Only one thing mattered when I ran a hedge fund – performance.

It was all about how well I did compared to the other guy.

While that’s fine for hedge funds, it’s a terrible mindset for traders.

When I highlight the success of my star pupils like Mike Hudson and Tim Grittani, it’s not because I want you to compare yourself to them.

It’s because I want you to SEE WHAT’S POSSIBLE!

But you can’t get there with a hedge fund mindset.

Only one benchmark matters – YOUR PERFORMANCE.

You should be focused only on what you’re doing and no one else.

I know from personal experience how hard that can be.

We all get FOMO reading chat posts or watching the market run hard when we aren’t in a trade.

I ignore all that and focus on the key metrics to ensure I keep improving.

Start With a Log

The only way you will ever be able to see whether your trading improved or not is by keeping a trading log/journal.

Otherwise, you’re relying entirely on memory.

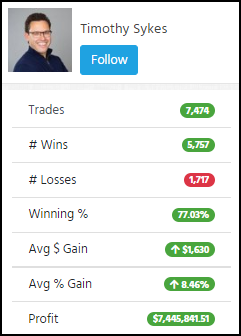

Anyone who is interested can look up every trade I take right here on profit.ly.

That’s also where I house my trading metrics.

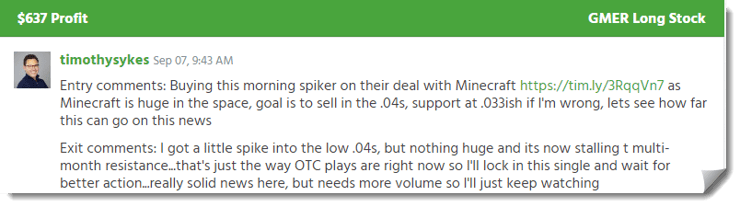

Every trade I log contains the following pieces of information:

- Entry Price

- Exit Price

- Date/Time

- Symbol

- Shares

That’s it. You don’t need to capture anything more.

In fact, most brokers provide a downloadable list of transactions on-demand, usually for tax purposes.

Along with those data points, I also drop in notes as to why I took the trade and executed it the way I did.

In the example above, I also included the stop area.

Using this information, I can calculate the following measures:

- Win Rate

- Average Profit

- Average Loss

- Average Position Size

Interpreting Your Results

Every trade we take has what’s known as an expected value. This is what I should make on average over time, wins and losses included.

As long as that number is positive, I’ll make money.

The expected value is calculated as follows:

EV = (Win Rate x Average Win) – (Loss Rate x Average Loss)

The average loss is just 100% minus the win rate.

Based on my stats, we get the following expected value:

EV = (77% x $1,630) – (23% x $1,129) = $995.43

That means every trade I take, assuming I take an average position size, I make $995.43.

You’ll notice in my stats box above that my win-rate comes in just above 77%.

With such a high win rate, my average losses can be greater than my average wins and I would still make money.

In fact, my average loss would need to exceed $5,450 before I would start losing money.

The higher my win rate, the less I need to make on an average win vs my average loss.

More Breaking News

- Kyndryl Holdings Stock Shows Mixed Performance Amid Market Turbulence

- QuantumScape Takes a Big Leap with New Battery Line

- Price Predictions Fueled by Company Moves In Market Dynamics

- Spotify’s Royalty Growth and Stock Upgrade Create Buzz

If my win rates are lower, I need to make more per average win.

The Fundamental Fix

Let’s say I’m new to trading and have yet to turn a profit.

The first thing you want to check is your win rate.

You need to improve your win rate if you win less than 40% of the time.

That means focusing on better setups until you get above 50%. Ideally, you want to get to 60% or above.

The only way to make money with a win rate below 50% is to achieve an average win greater than your average loss.

But as my metrics show you, I have a high win rate, and average wins greater than my average loss.

So you can have your cake and eat it too.

How is this possible?

Keep your losses small and fast.

I say this over and over.

But let me put it in practical terms.

Assume I achieve a decent win rate of 65% but still lose money overall.

I want to focus on reducing my losses without hurting my win rate. Or I can try to increase my average wins.

However, I found it easier to reduce your average loss without hurting win rates by focusing on getting a better entry.

It All Starts…

With the right setups.

No one needs to beat their head against the wall trying to find repeatable patterns.

I’ve already done the heavy lifting.

Get my #1 pattern that helped me earn my first million trading.

Leave a reply