I always felt like I was leaving profits on the table in my early days.

After all, I was trading high-flying penny stocks. And sometimes, they’d shoot up 20%, 30%, or even 50% after I sold them.

Every trade seemed to have its own woulda, coulda, shoulda moment.

What a waste of time!

The truth is you’ll never get out at the top. And there’ll always be some meat left on the bone.

So instead of beating myself up, I started to do one little thing that changed everything.

It kept me focused, my gains were consistent, and my profits shot up significantly.

If you’re able to implement this one strategy, I think it could be a difference-maker for you.

Today, I’ll show you how it works and two ways you can implement it.

Table of Contents

Selling Into Strength

The best traders I know buy into weakness and sell into strength.

It seems easy enough on its face.

Yet, not everyone knows how to do this.

That’s why I use price action – the relationship between price and volume – to determine when a trade is over.

You see, when I see a stock that’s been raging higher suddenly hit a wall of volume and slow down, I know that buyers have lost a step.

It’s at that point that I want to exit my position.

Similarly, when volume starts to pick up and price is starting to rally, I can use that as an entry point for my trade.

Here’s two ways I could accomplish this.

Method #1 – One and Done

This method is pretty straightforward and the one I typically use.

Quite simply, I pick one price to exit and take off the entire position.

To do this, I look to see when momentum is waning in a stock.

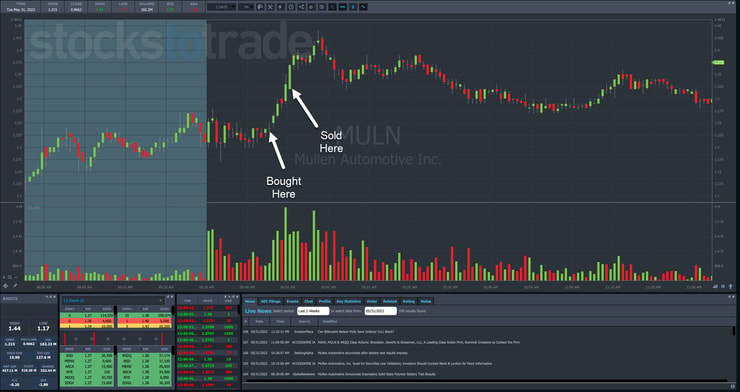

Here’s an example using my trade from Tuesday morning in Mullen Automotive (NASDAQ: MULN).

On this one-minute chart, I noted where I bought and where volume began to increase as the stock approached the high of the day.

I then used that momentum to ride the stock for a break over that high.

Next, shares popped on heavy volume, and a large green candle. This is where I sold my position into strength.

I saw the price continuing to climb, yet the volume began to fade.

That’s when I decided to exit the trade.

More Breaking News

- Nebius Group Stock Jumps Amidst Strategic Partnership Rumors

- Futu Stock Surges: A Perfect Storm?

- DeFi Technologies Expands to Dubai, Shares Surge Over 2%

However, there’s another method I could’ve used known as ‘scaling out’.

Method #2 – Scaling Out

Scaling out works exactly like it sounds.

Instead of selecting one target, I exit in pieces along the way.

For example, in the MULN trade, I entered at $1.23 and exited at $1.34.

Scaling out, I might’ve taken 50% of my position off at $1.34 and tried to take the remainder off at the round $1.50 mark.

Traders also refer to this as locking in profits along the way.

Once I take profits, I never want to let the trade go bad.

It was one of the first risk management techniques I learned that helped me move from losing money to becoming a profitable trader.

So, in almost every case, after my first exit, I will stop out back at my entry point, whether I use a stop loss or do it manually.

Now, a lot of people want to know the best way to find those prices when I scale out.

There isn’t a specific percentage or dollar amount that I’ve seen work consistently.

Instead, I can use price action to look for multiple spots to exit a trade.

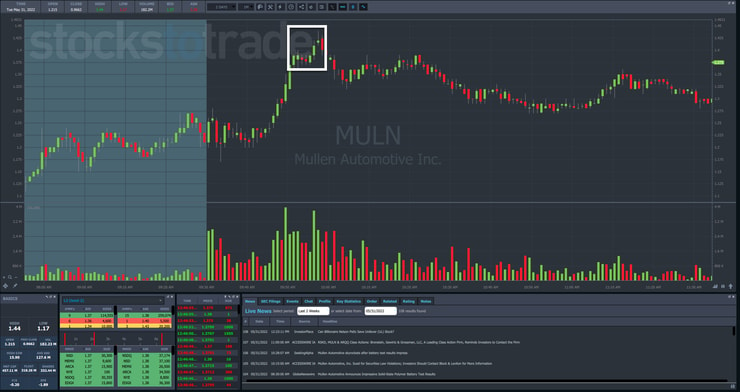

Going back to the chart of MULN, there’s another area where I could’ve taken off additional shares.

In that white box, you’ll see that price started to trade sideways on declining volume.

I could’ve used that as a secondary signal to exit the trade.

Similarly, the stock peaked around $1.43 on declining volume.

That could also act as a signal for me to exit the trade.

Now, I could also try to align these exits with resistance levels. That’s a perfectly good option as well.

And when I get price action at a resistance level, it’s like getting an extra loud signal.

The Bottom Line

When I exit my trades, I want to lock in profits as the stock rises. I prefer not to wait until it turns around before exiting a trade.

I know some traders prefer to do this.

However, especially in this market, I want to take a more conservative approach and preserve capital rather than risk it.

—Tim

Leave a reply