We could be on the cusp of some INCREDIBLE trading months.

While most of Wall Street battles back to breakeven, penny stocks are starting to heat up…

…And I know EXACTLY why.

Last month, I began pounding the table, telling my Millionaire Challenge students to prepare themselves.

Because after months of stale action, true penny stocks began to show signs of life.

It all comes down to a seasonal trend known as the ‘January Effect.’

Most market commentators don’t explain this concept thoroughly.

And it’s not like it takes a degree in quantitative finance to understand what’s going on.

They speak in broad terms and get the basic idea right.

But they miss the mark when explaining HOW it plays out.

Fortunately, I know the ‘January Effect’ like the back of my hand.

I want to fill in the holes left by Wall Street pundits and social media jockeys.

To get you started, check out this YouTube video I made in 2018 that explains the basics:

Once you’ve got a good handle on the fundamentals, head to my blog and I’ll explain where and when to look for these opportunities.

Find The Carnage

Search the internet for the ‘January Effect,’ and you’ll find the same explanation…

Investors sell losers in December to take a tax write-off and then buy them in January.

Makes sense right?

Here’s where almost everyone gets it wrong.

They ignore the most important word in that description – losers.

People hear the words ‘January Effect’ and apply it to every stock.

But that’s not how it works.

The ‘January Effect’ tends to move the most beaten-down names.

Broadly speaking, that would make technology stocks a prime target for this year.

In the penny stock world, it tends to create sharp moves and multi-day runners.

That’s precisely why I keep an eye on former Supernovas.

These stocks already proved they can run, so I want to know if and when they start to move.

Take Chinese stocks for example.

Names like Xpeng Inc. (NYSE: XPENG) and NIO Inc. (NYSE: NIO) surged as shorts got squeezed.

Commentators attributed this to a possible reversal in COVID restrictions.

The reasons don’t matter.

What matters is the convergence of three factors:

- Beaten down sector

- Headline catalysts

- Underlying strength

Now, let’s talk about how to locate these potential plays

Look for This…

We already have a watchlist that includes former Supernovas.

I want to add any tickers that started the year much higher and are now below $5.

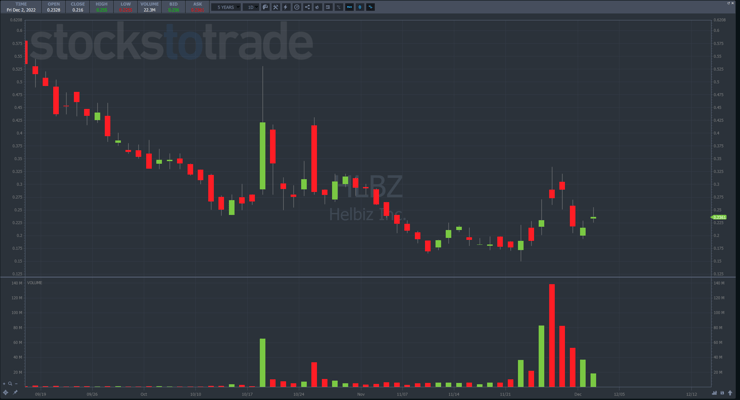

This includes momentum names like Stitch Fix Inc. (NASDAQ: SFIX), AMTD IDEA Group (NYSE: AMTD), Helbiz Inc. (NASDAQ: HLBZ), and more.

Once my list is set, I look for any increase in volume.

Typically, stocks follow my 7-Step Penny Stock Framework and fade into oblivion.

However, like zombies, they can rise from the dead under the right conditions.

Take HLBZ, for example.

This former Supernova fell for nearly a year before catching a spike in late Summer.

After that, shares faded until recently, when things began to pick up on tremendous volume.

So far, the stock has held up, even after giving back some of the gains.

And it may not recover.

But this illustrates what I’m looking for in terms of the ‘January Effect’ on a penny stock.

I also want to let you in on a little secret…

The ‘January Effect’ can start as early as November.

Shocking right?

With markets down as much as they have been, tax loss selling can occur earlier than normal.

More Breaking News

- ELAB Shares Boosted by Precision Machining Acquisition: Market Opens Eyes

- Avantor Faces Scrutiny Amid Fierce Legal Challenges and Financial Woes

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- American Airlines Grapples with Operational Setbacks Amid Harsh Winter Weather

All you really need is a stock to get so oversold that the slightest bit of news can send it soaring.

Keep This in Mind

The ‘January Effect’ creates potential opportunities.

But it’s an inexact science as well.

I caution traders against blindly following any penny stock or former momentum name that’s rallied hard.

Especially with larger cap stocks and those with bigger floats, look at the overall market.

Generally, when the indexes float higher, these stocks do better.

That doesn’t mean they can’t operate independently.

However, aligning a trade within the market context will make things a lot easier.

—Tim

Leave a reply