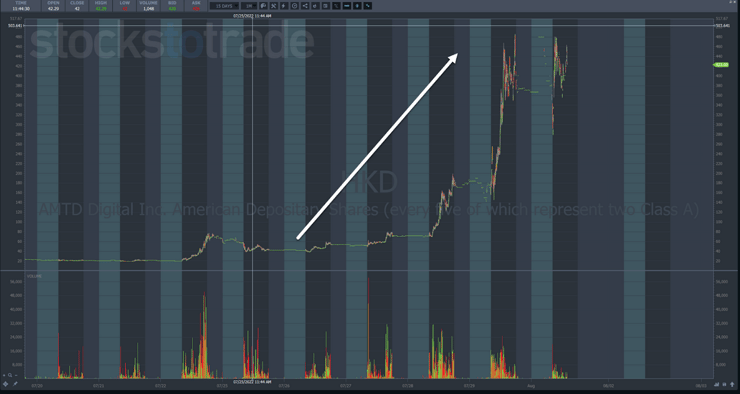

3,924.9% in 14 days.

That’s how much AMTD Digital Inc. (NYSE: HKD) rose and how long it took.

This is a real life example of my Supernova pattern in action.

We’ve already seen shorts get squeezed on names like ToughBuilt Industries Inc. (NASDAQ: TBLT) and others.

I work with my students to study these setups and plan so that they know EXACTLY what to do when these profitable patterns present themselves.

The good news is that I expect this is just the start of things…

Over the next few weeks, I see tons of stocks with incredible potential to run.

And while I’d normally reserve this kind of info for my students, I want to share a few tickers that I feel offer the most tradeable opportunities.

Table of Contents

AMTD Digital Inc. (NYSE: HKD)

There is no way this stock wouldn’t make my list.

Shares debuted on the NYSE two weeks ago in an initial public offering (IPO).

At the time, the stock traded at $7.80.

So far, shares have hit a high of $485.

It doesn’t take an experienced trader to recognize this for what it is – a juiced up stock.

We saw this happen with GameStop Corp. (NYSE: GME), AMC Entertainment Holdings Inc. (NYSE: AMC), and several others during the meme stock craze.

All of those eventually failed.

What many shorts don’t realize is the pullback process takes time.

In between the massive drops there are huge rallies.

Unless you know how to recognize these patterns, you’re bound to get chopped up in the price action.

Let’s go back for a moment and take a look at GME.

This daily chart highlights three major moves in the stock’s price.

There was huge amounts of price action between the first two moves as shares spiked and plunged.

Traders need to understand the different phases of a Supernova to identify potential trade setups correctly.

You can’t just buy into momentum, hoping to be right on the trade. That’s a good way to get blown out very quickly.

Make sure you study past examples as I have here in my penny stock framework article.

Know this – HKD will come back down to earth. But be careful. If you’re shorting, borrowing costs can get expensive on stocks like these, so be sure to check with your broker before placing a trade.

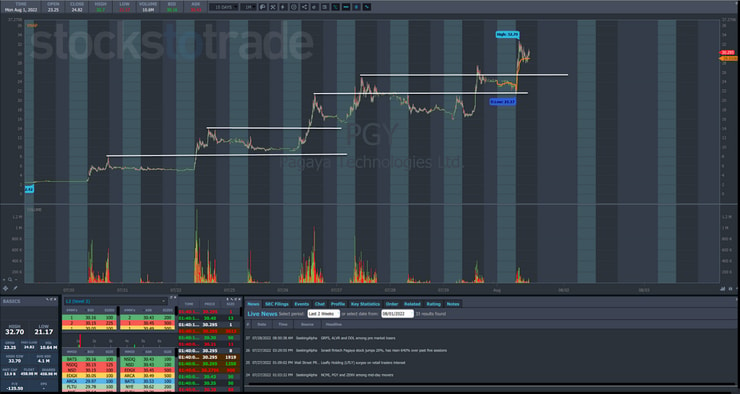

Pagaya Technologies Ltd. (NASDAQ: PGY)

This isn’t a typical penny stock for me.

Shares of this company had been trading below $5 before the company completed its SPAC merger agreement.

That’s when interest began to heat up.

Shares have climbed as much as 1,251.24% over the last two weeks, right alongside HKD.

And like HKD, PGY has millions of shares in its float.

Nonetheless, the stock has been on a rocket ride since the merger with little to no news.

If you understand how these Supernova patterns play out.

Now, while I won’t give away all my secrets, I want to draw your attention to the highs made by the stock as it moves along.

Notice how each time it breaks those highs, it does so on heavy volume and tends to hold above them.

When this changes, that would be my first indication of the Supernova burning out.

More Breaking News

- 3 Robinhood Penny Stocks Moving on Bitcoin & Trump News

- Webull Corporation’s Stock Skyrockets: What’s Driving the Surge?

- Joby Aviation’s Remarkable Stock Leap: Exploring Recent Developments

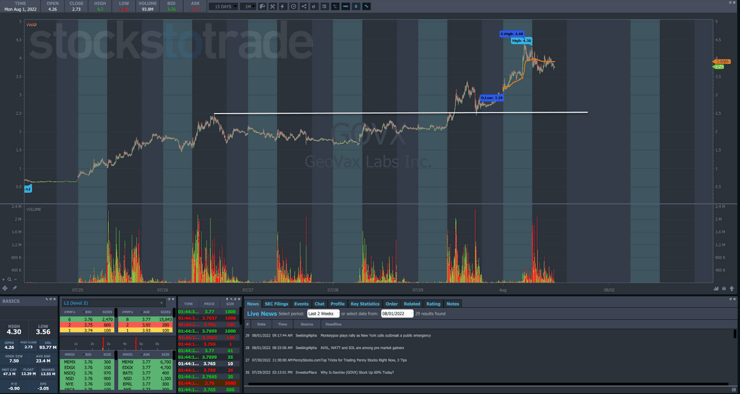

GeoVax Labs Inc. (NASDAQ: GOVX)

The pandemic left everyone on edge. When news hit about a potential Monkeypox outbreak, traders jumped on relevant stocks.

Stocks related to the vaccination and treatment of the disese, like GOVX saw immediate interest with volume jumping along with share price.

We’ve seen similar price action in Siga Technologies Inc. (NASDAQ: SIGA).

I’m partial to GOVX because unlike the other two stocks on this list, it only has a float of 12.29M shares.

That can help push the stock around and create some explosive moves.

Now, while shares haven’t gone parabolic in the same way as HKD, they’ve still provided ample trading opportunities if you know where to look.

Again, I want to point out the high made on the 26th. Once that was broken on the 29th, the stock immediately pushed higher.

Later that day, shares came back to test that breakout area and held into the close and through the weekend.

The Bottom Line

This is just a sample of the stocks with amazing potential right now.

And with the potential for huge spikes and drops, there’s more than one way to play these names.

—Tim

Leave a reply