2022 hasn’t been an easy market for anyone.

I read one headline that said the average retail portfolio is down 44%.

I watched countless traders get sucked in by promoters as momentum names like Carvana (NASDAQ: CVNA) and Peloton (NASDAQ: PTON), holding onto losing positions that only got worse.

Those that did turn a profit were forced to resign themselves to smaller profits to avoid getting chopped up.

Luckily, many of my Millionaire Challenge students heeded my warning from last November.

They’ve managed to stay in the green while so many others watched their 401Ks dwindle.

I went from making over $1 Million in 2021 to only earning $130K this year.

But I DID turn a profit.

This was a year for learning, not earning.

Instead, I focused my students on studying hard, identifying key patterns like my Supernova, and practicing solid risk management.

Because eventually, markets

But the tides are turning…

We could be in for one of the best markets for traders since early 2021.

Check out this YouTube video where I laid out my entire thesis.

Now, some folks will read the headers in this post and think I’m about to dive in head first.

But that’s not the case.

Let me explain how I plan to approach the next few months.

Because while there are tremendous opportunities, there’s also plenty of danger.

Table of Contents

Trading is a Means to an End

People confuse trading and investing all the time.

As a trader, I don’t worry about where the market is or when it’s going to bottom.

I’m more concerned with the opportunities and the risks.

2022 had so many negative catalysts that could have sent stocks spiraling:

- Inflation

- War

- Energy

The list goes on and on.

I spent more time on guard for a market puke than a run.

That’s why I kept my position sizes small, took profits early, and more importantly, cut my losses quickly.

I was in ‘protection’ mode.

Now, we’re starting to see what pundits like to call ‘green shoots.’

The economic data stopped deteriorating.

It’s not gotten better, but it’s slowly not getting any worse.

Typically markets bottom months before it’s reflected in the data.

This doesn’t mean the bear market is over.

What it does mean is there are likely to be more trading opportunities.

And for me, that’s what matters most.

Watch for Short Squeezes

With bear markets come short sellers.

As markets rise, those same traders start to get squeezed out of their positions.

Case and point – Meta Materials (OTC: MMTLP).

I’ve been all over this stock lately as it went from a Supernova to a multi-week runner.

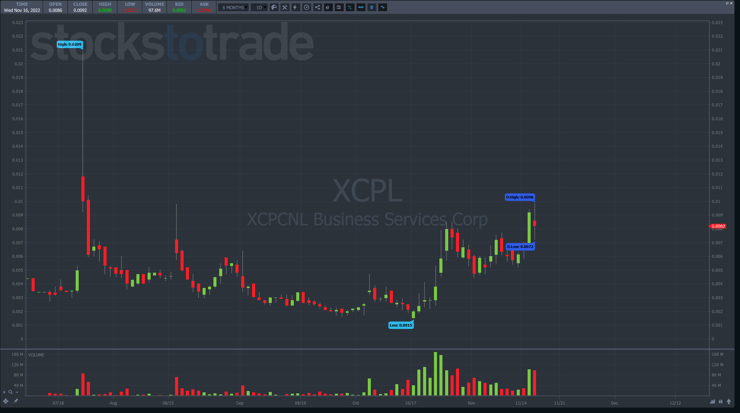

XCPCNL Business Services Corp. (OTC: XCPL) is another stock that’s been great for morning panic dip buys.

What’s different now is many stocks that typically faded after their first run are holding up for multiple days.

It’s not everywhere. But it’s happening in NASDAQ and OTC penny stocks.

The January Effect

This seasonal pattern isn’t anything new.

However, I look at it a little differently than most folks.

Investors like to sell their losing positions towards the end of the year to lock in losses for tax purposes.

This pushes already beaten-down stocks even lower, creating extremely oversold conditions.

That’s why you see many of the worst performing names from the prior year bounce back in January. Hence the January Effect.

Now, because everyone knows about this, you’ll see folks try to front-run this idea, leading to names popping in December and as early as November.

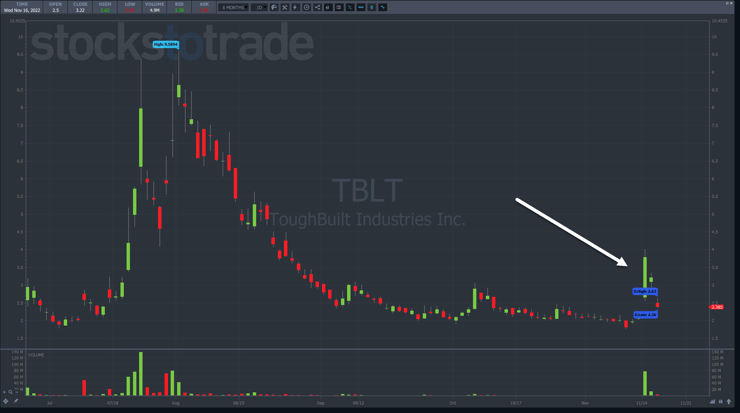

A great example of this is ToughBuilt Industries (NASDAQ: TBLT).

The long-term chart is terrible.

But a great earnings catalyst boosted shares for a couple of days, creating some nice trade opportunities.

When you dig into the intraday chart, you’ll see something that looks like stair steps.

This type of price action creates trading opportunities, even if only for a day.

Keep an Open Mind

People have this idea that you need to stick with your bullish or bearish bias.

They accuse me of changing my views too easily.

I tell them, yeah, I do.

That’s trading.

My opinion doesn’t matter.

The charts, the news, and the patterns are the only things that matter.

It takes practice, but once you push your ego aside and simply look at what’s in front of you, trading becomes SO much easier.

–Tim

Leave a reply