The last few days have seen a bonanza of trading opportunities.

Students of my mentorship program who followed my framework stayed patient while they waited for these choice setups.

But let’s face it, not every trade can be a winner.

I’ve taken my share of losses these last few months.

However, I make it a point to keep my losses small and take them quickly.

It’s a core part of my trading style and the Supernova Framework.

What many traders don’t realize is that there are two ways to stop out of a trade: price action or a hard stop.

I’m a fan of the former.

But I want to compare them both and show you when each is appropriate.

That way, you can choose the best one that matches your strategy.

Hard Stops

Hard stops are the most common method for traders to use for stop-loss orders.

These are specific price numbers that when reached trigger an exit order.

Traders can either place these as ‘stop loss’ orders with their broker or enter them manually.

If you can, placing them manually is ideal, especially with OTC markets and penny stocks. Otherwise, you may be at risk of market makers moving stocks to trigger your stops, known as ‘stop hunting.’

However, for newer traders and those who struggle to adhere to their stop losses, sticking with stop-loss orders is just fine.

Placing stop-loss orders can take some practice.

There’s a balance between giving the trade enough room to work and taking too much risk.

One way to control this is by determining your stop loss and profit target and then managing your entry.

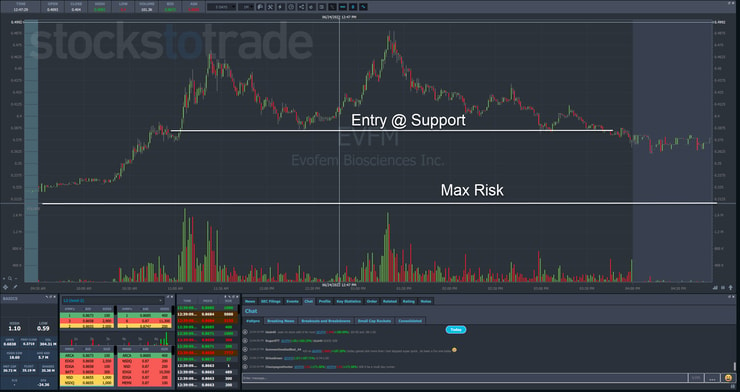

Let’s use my trade with Evofem Biosciences Inc. (NASDAQ: EVFM) from the other day.

I entered the trade near a support level around $0.37. My actual entry was $0.39.

The stock itself had been trading around $0.30 for the last few weeks. So that was my stop-loss spot for maximum risk.

This left me with a maximum risk of around $0.09.

Now, I couldn’t say for certain what my target was. But it’s fair that I wanted to see a break of the highs that day, which was at $0.50.

With an entry of $0.39, that gave me roughly $0.11 of upside potential to $0.09 of downside.

Keep in mind that is a minimum upside. I expected that if the stock broke that spot, which it did, shares would trade much higher.

Once I set up a trade where the reward is greater than the risk, if I win those 50% of the time, over enough trades, I’ll make money.

The greater the reward compared to the risk, the better I will do.

That’s why getting a good entry is so important.

Using Price Action

Now, my preferred method of trading uses price action as a way to stop out of trades.

Instead of working with specific numbers, I look to see when momentum has slowed.

Price action is a core component of morning panic buys.

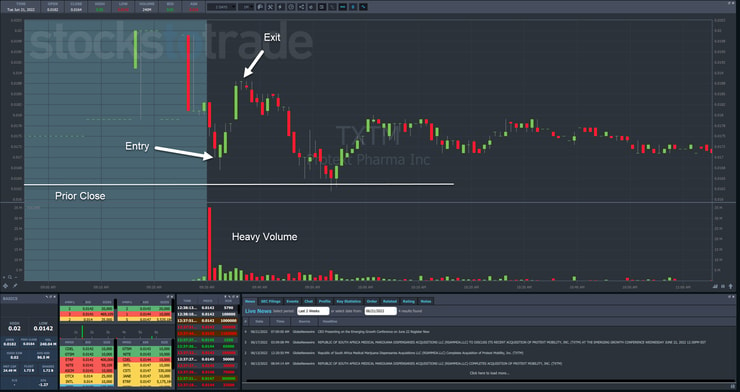

Let’s look at my trade in Protext Pharma (NASDAQ: TXTM) as an example.

Here, I waited until just after the open to buy into morning panic selling right near the prior close.

From there, I waited for the stock to rebound.

It was at that point I watched volume begin to slowly die out, even on the one-minute chart.

Once that happened and shares started to trade sideways, I felt it was time to exit the trade.

Conversely, let’s look at a trade I took in Sysorex Inc. (OTC: SYSX) from several weeks ago.

In this trade I bought the panic dip. However, I didn’t get a good price and the stock simply traded sideways from my entry.

That’s why I decided to cut the trade and move on.

You see, the morning panic dip buy relies on a rebound. Sometimes it’s big and other times it’s tepid.

More Breaking News

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

- Novo Nordisk’s Shares Surge as FDA Targets Illegal Drug Marketing

- Oracle’s $50B Cloud Expansion Plans Fuel Stock Surge

By focusing on getting a great entry and then following the price action, I ensure that I drop the trade when the buying pressure subsides and lock in profits or small losses.

Final Thoughts

These methods aren’t mutually exclusive. You can incorporate both into your trading.

Regardless of which you use, make sure you have clear guidelines as to when and how to exit the trade.

—Tim

Leave a reply