Energy Inc (NASDAQ: FCEL) — The EV Battery Stock With the Exxon Deal

My third green energy penny stock pick is FuelCell Energy Inc (NASDAQ: FCEL).

This is a HUGE former runner.

FCEL spiked 1,300%* between November 2020 and February 2021. Take a look at the chart below (every candle represents one trading day):

In April 2024, the company announced it expanded an existing agreement with ExxonMobil Technology and Engineering to develop CO2 capturing technology that simultaneously creates electricity. It’s called carbonate fuel cell technology.

Later that month, FCEL announced that its technology would also be used by the Sacramento sewer system to help create electricity from biogas.

The news didn’t inspire much price action. But past spikers can spike again … And considering the abundance of bullish catalysts, it’s only a matter of time until the momentum picks up again.

Wait for the confirmation of volatility.

I don’t want to buy and hold shares of this stock. That’s a waste of time and capital. Instead, we wait for the stock to show us momentum. Then we trade the best setup.

4. Plug Power Inc (NASDAQ: PLUG) — The Hydrogen Stock That Might Not Survive 2025

My fourth green energy penny stock pick is Plug Power Inc (NASDAQ: PLUG).

This is another big spiker from 2020 and 2021.

In January 2021 alone, the price gapped up 140%* in less than two weeks. It’s an incredible feat for a stock that was already on a run and was trading above $30 per share.

But alas, the momentum was unsustainable. Like most of the trash companies in our niche, the bull spike was attributable mostly to hype and speculation.

From 2021 until now, the stock lost 95% of its value. It’s back in penny stock territory.

And things aren’t looking good in the short term:

- In November 2023 the company announced concerns about its funding and cash levels over the next 12 months.

- There’s currently a class-action lawsuit investigating “false and misleading statements” the company may have made.

There’s a real concern that this company could delist from the Nasdaq.

I’m interested in the price action because it’s a former runner and because we’ve seen bankrupt stocks turn into huge short squeezes before.

Greedy short sellers see a bankrupt stock like PLUG trading under $2 and they think that they can ride it lower. It’s a decent thesis. The company is garbage.

But if there are too many short sellers in a stock, any bullish momentum could cause some to panic and get out. Short sellers have to buy-to-cover to exit. And the added bullish momentum could cause other short sellers to panic.

Soon enough, we’ve got a crappy stock squeezing 1,000%* just due to short sellers blowing up.

I’m waiting to see if a scenario like this plays out.

5. Mullen Automotive Inc. (NASDAQ: MULN) — My Troll Meme Stock Pick for the Bagholders Out There

My fifth green energy penny stock pick is Mullen Automotive Inc. (NASDAQ: MULN).

There are likely still bagholders that bought MULN shares at the top of the 2020 spike.

The price tried to push higher several times but traders sold into the momentum.

There’s a chart of the spike below. Understand, the shares never traded at $400,000. The chart shows the high price level because of share dilutions and contractions that have happened since then.

Every candle represents one trading day:

Don’t hold shares of these volatile stocks.

We’re here to trade high-probability patterns that accompany these spikes.

MULN helps to manufacture electric vehicles and energy solutions. And its history of spiking makes it a top watch for future green-energy trade opportunities.

That is, if the bagholders ever give it some breathing room …

6. Nikola Corporation (NASDAQ: NKLA) — The Hydrogen Fuel Cell EV Stock

My sixth green energy penny stock pick is Nikola Corporation (NASDAQ: NKLA).

NKLA designs and manufactures battery-electric as well as hydrogen-electric vehicles.

In March 2024, NKLA announced its first Hyla refueling station in Southern California was open for business. The resulting spike measured 80%*.

In April 2024, we learned of rumors surrounding potential fraud and misconduct at NKLA. The price fell dramatically as a result.

This stock has been on the decline since it completed a 1-for-30 reverse stock split on June 25, 2024. In 2025, it’s once again trading under $1, which means it’s in danger of being delisted from the Nasdaq exchange.

I doubt that will happen. Instead, watch for a pump or another reverse split. Both will introduce volatility to this stock and give us the kind of setups we’re looking for…

7. American Battery Technology Co. (NASDAQ: ABAT) — The EV Battery Penny Stock Spiker

My seventh green energy penny stock pick is American Battery Technology Co. (NASDAQ: ABAT).

This company works in lithium battery recycling. Lithium batteries are a necessary component for most EVs.

From December 2020 to January 2021, the stock spiked 2,500%*. Back then, the ticker symbol was ABML. On September 20, 2023 the company uplisted from the OTC markets to the Nasdaq, changing its ticker to ABAT.

There wasn’t much volatile price action as a result. But I’m glad to see that it’s trying!

As a former runner, it’s only a matter of time until one of its pumptastic catalysts inspires another buying spree.

*Past performance does not indicate future results

Green Energy Stocks Under $5

The allure of hot sector penny stocks is undeniable. These stocks present a unique blend of opportunity and volatility. Green energy is booming, making green energy stocks a magnet for investors looking for the next big breakthrough. The gains here can be proportionately greater than those from more established stocks, mainly because even minor positive developments can send their prices soaring.

However, it’s crucial to approach these opportunities with a clear strategy and an understanding of the risks involved. The volatility of penny stocks, combined with the speculative nature of biotech ventures, means that while the potential for rapid gains is significant, the risk of losses is equally high. Conduct thorough research, looking beyond the hype. And never invest in these stocks — only trade them.

Remember, the key to success in trading green energy stocks under $5 is not just about jumping on every opportunity but being selective and strategic. It’s about leveraging the explosive potential of the green energy sector while managing risk meticulously. By focusing on companies with the potential to lead in their niche, traders can capitalize on the disproportionate gains that these penny stocks offer, all while keeping their investment strategy tight and cutting losses quickly.

Best Online Brokers for Energy Penny Stocks

Choosing the right broker is crucial for trading energy penny stocks. Look for brokers that offer extensive research and data tools. The more information you have, the better your trading decisions will be. I’ve been teaching trading for years, and I always tell my students to use platforms that provide real-time data and have a user-friendly app.

Also, consider the fees and commissions. High fees can eat into your profits, especially when you’re trading penny stocks. Some brokers offer commission-free trades, which can be a significant advantage. Make sure to read the fine print and understand all the costs involved.

Risks of Investing in Renewable Energy Penny Stocks

Investing in renewable energy penny stocks is not without risks. Market volatility is one of the primary concerns. These stocks can be highly volatile, making them risky investments if you don’t know what you’re doing. I’ve seen many traders who fail because they don’t understand the risks involved.

Another risk factor is the dependency on government policies and subsidies. A change in policy can significantly impact the industry. Also, consider the company’s operations. Are they involved in exploration or production? Each has its own set of risks and advantages.

Market volatility is a concern, but what about those penny stocks that are priced under 10 cents? These ultra-low-priced stocks can be even more volatile, offering both high risks and high rewards. If you’re considering diving into this end of the penny stock pool, make sure you’re well-informed. Here’s a detailed article on penny stocks under 10 cents.

Are Clean Energy Stocks Worth Watching?

Clean energy stocks are worth watching, just like stocks in other sectors. I maintain watchlists in multiple sectors, so I’m always prepared when one of these sectors gets hot.

I recommend you do the same and keep sector-specific lists of penny stocks. Organizing your preferred stocks into watchlists helps you prepare for stocks to trade when you spot unusual volume or news catalysts.

I also keep a NO-COST penny stock newsletter if you’re curious about which green energy stocks I watch weekly. As always, these aren’t buy recommendations. Self-sufficient traders watch more than they trade.

Subscribe to my NO-COST weekly stock watchlist here!

When To Buy Clean Energy Penny Stocks

As I’ve said time and time again: I react to the market, I don’t try to predict it. Predicting stock movements is for fraudsters, and you won’t be able to adjust if your prediction is wrong. Learn a stock’s patterns and history — and be ready to cut losses quickly when you’re wrong.

Learn more about buying penny stocks and all things trading in my Trading Challenge! Here, I share the knowledge earned during my 20-plus years in trading to help you become a self-sufficient trader.

Here’s what you get from the Challenge:

- Interactive webinars with me and my top students

- Over 7,000 video lessons

- Access to my community chat room

- So much more!

Are there green energy stocks you’re keeping an eye on? Let me know in the comments!

Green Energy Penny Stocks Watch List 2025 FAQs

How do I trade green energy stocks?

You trade green energy stocks just like any stocks — keep a close eye on their news and react to chart movements. Always do your due diligence and study the stock’s history and chart to ensure you make the right trades.

What are the best energy stocks to trade?

There’s really no “best” energy stock to trade because circumstances change and prices move. However, you can keep a watchlist of your preferred energy companies and monitor each of them closely. When you see a good setup it might be a good time to trade.

Can you get rich quickly with penny stocks?

You can get rich with penny stocks, but not necessarily quickly. Penny stock trading is a great way to build your trading account, knowledge, and experience — all things you need to become a successful and smart trader.

Are energy penny stocks in oil and gas or renewables?

Energy penny stocks can be in both oil and gas as well as renewables. However, with the global focus shifting towards combating climate change, renewable energy stocks are gaining more attention. From my trading experience, I’ve found that renewables often offer more long-term growth potential.

Are energy penny stocks volatile?

Yes, energy penny stocks can be highly volatile. This volatility can offer significant returns but also comes with increased risks. It’s crucial to have a solid trading plan and stick to it. I’ve been right about 70% of the time in my trades. It’s all about managing risks effectively.

What investment opportunities exist in green penny stocks?

Green penny stocks present an investment opportunity for those interested in diversifying their portfolio. You can take various positions in companies focused on sustainable energy, such as SUNW, which deals in electricity production. ETFs specifically tailored for green energy are also available.

How do dividends and revenues factor in?

For the most part, green penny stocks do not offer dividends due to their focus on growth. However, their revenues can indicate the performance of these companies. It’s important to consult an author specializing in the green energy sector for the most reliable details.

Can I trade these stocks on OTC markets?

Yes, many green energy penny stocks are OTC (Over-The-Counter) traded. Before making any investment, check the exchange where the stock is traded and be mindful of the disclaimer usually associated with OTC stocks. A financial fund that focuses on OTC green energy stocks might be an opportunity for investment.

How are these stocks countering fossil fuels?

Companies like SUNW are making strides to reduce dependency on fossil fuels. They create infrastructure for renewable energy, which can be a great addition to your investment portfolio. The global focus is shifting toward sustainability, creating a chance for these stocks to excel.

What types of firms are listed in this category?

Different types of firms are included, offering various services related to green energy. From waste management systems to energy storage assets, the range is diverse. Some even forge partnerships with established companies to expand their services and scale their operations.

What does the financial media say about green penny stocks?

Reputed media outlets like CNN cover these stocks and their performance. It’s advisable to keep track of the news for any significant reasons that could impact these stocks. Always pay attention to the interests discussed in such articles to better understand the landscape.

What should you consider for portfolio addition?

Before making an addition to your portfolio, consider the company’s value compared to its revenues. It’s also important to assess the money invested in infrastructure and applications for renewable energy. Diversification through ETFs is also an option.

How can sales performance impact stock value?

Sales figures and revenue generation play a significant role in determining the stock’s value. In the green energy sector, revenues mostly come from applications like energy storage, solar installations, and waste management services.

What role do partnerships play in green penny stocks?

Partnerships are crucial for these companies to expand their assets and services. Strategic alliances can substantially increase sales and improve the overall performance of the stock in the market. Such details are often covered by financial media.

Leave a reply