I like to think of myself as the buffet of trading.

There’s a little something for everyone.

Whether you want to trade dozens of times a day or once a week, I’ve got something for you.

Because let’s face it – not everyone lives on the same schedule.

Half the time, I’m globe-trotting between my home base in Miami and building schools and homes in Bali.

Check out my Instagram or Twitter and meet this family in Bali we’re helping put into a wonderful new home.

Spread awareness where you can!

Since I can’t sit in front of the computer all day, I focus on the times when the market provides the best opportunities.

And one of my favorites is the morning panic dip buy.

This is a great setup that many people can use, regardless of whether you have a $500 account or a $50,000 account, because it focuses on limiting losses and maximizing gains.

Let me walk you through an example trade I took in Ilustrato Pictures International Inc. (OTC: ILUS), where I used this pattern to walk away with a tidy little profit.

Morning Panic Dip Buys

If you had to buy a pullback, would you do it in an uptrend or downtrend?

Obviously, an uptrend is much easier to work with.

Small pullbacks in larger uptrends tend to get bought up.

The trick is to know when and where to jump in.

Now, I’ve written about morning panic dip buys in the past.

To start, I run a screener in the StocksToTrade platform.

I filter for tickers that saw increased volumes and decent gains recently. Ideally, they’re in multi-day uptrends.

Additionally, I use the Breaking News Chat room to identify news catalysts behind the move.

This team is an incredible resource for traders looking for the real headlines behind a stock’s move.

Plus, the team keeps tabs on chat pumps that can mess with premarket movers.

Keeping this in mind, here’s a taste of what I sent my mentorship students well before the market opened…

ILUS, NRBO, LGIQ are 3 low priced spikers worth watching for potential dip buys into any big morning panics, but I can’t just buy gradually uptrending or downtrending action and prefer intraday panics to chasing anything up too high. I made a little dip buying ILUS, but it was midday with no clear catalysts so I’ll look closer to the market open and ideally a news catalyst comes out too.

No joke, I sent this at 1:15 a.m. Eastern, which proves a point. You don’t have to be in the market every second of the day.

I, and plenty of my students, do our homework after the market closes when we have time.

Ilustrato Pictures International Inc. (OTC: ILUS)

Once I had the stocks identified, it was a simple matter of waiting for a pullback to the appropriate levels.

If you want to make things easy on yourself, our StocksToTrade platform comes with automatic support and resistance levels created by our proprietary algorithm.

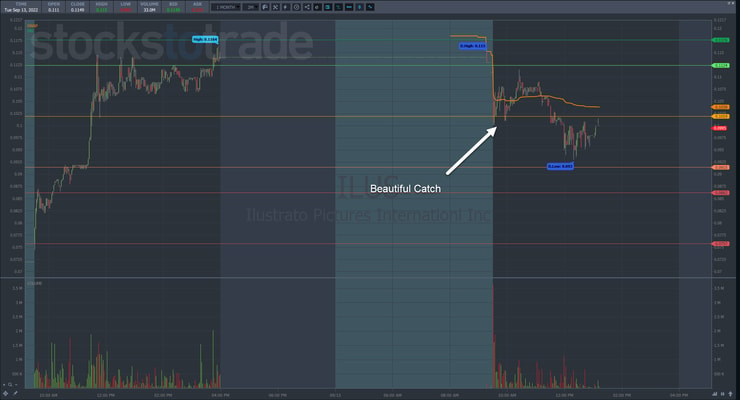

You can see how well they worked in the chart below.

But let’s say you wanted to do this the old-fashioned way.

I find support and resistance spots by looking at the swing points and consolidation ranges.

Here’s what that looks like in ILUS.

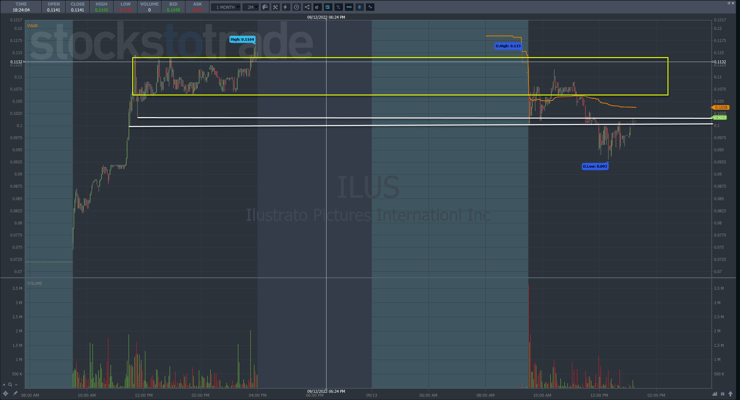

I drew a yellow box around the closest consolidation area.

However, that wasn’t far enough away to really give a good pullback.

The next two white lines come in where the stock made a swing low on the one-minute chart.

That was far enough away to offer a nice sized pullback.

Ideally, I want to see the stock yank back in there quickly and then stop on heavy volume.

When you see volume increase and candlesticks go from long bodies to narrow ranges, it’s a sign that buyers are stepping up to purchase shares.

I also rely on signals I get from level 2 data.

I often let the stock show me it made a bottom before jumping in. That way, I’m not the first one in and I have a low to trade against, narrowing my risk.

And that’s a big part of trade management.

To generate consistent gains over the long-haul, I cut losses quickly and keep them as small as possible.

That’s why you’ll see my average win is much larger than my average loss.

Remember, trading doesn’t need to be complicated. All it takes is one setup to change everything.

—Tim

Leave a reply