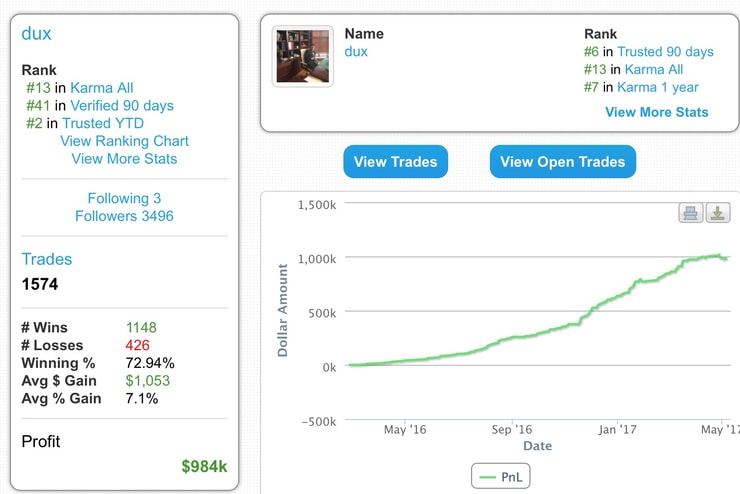

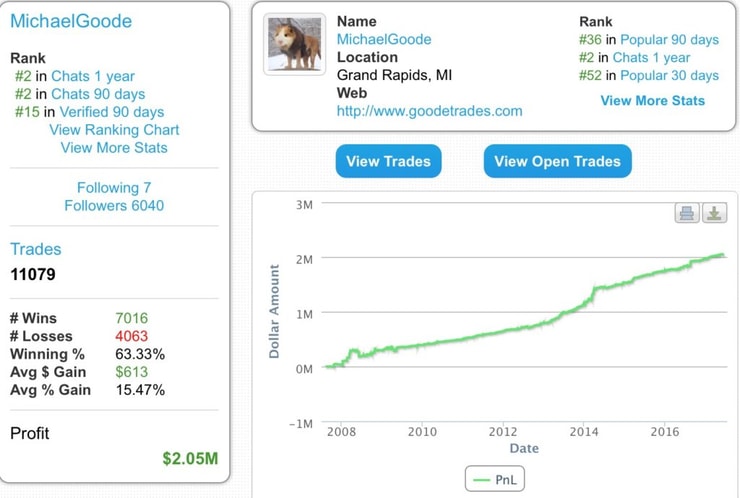

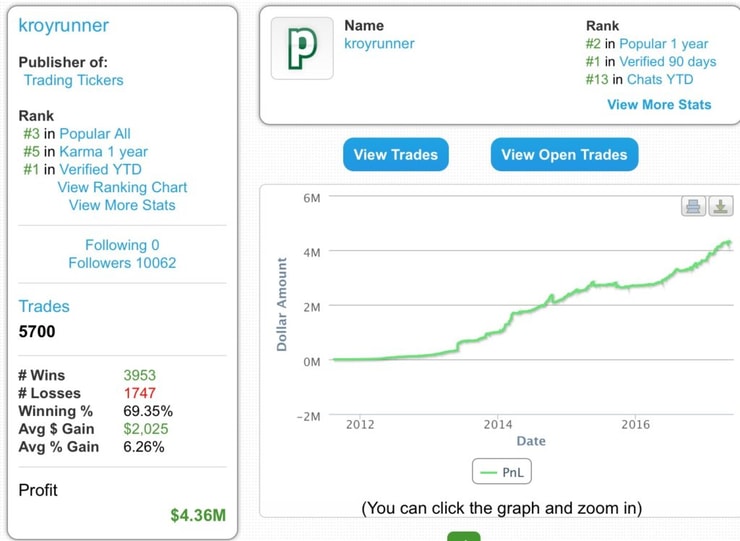

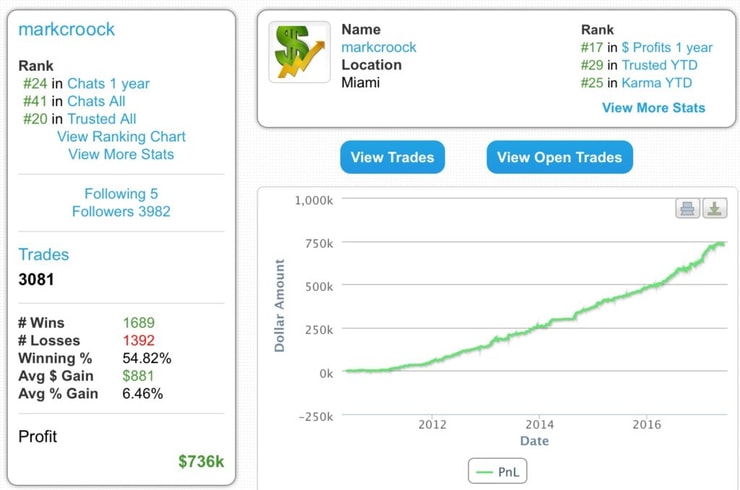

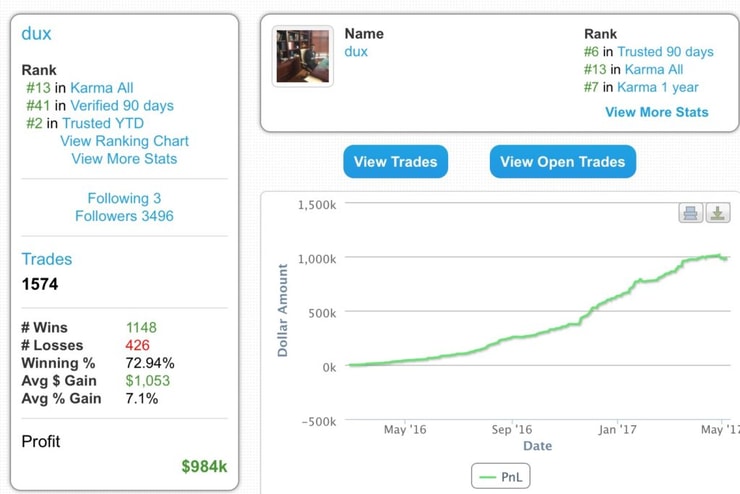

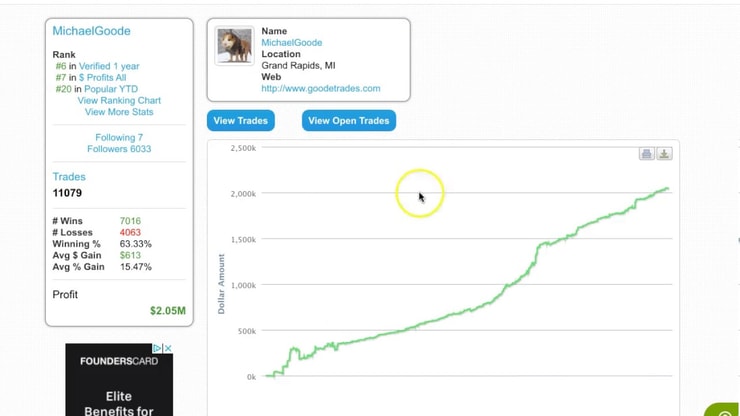

A question I get asked often is “how do I grow my account exponentially?” Considering that earning 10-20% per year is considered “great” on Wall Street, when I start talking about 100-200% yearly returns** instead, people get VERY interested and EVERYONE I talk to wants to be my next Millionaire Trading Challenge student…and why wouldn’t they after seeing my top students performance charts like the ones below:

I’m SO excited to FINALLY reveal this, whewwwwwww have we got some amazing stuff planned for you at my upcoming conference in just a few months! Go HERE ASAP to get on the earlybird list and save $1,000+ off the regular ticket price.

But because I also have thousands of students, having less than half a dozen truly successful students means it has to be luck, right?

After all, we trade penny stocks and nobody in the history of the world has EVER consistently made money on these junky stocks, and certainly, no credible Wall Streeter would ever recommend people trade these kinds of stocks, right?

When I first wrote my best-selling book (which you can get for FREE HERE) several “financial experts” told me straight up that I was crazy if I thought average retail investors and traders would understand my niche strategy that was VERY far from the typical “buy and hold good quality companies and you’ll be rewarded over time” that is the mainstream’s main investment strategy, a strategy that AT BEST earns them 10-20% per year which to me is just shit.

So, it’s ENTIRELY up to you, NOBODY is forcing you AT ALL as the beauty of being real in an industry full of scams is that I don’t need ANY doubters as students (as they, along with lazy students, make for shitty students that waste my time, making me repeat myself and not being willing to put in the thousands of hours required to truly become my next Millionaire student) so feel free to ignore me and key trading rules like these and my weird strategy focused entirely on the highly questionable little niche of penny stocks that 99.99% of the world hates on every single day…but if you want 100-200% returns, which you should, especially since 10-20% per year doesn’t move the needle if you’re like most of my students who have $2,000, $5,000 or $10,000 to their name, then keep reading.

Because aside from those truly awesome profit charts from my top trading challenge students, and mind you those guys aren’t just my students anymore, they give other Trading Challenge students live trading and Q&A webinars and mentor other trading challenge students now too alongside me, we also have several students who haven’t necessarily made $1 million or even $500,000 and not even a “lowly” $250,000…no instead they’re just passing $100,000 in profits now and you can read about them in GREAT posts like “10 Lessons From Another Student Who Just Passed $100,000 In Profits” and in this video too:**

And forget about great success, remember the ugly stat that 90%+ of traders LOSE, so any gains whatsoever are a gift and if you can learn any strategy that offers consistent profits, or even somewhat consistent profits, well, then you don’t even need to make six-figures or seven-figures to be considered truly successful in this niche, here’s one of my Trading Challenge students who trades with a VERY small account and just passed $10,000 in profits

My @profitly Looks like a breakout! Hitting 52 week highs. #focus #dedication #StudyHard @timothysykes @timothysykes #Pennystocks pic.twitter.com/2JatHxULb4

— Ed Bogaert (@EbogeyEd)** June 25, 2017

More Breaking News

- Protolabs Set to Announce Q4 2025 Results, Market Braces for Impact

- Jiuzi Holdings Receives $30M Investment to Boost Southeast Asia Expansion

- Sony’s Earnings Surge Drives Stock Momentum

- Itaú Unibanco Gears Up for Investor Q&A with 4Q25 Results

And yes, while I do have thousands of students, a mere 500 or so bother watching ALL my video lessons, DVDs and webinars and out of those who take their education that seriously, it’s actually a surprisingly high number of them who have found success.

This is the beauty of learning to grow an account exponentially, it’s NOT about making millions or tens of millions of dollars in the first year or two, it’s learning and practicing good habits so that you can grow your account exponentially OVER TIME and it takes a ton of time when you first start with just a few thousand dollars and that’s okay if you’re prepared for that from the get go like I would prefer…NEVER forget that my top students have reached seven-figures only after several years and literally THOUSANDS OF HOURS OF HARD WORK AND STUDY.

I keep mentioning THOUSANDS OF HOURS OF HARD WORK AND STUDY because it’s true as there is no exact formula here, it’s just learning rules, patterns and discipline and adapting to whatever opportunities the stock markets brings us each day, each week, each month, and each year and being ready to capitalize on only the best plays, if you’re patient enough.

Enough of all the general stuff, let’s get to the good stuff that actually grows your account exponentially:

1. Here’s a video lesson I made in the middle of the night last night, it makes some good points although you’ll have to excuse me for being a bit tired, I’ve been doing some badass charity work all day lately, then going to work late night (that’s the kind of work ethic you’ll need to be successful in life):

2. Watch this CLASSIC video lesson specifically on how to grow a small account, the strategy IS different from the one you would use if you are trading with a big account (hence why I can do everything I do from a single laptop from ANYWHERE in the world, not multi-screen monitor or big fancy office in NYC required)

3. Understand the account minimums and work/study minimums required to succeed by reading this blog post “What’s The Minimum Needed To Trade Penny Stocks?” and this blog post too “What Is the Pattern Day Trader Rule And Why You Do NOT Need $25,000 To Trade Stocks”

4. Stop trying ANY strategy that is mainstream, while also avoiding strategies where you can’t cut losses quickly (options trading), where there’s too much competition from the richest/most powerful people in the world of finance so your odds of success are pathetic (forex), and also avoid outright scams like binary options that is getting shut down in more and more countries, thankfully, but still some desperate people turn to it and that’s just sad.

5. Get the right mindset needed to grow an account exponentially, it doesn’t happen overnight and that’s a good thing because it forces you to study a lot at first to have the best chance at success. If you don’t study or expect success right away, YOU WILL FAIL. The good news is that while it’s tough, it’s not that complicated if you’ve read my free guide like this so no matter how much you study, you can understand EVERYTHING within 1-2 years or 3 years at worst if you’re slow like Forrest Gump. Read this blog post “Are You Studying And Working The Wrong Way?” and this one too “A Key Trait You Need To Become A Millionaire” for some more background info and also watch these 2 video lessons below too:

And before I forget if you find this blog post useful, please leave a comment and tell me EXACTLY what you learned and which, if any, of these bullet points #1-5 resonate with you the most!

Leave a reply