2022 was an incredible year.

Even if you didn’t hit all your goals, take the time to recognize your success.

You did awesome!

I want you to make sure you get started on the right foot…

…which is why I taped this video which gives you a blueprint to make 2023 even better!

Look, it’s easy to get down on yourself and dwell on what you missed.

So, take a lesson from the name of the latest learning center our charity built in Bali.

Opening these schools reminds me how lucky I am to have what I have…

…how lucky I am to share my knowledge with others.

Giving back keeps me grounded.

Now, you’re probably thinking, ‘Are you really helping others with a holiday special?’

Yes…yes I am.

You wouldn’t be reading this post if you weren’t interested in trading.

You wouldn’t be reading this post if you didn’t want to learn how to improve.

30+ of my students used my lessons to become millionaires.

My 7-Step Penny Stock Framework is already available to anyone who wants a taste of what’s in store.

And as you review 2022 and prepare for 2023, keep the following in mind…

…because they’ll be crucial to coming out on top next year.

Table of Contents

What You Do Now Impacts Next Year

Every day I send my students my trading plan for the day.

I list the stocks I’m watching, why, and what setups I’m looking for.

There isn’t a day that goes by when I don’t have a trading plan.

Step back from the day-to-day, and I have weekly, monthly, quarterly, and, yes, annual trading plans.

There is no better time to prepare for 2023 than right now.

If you walk into January doing the same things as 2021, then you’re in trouble.

Think about this…

The start of 2021 was a trading bonanza. There were setups left and right.

The start of 2022 was pretty lousy. Markets began to drop, and most penny stock runs lasted a day at most.

I saw this coming as early as November of 2021 when I said I expected a market crash.

My 2021 plan called for smaller sized trades and an abundance of caution.

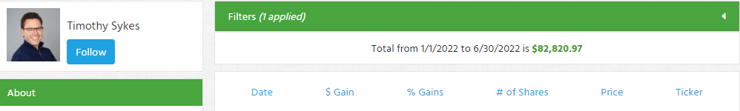

That served me well as I made a bit more than $80,000 in the first half of the year.

It might not seem like much. But given how badly the major indexes did, I’ll take it.

There is a Process

I can’t tell you how to invest $50 million.

I CAN show you how to take a small account and grow it into a nice nest egg.

Yes, there is some art to trading.

But with the right process, anyone can learn the framework to find profitable trades regularly.

Most traders spend years jumping from one indicator to another…one strategy to another, all in search of something that clicks.

That’s why I start them with the 7-Step Penny Stock Framework and teach them:

- How to locate Supernovas

- What to expect from them

- Which setups to apply to each phase

- How to execute the trades

- What risk management entails

Every one of my millionaire students started the same way.

They didn’t all start with the same knowledge, but they all began with the fundamentals.

As they learned and grew, each developed their own style that worked for them.

That’s the ‘art’ part of trading.

That’s how you make it your own.

More Breaking News

- European Wax Center Signals Confidence with Financial Projections Boost

- Skyward Surge: Momentus Inc. Soars and Faces Market Dynamics

- Kyndryl Holdings Stock Shows Mixed Performance Amid Market Turbulence

- Prosperity of Tokyo’s Finance Hub: UOKA Shines

That’s how you make it sustainable.

Decisions Matter

Your P&L isn’t as important as you think.

People get it in their heads that if they just make a certain amount of money per trade or certain amount per week, that’s what they should expect and strive for.

Some trades win and some trades lose. That’s part of the business.

You can’t control the outcome, only the decisions you make.

You decide which patterns to follow…

You decide which setups to take…

You decide how much to risk and where…

But even the setups with the highest probability of success can and will fail.

If you make the right decisions over and over, the P&L will take care of itself.

And Always Remember…

You get out what you put into trading.

Make 2023 your best year yet!

—Tim

Leave a reply