Two of the biggest misconceptions I hear about trading are:

- You need a lot of money to get started

- You have to give up your job or school to trade

After +20 years of trading my own money and 15 years of teaching people how to trade, I can confidently say both are untrue.

You don’t need much money to get started and don’t have to give up school or a career to trade.

Most of my now-millionaire students started with just a couple thousand dollars.

I made seven figures in 2020 and 2021, trading part-time. So I know from personal experience you don’t have to trade full-time to get incredible results.

In fact, there are several strategies I teach that require minimal time.

Today I’ll share with you what one of those strategies is.

Plus, the most important element you NEED to pull off the strategy and how it helped me make over $7.4 million in trading profits.

Table of Contents

One Of My Favorite Strategies To Trade

I spend most of my time traveling, working on my charitable foundation, and mentoring students. Trading has become a part-time gig for me.

Nonetheless, I made $1.19 million in trading profits in 2020 and $1.07 million in 2021, trading part-time.

I’ve learned to trade around my hectic schedule.

And of my favorite strategies is the Weekend Trader.

I love it because this trade happens on Fridays around the same time every week.

So if you’re someone who can only dedicate 1-2 hours per week to your trading, then this is the strategy I would tell you to study and master.

It has delivered some of my biggest gains in 2023.

On February 24th, I utilized the strategy to make $1980 in profits (I risked $2,955 in capital), a gain of 67% in just a few short hours on the ticker symbol FAGI.

It also delivered my biggest winner of 2023, a gain of $6,876 (I risked $30,863.25 in capital) in the ticker symbol GTII.

For a full detailed breakdown of the strategy, watch this.

The short version of the strategy:

- The stock must have a strong catalyst

- The price action must be clean

Often, traders zone out on Fridays, they’re ready to shut it down for the weekend, and they often miss stuff that happens late in the afternoon.

That’s why you get a delayed reaction when some companies issue a press release late on Fridays. The big move doesn’t happen until Monday.

In other cases, in the world of penny stocks, a company will tell you in advance that a press release is coming, potentially over the weekend. They do this to pump their stock. And just like my previous example, you might get a delayed reaction, with the stock not making its big move till Monday.

It’s how I found FAGI and GTII.

There’s a little bit more to the strategy, and if you want to learn more about it then click here.

How Traders Mess This Strategy Up

Most people who get into trading do it because they want to make more money, improve their financial position in life, and reach their financial goals.

But their actions don’t align with their goals.

For some reason, they think they must always be trading to make money. And they’re constantly looking for stuff to trade.

That’s not the way you should be looking at this.

You should only be trading because you feel the opportunity makes sense and the risk-to-reward is in your favor.

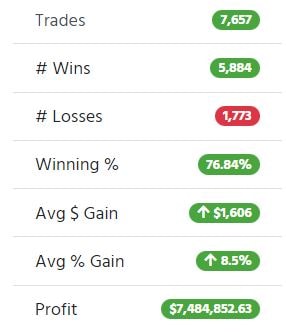

Check out my stats:

I don’t trade for the sake of trading. I trade because I think I can profit from the setups I see. Of course, I never know what trade will be a winner or loser. That’s why I am willing to take my losses quickly.

When you first start trading, you know nothing.

You must invest your time studying and learning the setups, strategies, catalysts, and patterns.

But studying doesn’t mean trading aggressively. If you do trade, it should be tiny amounts because it takes time to learn all this stuff.

My best students didn’t make money their first year. Some it took two and three years before it started to click for them.

After developing your skills, you must master the next step…

Patience and Discipline.

Last Friday, I was on the prowl for my Weekend Trade.

I scanned these stocks:

ROBT

The company had some insider buying—a decent catalyst, but the price action is pretty weak.

RIVN

The company had a decent catalyst with a rumor that it was going to be producing 20% more vehicles than originally reported… but the price action was choppy.

More Breaking News

- AppLovin’s Stock Jumps Amid Optimistic Analyst Upgrades

- RITR’s Strategic Moves Signal Potential Growth Amidst Market Challenges

- Exponent Stock Boosted by Strong Q4 Performance and Dividend Hike

- Vizsla Silver Corp. Sees Stock Flux Amid Strategic Movements

AMBL

A potential press release is in the works regarding its lithium deposits. A decent catalyst, but if you look at the chart, the stock pops and fizzles quickly. So this was another no-trade for me because I didn’t feel the price action was strong enough.

At the end of the day I decided not to take a Weekend Trade.

I know it’s boring right?

But I don’t trade for the sake of trading. Every dollar I make in the market gets donated to charity. My job isn’t to just slap trades on. It’s to find high-quality setups and play them.

If you’re struggling right now, try to figure out where you are lacking.

Do you not have enough skills yet or are you just not patient and disciplined enough?

Either way, I can help you if you’re serious.

Leave a reply