“Professional” financial advisors will tell you to buy stocks when they’re on sale.

However, if you followed that advice last week trying to buy regional bank stocks, you would have gotten slaughtered.

When you see a stock down 50-60% in SVB Financial Group (SIVB) in a single day, you’re probably thinking, it’s got to bounce, right?

The stock opened last Monday at $284.

By Friday, it was halted at $39.49.

Many other regional banks sold off hard as contagion spread throughout the regional banking sector.

Dip buying is a strategy I LOVE and one I teach my students.

However, there’s a right and wrong way to do it.

Pick the right way, and you can potentially bring in quick profits.

Choose the wrong way, and your account will be wiped out.

How do I do it?

The Psychology of Dipping Buying

There are two different types of dip buys. One I prefer and the other I avoid.

Allow me to explain.

Last week’s bloodbath in regional banking stocks looked like a dip buying opportunity to newbie traders, but I wasn’t fooled.

In fact, before this even happened, I warned my students to avoid Silvergate Capital (SI).

You see, when there is a major catalyst event like the one we had last week, the charts get thrown out the window.

Fundamentals drive the moves. But when the selling picks up… traders are selling first and asking questions later.

You have no edge in trading these stocks unless you know the bank’s assets, liabilities, and balance sheet.

Newbie traders get sucked into the dumb idea: It’s down…it can’t go down much lower.

So they buy the stock…then it dips lower…they’re in disbelief…but instead of cutting their losses…they buy more… thinking the bleeding has to stop.

And that’s exactly how you can blow up your account.

You have no real reason for buying except that the stock is down, and when it drops more, your emotions come into play, and you get wrecked.

This type of dip buying is an absolute disaster and should be avoided.

Dip Buying The Right Way

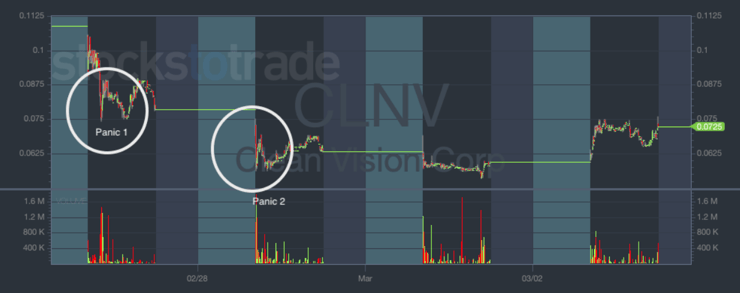

One of my favorite setups is the panic dip buy.

I teach it to all my students.

But when I’m buying a stock on a dip, it’s not weak stocks with negative catalysts.

Instead, I focus on buying stocks with positive momentum and strong catalysts.

And while I call it the panic dip buy, it’s not because traders fear that the company is fundamentally wrong.

It’s that they chased the stock, usually out of FOMO, and are tapping out because they got in at bad prices.

I’m usually interested in buying the dip when I see that type of action because I believe it can snap back fairly quickly.

CLNV chart 1-minute candles

Source: StocksToTrade

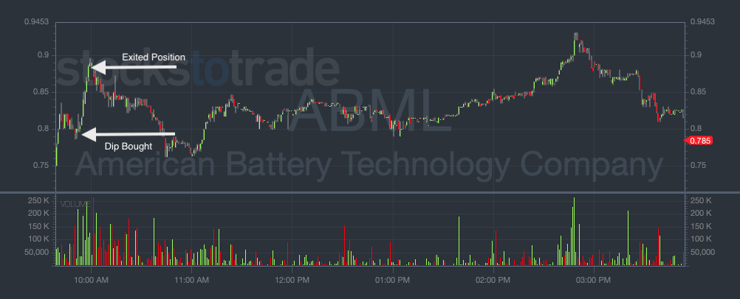

Here’s another example:

ABML chart 1-minute candles

Source: StocksToTrade *Risked $6,000 to profit $675

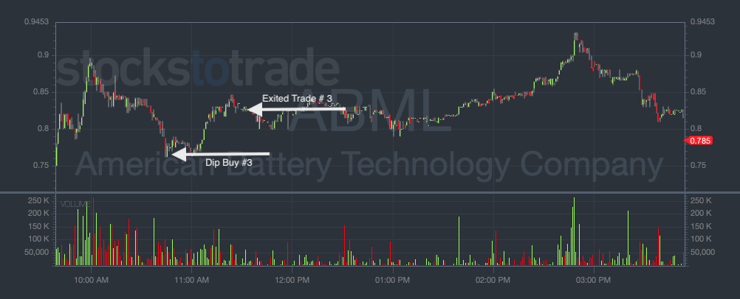

And another one in the same symbol:

Source: StocksToTrade

Just like a great poker player plays his opponent, not the hand…I am trying to take advantage of other traders’ mistakes.

Whereas what we saw in the regional banks was fundamentally driven.

In that case, you’re trying to catch a falling knife.

That’s very dangerous and super risky.

On the other hand, I have no problem buying stocks on a strong uptrend with positive momentum on a dip.

At the end of the day, one of the few things we can control is our risk.

Next time you see a stock crashing down, ask yourself why that is, and if there’s an opportunity or not.

Sometimes the best play is to stay away.

If you’d like to learn more about how I play the markets and how I’ve helped 32 of my students become millionaire traders, then click here to find out more.

Leave a reply