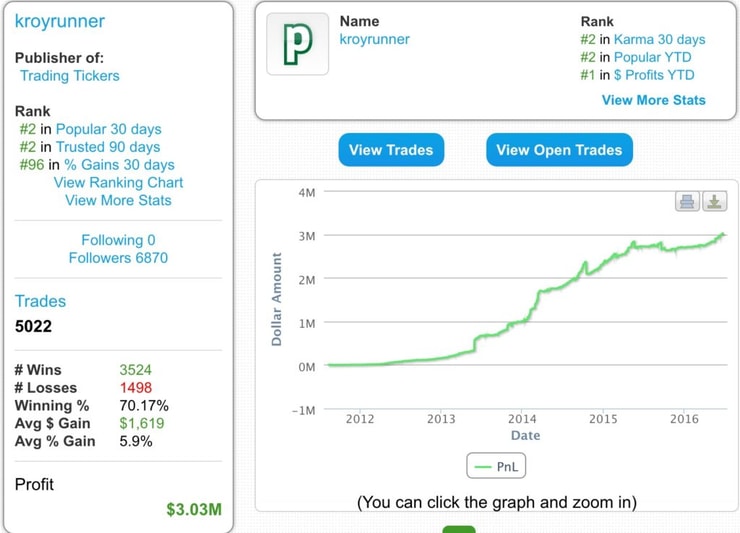

My top student Tim G. has just reached a major milestone, passing $3 million in trading profits** in his 4th year of trading!

We are so fortunate enough to have him share his top lessons (definitely thank him and congratulate him on this achievement in the comment section below)…also go check out his new website HERE where he shares even more tips/lessons he’s learned and developed his own unique strategy over the course of his journey.

Here’s a little recap of his inspirational story:

He’s been profiled HERE by CNN and we were on Fox TV HERE and HERE on TV again and he also gave 20 great trading tips HERE when he passed $2 million in profits.**

Now he’s just passed $3 million in profits** in just a few years, nearly doubling my initial accomplishment of turning $12k into $1.65 million in my first 4 years**…and even more important than just the money he’s made, he’s somehow remained incredibly humble and well-ajusted (major issues I’ve had along the way LOL) and I am so incredibly proud of him and grateful to him for sharing his lessons with us, giving bi-monthly webinars to other trading challenge students and most importantly, showing every trade trade publicly HERE

(anyone can claim to make millions, and they often do, but my top trading challenge students and I back it up, showing the good, bad and ugly trades ALL PUBLICLY…I don’t trust ANY trader who doesn’t share their detailed “batting average” publicly, unless they run a hedge fund like this great trader** who legally cannot share publicly anymore)

Tim…man, what can I say, the student truly has become the teacher as more often than not I see you choosing better trades than me (like shorting the STAF morning spike on Friday instead of buying it)…truly, big time congrats on all your success! It’s even more awesome now that you’re teaching others and congrats on the awesome reviews of your Trading Tickers guide too!

MEMORIZE these great tips, share them with your fellow traders and even print them out if you can as they are truly golden/dead on accurate! I agree with each and every single point and remember, both of us started with just a few thousand dollars so while it sounds impossible to turn that into seven figures, it’s not, it’s just VERY difficult as it takes a TON of hard work, study, perseverance through the bad times/losses/mistakes like these guys showed** and a constant desire to learn and adapt to new setups/patterns and most of all to see what you do best and focus on that!

1. Trading is NOT easy money. Unless you are prepared to put in a ton of time and effort, you will not find success. Expect to fail early and often. It took me 9 months and one account blowup to even begin finding consistency and start seeing profits. Learning takes TIME.

2. Don’t trade large when you’re learning. This ties into the last point, why play huge position sizes when you’re still figuring out what you’re doing? Since you likely will lose early-on, make sure those losses are small enough for you to recover from.

3. Trade smart size related to your broker’s commission structure. This is a tricky balance to strike related to the last point. But if you trade TOO small, commissions will eat you alive, even if you are a good trader. I always strived to need a 1.5% gain AT MOST to break even.

4. Don’t follow ANYONE’S alerts. It doesn’t matter if it’s a guru you just signed up to. If you just try to tail others, you will not find success. You are far better off learning WHY successful traders make the trades that they do, and using that to help develop your own strategy.

5. Especially don’t chase trade alerts. If you’re stubborn and still want to tail that guru, ask yourself, what price did they buy at compared to where you’re getting in? If you’re chasing and buying significantly higher, your account is not going to last long.

6. If you have to ask for advice, you shouldn’t be in the trade. I know it’s reassuring to get opinions of others when you’re in a trade and scared. But trust me, it will do you far more good to learn to trust your own opinions and trade plans, even if you’re wrong.

7. Determine risk and position size based off of the CHART. Preconceived % loss limits are silly. Use key points on the chart to tell you when to stop out, it will help make your trading more precise.

8. Know your risk level before entering a trade. This is the first thing I determine before placing a trade. By knowing my risk level, I can then size in appropriately based off of my risk point so that my $ loss will not be uncomfortably high if the trade goes wrong.

9. If the stock is beyond your risk, NEVER add. It’s amazing how long it took for this lesson to sink in for me, but I think it’s the most important. ALL of my largest losers have this in common, adding outside of my original risk level trying to turn a loser into a winner. It might work sometimes, but it’s not worth the massive losses when it doesn’t.

10. MONEY moves markets! Trash can run, good stocks can fall, trade the chart pattern, not what you “think” the stock should be doing. The market is ALWAYS right, whether it’s rational or not.

11. It can ALWAYS get worse! Maybe you got stubborn on a loser. Maybe the stock is making a move that makes no sense to you. NEVER assume it’s “Up too much” or “Can’t go lower”… IT CAN. “The market can remain irrational longer than you can remain solvent”

More Breaking News

- Cipher Mining Hikes Price Target Amidst Bold Strategic Moves

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- $30M Boost: Xinhui Solar Expands Jiuzi Holdings’ Reach in Southeast Asia

- SoFi Technologies Stock Surges: Q4 Wins Spark Analyst Upgrades

12. Don’t be a sucker for a good story. Whether it’s an OTC stock or it trades on a major exchange, don’t ignore price action because the story sounds good! Falling in love with a story is the easiest way to get stubborn. Remain cynical and remember most penny stocks fail long-term, even if they do put out sexy press releases!

13. Don’t be afraid to lose. It’s a part of trading, there’s no avoiding it. I only win 70% of my trades! As long as you CONTROL your losses by sticking to your plans and stop losses, you have NOTHING to be scared of.

14. Not all losses are a result of doing something “wrong”. No setup is going to work 100% of the time. Sometimes it will fail and you will take that unavoidable loss, and that’s fine! Again, just stick to your plan and your stop losses and CONTROL the loss!

15. Find your niche. Especially when you’re starting, don’t try to trade everything that moves! Figure out who YOU are as a trader. Are you more comfortable long or short? What setups are your favorite? Focus on one area, master it, then slowly branch out from there!

16. Track your trades. This will go a long way in helping you identify your niche. By tracking your trades, you can get an idea of where you succeed and where you fail. Once you identify your successful areas, focus there!

17. Finding your niche usually requires losing first. Yes, early on you may have to experiment a bit with different strategies, and most won’t work. You will take some losses, but you will learn a lot about yourself and this will help guide you in the direction where you can be successful!

18. Mistakes are the best learning tool. This especially goes for when you’re first learning, but even now I continue to learn from mistakes that I make. Don’t ignore them, don’t run from them, embrace them! They will help guide you to improvement.

19. It is okay to miss plays. So many traders want to trade everything that moves and nail every stock. This is the absolute wrong mentality! Instead, focus ONLY on the niche you develop, be consistent in ONE area rather than constantly gambling on every exciting chatroom play.

20. It is better to miss a play then to chase it. Sometimes you may get that perfect niche setup you love, but miss your execution. It happens! The WORST thing you can do is develop the bad habit of chasing because you’re so afraid to miss. Even if it works out, it’s just reinforcing a habit that will burn you down the road. There will always be another trade!

21. Build your own watchlist every night. It’s fantastic practice at developing your own plans and later seeing what ideas would have worked. Even if you aren’t trading yet, this is great practice!

22. Know when it’s time to take a break. Trading is mentally exhausting, it takes its toll over time. When I get burned out, a week or two of vacation time does wonders! Remove yourself from the market and come back refreshed, the difference is incredible!

23. Know the float of any stock you trade. Whether long or short, this is information you MUST know. The float ties into how easily a stock can be controlled/manipulated, as well as how large of runs it can potentially have.

24. Only trade stocks with exceptional volatility. This especially goes for those of you with small accounts. If the stock has no range, why bother? What good will a 2% gain do for your account, especially if you have to trade perfectly to achieve it?

25. Find the stocks with huge intraday swings, and take advantage! Even if you mess it up, you can still have significant profits.

26. Level 2 is a “Must use” tool. This goes more for OTC stocks than Nasdaqs, but I do find it helpful on all exchanges. Get it, learn it, and take advantage of it!

27. Stock scanners are a great tool to find new plays. I run basic scans throughout the day just to show me what stocks are the top % gainers and trading real volume. If something new comes up, I’m usually pretty quick to see it. Not to mention, many scanners are pretty versatile and can be setup to scan for your favorite plays, based on the criteria that matter to YOU.

28. Plan your trades around key chart points, NOT your profit/loss. Trading decisions should be made off of the chart, not your account balance. I hide my profit/loss (both realized and unrealized) until the end of the day. I don’t want to see it and have it influence my decision making!

29. Consider risk/reward AND success rate. It drives me crazy to see people saying they won’t take a trade unless it’s 3-1 risk/reward. What if you have a 1-1 risk/reward setup that wins 90% of the time? Is that not worth trading too? Consider both factors, and no matter what, make sure the odds are on your side!

30. Never stop learning. It’s amazing how much my trading style has evolved since I first began. I started off trading 99% OTC stocks, mostly on the long side. Now I’m mainly a short-seller, focusing on listed stocks. I constantly try to learn new setups and new angles to attack the market, because you never know when conditions will change! Adapt or perish!

Leave a reply