My trading is off to a slow start in 2023, with about $22,000 in profits so far.

And while I wish I were doing better, I can’t control the market.

So instead of being frustrated, I view this slower market as an opportunity to learn and improve.

Congrats to all my students for learning every day:

Hit my first 4 figure day here at @timothysykes conference between two trades. New biggest $ gain in a single trade. 🙌🏼 +$1,244 on two swing trades. NSAV for ~50% gain & NLST ~10% #iLoveOTC pic.twitter.com/YmJdTGULmG

— Kim (@kimmytrade) February 21, 2023

One of the benefits of trading in a slow market is it’s easier to identify good setups from bad.

The key is staying disciplined and patient while waiting for the ideal setups.

If you’re trading with a small account and are under the pattern day trader rule restrictions, this market is a blessing because it forces you to take only the best setups.

You don’t have to be in a trade every minute or hour. But I want you to pay attention, focus on what’s moving, and be curious about why.

And be prepared.

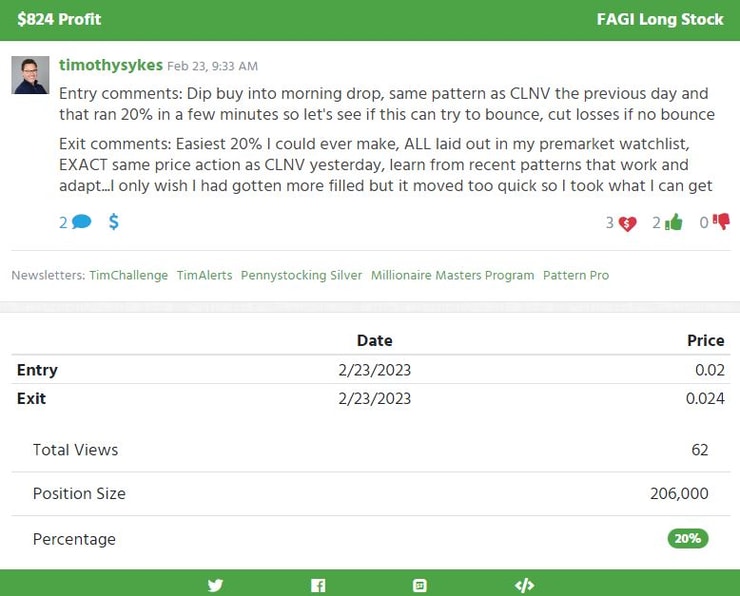

Preparation is what led me to one of the easiest 20% gains I had ever made on Thursday. (I risked $4,120 in capital to make $824)

I’ll share with you:

- What the trade was

- Why I liked it

- How you can get better at pattern recognition

The Gameplan

Every day before the market opens, I lay out my game plan which I share with my Millionaire Challenge students.

I share my thoughts on the overall market and the ticker symbols I’m watching for potential plays.

I had my eyes on ticker symbols CLNV, AMIH, FAGI, and SRNE on Thursday.

Here are the exact notes I shared with my Millionaire Challenge students:

“CLNV, AMIH, FAGI, SRNE are the low priced plays I’m watching right now, none of them are aggressive buys for me, but potential dip buys into any intraday panics. We’re not seeing many solid multiday spikes so waiting for optimal entries is key, for example CLNV had a gap down and morning panic yesterday despite the previous day’s strong close/multi-month breakout, but after that gap down/panic, it also spikes 20%+ in a few minutes. Those kinds of moves are what I’ll be looking for on these plays again.”

Many newbie traders will go into the trading day without a focus list. It’s easy to get distracted if you don’t know what to look for. And the chances of trading emotionally are significantly higher.

Of course, when you’re consistently profitable and more experienced, you can break some rules. But as a newbie, stick to rules-based trading and have a focused watchlist.

Going back to my watchlist notes, I noticed that CLNV had a gap down in the morning on Wednesday, creating an opportunity for a “panic dip buy opportunity.”

Source: stockstotrade

The stock had a quick 20% bounce after the morning panic sell.

I had CLNV on my watchlist because it had strong momentum and was in a breakout pattern.

Here’s what the daily chart looks like:

Source: stockstotrade

Seeing that the pattern worked for a panic dip buy opportunity, I was looking at other stocks that were breaking out with the idea of playing the same panic dip buy setup.

That’s one of the reasons why I had the ticker symbol FAGI on my Thursday watchlist.

The stock closed strong on Wednesday, going from a low of $0.0075 to a high of $0.0257.

Source: stockstotrade

Thursday morning FAGI sold off at the open…setting up for what I believed was a panic dip buying opportunity…and with CLNV fresh on my mind…I sprung into action…

Source: stockstotrade

I got my entry at $0.02 and was out at $0.024…

Making a quick $824 profit.

Takeaway:

- Take an inventory of what’s working in the market: trends, setups, patterns, and catalysts. Trading penny stocks isn’t rocket science. Look for relationships and patterns, and you’ll be ahead of most traders.

- Stay disciplined and patient. If you only take the best setups, you’ll crush it when the market heats up again.

- Study. Study. Study. That doesn’t mean it’s a day off if you’re not actively trading. Study what you missed, prepare for the next day, and review your trading.

- Looking to fasttrack your trading? Click here to get started.

Leave a reply