What time options trading stops is more complicated than it may seem…

Just like stocks, options have regular trading hours. Unlike stocks, options also have expiration times.

Your broker has the final say on trading hours. That’s especially true in this age of 24-hour trading.

More important is the expiration time for options. An options contract either be AM-settled or PM-settled — and this can make a big difference!

In this article, I’ll cover everything you need to know about stock options market hours — when they operate, when they close, and notable exceptions. I’ll also break down the timing of option expirations. Read on to learn more!

Are you a new option trader? Check out my guides to options trading basics and how options work.

Table of Contents

Operating Hours of US Stock Exchanges

Regular trading sessions for U.S. stock exchanges are 9.30 a.m. to 4 p.m. Eastern, Monday to Friday. Some options allow trading until 4.15 p.m. Eastern.

Still other options now trade around the clock. The Cboe Options Exchange has extended global trading hours for SPX and XSP index options to nearly 24 hours a day, 5 days a week.

Always check with your broker to see exactly what they allow.

The two major U.S. stock exchanges are Nasdaq and the New York Stock Exchange (NYSE). Both have regular options trading hours from 9.30 a.m. to 4 p.m. Eastern on business days.

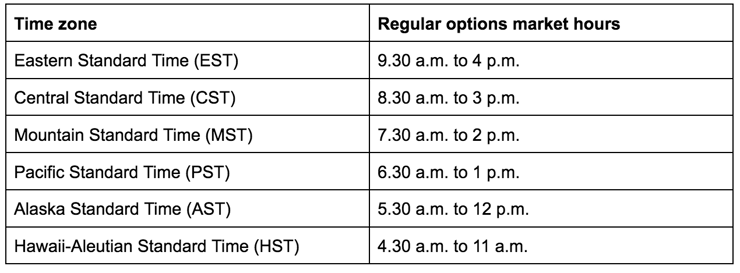

If you’re an option holder in another time zone, here’s a quick reference table:

US Stock Exchange Holidays

The NYSE and Nasdaq observe several bank holidays. On these holidays, the market is closed.

Here’s a list of stock exchange holidays:

The days before Independence Day and Christmas are half days if they fall on a regular trading day. The day after Thanksgiving, which is always a Friday, is always a half day.

More Breaking News

- Warner Bros. Discovery’s Turbulent Ride: Legal Concerns and Market Shake-Up

- Walgreens Boots Alliance Faces Financial Turbulence: Is Stability on the Horizon?

- Can Gevo Sustain Its Recent Success Amid Stock Market Fluctuations?

On half days, the market closes at 1 p.m. Eastern (1.15 p.m. for selected options).

Expiration Times

Expiration times always fall within regular trading hours.

There are two types of option expiration: AM-settled and PM-settled. Here’s a breakdown of how they’re different and when to exercise the contract.

- AM-settled options contracts expire at 11.59 a.m. Eastern, mostly on Saturdays. This means the last chance to trade AM-settled options is by market close on the preceding Friday.

- PM-settled options contracts expire at the end of market hours on their expiration date. Most PM-settled stock options expire at 4 p.m. Eastern. Certain options — mostly indexes and select ETFs — expire at 4.15 p.m.

If you don’t exercise or trade an option before its expiration time, you’ll lose your premium along with any right to exercise the option.

Exception for Cash-Settled Indices

There is an exception on the later expiration time for certain cash-settled indices. These five indices all expire at 4 p.m. Eastern:

- NDX (Nasdaq-100)

- RUT (Russell 2000 Index)

- SPX (S&P 500)

- OEX (S&P 100)

- XEO (XEO S&P 100 Index European)

What Time Does Equity and ETF Options Trading Stop in the US?

Equity options trading in the U.S. stops at 4 p.m. Eastern.

Certain broad-based ETF options have extended-hours trading and stop trading at 4.15 p.m. Eastern.

There are some of the broad-based ETFs with extended trading hours:

- DBA (Invesco DB Agriculture Fund)

- EFA (iShares MSCI EAFE ETF)

- KRE (SPDR S&P Regional Banking ETF)

- MDY (SPDR S&P MidCap 400 ETF)

- SLX (VanEck Steel ETF)

- XME (SPDR S&P Metals & Mining ETF)

Want to learn more about how options trading started? Read up on the history of options trading.

Learning from experienced traders is one of the best ways to learn all of the rules.

If you’re searching for a mentorship program, check out my former student Mark Croock’s Evolved Trader. He’s taken my penny stock strategies and applied them to options trading — making $3.9 million in career earnings in the process!

Here’s a sneak peek of Mark’s curriculum:

Leave a reply