Listen up, people! This market is special …

And I mean that in the best way possible. But the truth is, trading’s been tough.

Don’t feel bad if you’re struggling.

Over the past two weeks, I profited $1,837. That isn’t a lot for me.

To put it in perspective, during the same time last year I profited $22,811…

If you’re disappointed with your current results — don’t beat yourself up. I’ve been doing this for 20+ years and even I’m underperforming.

It’s because of the overall markets. They’re getting slammed right now. Take a look at the S&P 500 ETF Trust (NYSE: SPY), it’s down 16% since the start of the year…

But there’s hope for us yet!

By looking carefully, I’ve been able to find volatility in the market. Keep reading, I’m gonna teach you how…

My AMC Trade

If you’re familiar with my trading, you know I usually like to play OTC penny stocks.

But recently, there haven’t been as many opportunities in that niche. So I’ve adapted to follow the volatility.

I’m not worried, OTC runners will come back. It’s just a matter of time.

Learn how to trade these volatile spikers before the sector heats up again.

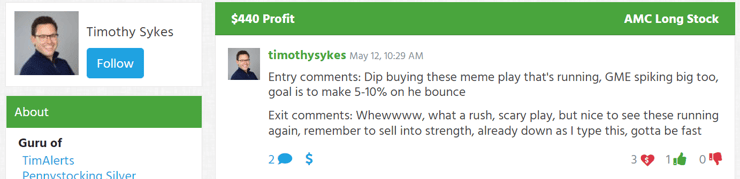

But while I’m waiting, I can take advantage of other market volatility. Like my AMC Entertainment Holdings, Inc. (NYSE: AMC) trade …

When I can’t find plays in my favorite niche (OTC penny stocks), I expand my search to listed stocks. Sometimes, I’ll even look for stocks that trade above $5 if that’s where the volatility is.

After minting 20+ millionaire students, I learned that my patterns show up elsewhere in the markets.

I always focused on what I was most comfortable with. But my students have shown me that my strategies are much more versatile than I initially thought.

Take Mark Croock for example. He uses my patterns for options trading.

Or Roland Wolf, he’s always been more comfortable trading listed stocks.

Learn to Trade

There are a bunch of different patterns that traders use.

Here are the ones working for me right now.

But what’s even more important than the patterns is the process I use to trade them.

Once you learn the process, you can apply it to whichever trading pattern you want.

If you’re serious about trading …

Start the journey all my millionaire students took.

Oh, I almost forgot!

I’m going on a live tour with other millionaire traders to answer questions live and in person! Don’t miss out on this learning opportunity. I’m coming to a city near you!

Leave a reply