The most influential person in my trading career isn’t a hedge fund manager like Carl Icahn or Ray Dalio.

It’s my father.

Many of you probably don’t know this, but as a family-run business, my students can actually chat with my dad about trading.

When I was prepping for Friday’s live challenge webinar Q&A, I asked him what pressing topics I should cover.

He said to me…

I have never worked with a student that has consistently traded the same stock on the same day after a loss with any amount of success.

That’s a real eye-opener for traders who think it’s all about how much they win.

The reality is my P&L does better when I focus on minimizing losses.

Now, a lot of my students think that by cutting losses quickly, I would lose the majority of my trades.

They’re often surprised when they find out I tend to win more than I lose.

And it’s actually much easier than most of them think.

Table of Contents

Don’t Chase the Trade

I’ve been trading for decades now, and I still make rookie mistakes from time to time.

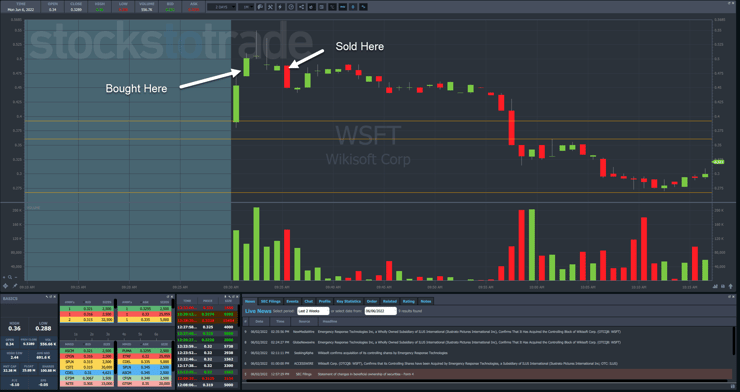

Heck, just last week I went a bit too aggressive with Wikisoft (OTC: WSFT).

With this trade, I was mad at myself for not holding overnight.

That put me in the wrong mindset from the get-go.

I bought into the trade as it ran higher when I probably should’ve waited for a better morning dip.

Thankfully, I trained myself well and recognized the price action was a bit ‘toppy.’ So, I cut the trade for a small loss.

Entries on Price Action Bottoms

Now, when I trade the morning panic, I rely heavily on price action to tell me where the bottom is.

Some traders find this difficult to work with because it doesn’t specify an entry price ahead of time.

But that’ doesn’t mean you can’t come up with one.

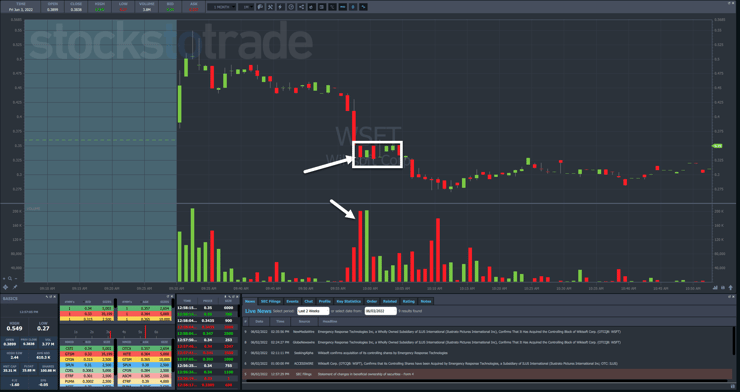

Let’s go back to the chart of WSFT and a second entry I took that day (sorry dad!).

This spot was much more in line with what I like to see with morning panic buys.

Shares plunged on heavy volume before finding support just below the prior day’s close on equally heavy volume.

I want to look at those two candlesticks with the highest volume; one red and one green.

By the next candlestick, volume dropped off significantly.

Using this information, I can assume that the stock has reached a temporary bottom here.

This entire range goes from $0.315-$0.35.

If I use $0.315 as my stop, I can set my entry close by.

In this case, I got in at $0.33 and out at $0.345.

Mathematically, I got into the trade slightly below the halfway point of the range.

Doing this gives me wiggle room to let the trade try and work itself out.

More Breaking News

- Credo Technology Unveils AI Retimer Amid Strategic Partnerships

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- BigBear.ai Expands Partnerships and Strengthens Financial Position

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

Oftentimes, when a stock hits a morning panic low, even if it doesn’t bounce much, there’s usually an opportunity to pick up a few pennies.

Get Entries as Close to Your Stop as Possible

This is the key to how I manage to obtain a higher win rate than I otherwise would.

When stocks don’t meet my entry prices, I let them go their own way.

If I chase them, I increase my potential risk. While that might allow me to catch a few more trades, those profits get swallowed up by the losses on the ones that don’t work out.

That’s why I’d rather wait to get filled at the entry price I choose than what the market may give me.

Think about it like this.

Imagine I’m looking at a stock that found a bottom around $0.90. Right now, it trades at $1. Ideally, it could get as high as $1.10.

If I bought it right here I would risk $0.10 to make $0.10.

But, if I bought it at $0.98, now I’m risking $0.08 to make $0.12.

An entry closer to my stop not only reduces my potential losses but increases the odds and size of my potential profits.

The Bottom Line

Don’t let the glitz and glamor of big wins that get thrown out on Twitter distract you.

I’m telling you right now, the ones who treat trading as a business, improving little by little, and building up their accounts over time are the ones who ultimately find success.

Now, there is one pattern that’s helped many of my students shorten the learning curve.

Check out my #1 trading pattern – Supernovas.

—Tim

Leave a reply