How much tax you pay on your options trading doesn’t have a simple answer…

One thing is for sure: if you don’t build taxes into your trading strategy, you won’t be profitable at the end of the day… or year.

I won’t sugarcoat this — options taxation can get pretty complicated. But that’s why I’m here (and more importantly, that’s why you hire an accountant).

I am not a tax expert. The following is just what I’ve learned in my 20+ years of paying taxes on my trading gains…

I’ve made more than $7.4 million in my career — and had to pay a good amount of that in taxes.

Let’s dive into the tax implications of options trading!

Table of Contents

How Does the Internal Revenue Service Handle Options Trading?

The Internal Revenue Service (IRS) handles options trading according to options contract type. The IRS divides options contracts traded on the market into two categories:

- Non-equity options

- Equity options

There’s also a third category that has nothing to do with the other two — employee stock options.

Before we go on, here’s an important note: IRS terminology differs from that of the financial industry. Many people consider themselves “traders.” But the IRS considers most retail traders to be “investors.”

There are a number of vague criteria that you must meet for the IRS to consider you a “trader.” These include:

- You must seek to profit from daily market movements in the prices of securities and not from dividends, interest, or capital appreciation;

- Your activity must be substantial; and

- You must carry on the activity with continuity and regularity.

How much activity is substantial? How do you measure continuity and regularity?

If you don’t already know the answers to these questions, you’re most likely considered an “investor.” That’s the audience this article is speaking to.

If you’re a “trader” according to the Internal Revenue Service, talk to a tax professional. You can also read IRS Publication 550 and IRS Topic No. 429 to learn more.

A good options trader has to know the lingo. Read my complete guide to options trading terms to start learning.

Categories of Taxable Options

We have three different types of stock options when it comes to tax purposes:

Employee Stock Options

Employee stock options (ESOs) are options contracts given to a company’s employees. They’re not usually traded on the open market. ESOs are usually used to entice new recruits or reward current staff.

There are two types of ESOs:

- Non-qualified stock options

- Incentive stock options

The main difference between these two options is how the gains are treated.

Non-qualified stock option gains fall into your ordinary income tax. Incentive stock option gains can be treated like ordinary income … but they can also be taxed at a preferential rate in some situations.

Equity Options

These factors influence tax on equity options:

- Contract holding period

- Position type

- How the options are settled

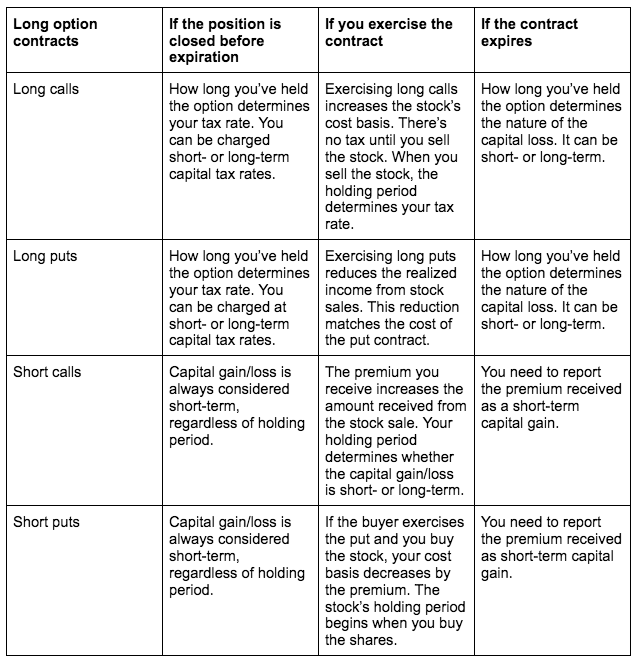

To make understanding equity option taxation easier, let’s break this down with a table:

This table only covers long and short options trades. Taxation is more complicated on strategies like spreads, butterflies, and straddles.

Do you use a lot of complex options strategies? Consult a tax expert to learn more about the tax implications.

Non-Equity Options

Non-equity options tax is regulated in the Internal Revenue Code section 1256. This code covers options contracts that represent futures, commodities, indexes, and currencies.

Gains are taxed at a 60/40 split between long-term gains and short-term gains. Here’s how to calculate tax on non-equity options:

- 60% of your capital gain/loss is taxed at the long-term rate.

- 40% of your capital gain/loss is taxed at the short-term rate.

You also need to report unrealized gains or losses each year. You can calculate them based on your held options’ fair market value on December 31st.

Calculating unrealized gains or losses will help determine your cost basis for the coming year.

Looking to learn more about options trading terms and strategies? Check my guides on spreads, strike prices, and swing trading.

How Much Tax Do I Pay on My Options Trading?

The tax you pay on your options trading depends on these factors:

- The type of option

- How long you’ve had the contract

- Whether you lose or gain money from the option

- The position type (long or short)

How much tax you pay on options is heavily influenced by what kind of trader (or “investor”) you are.

Non-equity options traders have more favorable tax treatment thanks to the 60/40 rule. Most employee stock option holders can also have their gains taxed as regular income.

Options trading taxes get more complicated with equity options. How much you’re taxed depends on the type of position and when you close it. Whether you post a gain or loss also influences your tax rates.

Binary options are pretty much gambling. If you’re going to gamble, make sure you don’t get scammed as well — check out the best binary options platforms in this guide.

How to Report Options Trading Income

You don’t have to report employee stock options until you exercise them. When you exercise those options, you usually exercise them through your employer. So, employee stock options gains are folded into ordinary income tax, which goes on Form W-2.

The same goes when buying open-market options, which include equity and non-equity options. You don’t have to report anything until the contract is exercised. When the options are exercised, you’ll report it on Schedule D of Form 1040.

Remember: it’s best practice to consult with a licensed tax professional with experience in options taxation for guidance.

How to Minimize Taxes on Options

There are a number of proven ways to minimize taxes on options trading. Here are some tax-cutting tactics you can employ:

- Trade long-term options like indexes and other non-equity contracts. The tax rate is simpler and usually lower.

- Open an Individual Retirement Account (IRA). Traditional IRAs let you deposit money to reduce your taxes that year.

- Double-check your tax forms to ensure everything is filed correctly. Putting in the wrong data might give you a higher tax bill.

- The most important tip of all: talk to a tax professional with experience in options taxation. They know the ins and outs of taxation and can help you minimize your tax bill.

Don’t worry more about your tax bill than your trading plan though. A good trading plan should include tax considerations…

But if you let them guide you, you might not make the best trading decisions in the first place!

Key Takeaways

Like the famous saying goes, there’s no way to get out of your tax obligation. Depending on the types of option you trade, your tax calculations may be simple or complicated.

For the most part, you don’t get taxed when buying options. You’ll only get taxed if you exercise your options and gain or lose money.

Learning how to file taxes on option gains is hard, but so is options trading. It might just be the hardest thing you’ll ever learn. You can make it easier by learning from a skilled mentor.

In the options world, I think there’s no better mentor than my former student Mark Croock.

Mark has racked up $4 million in career earnings, mostly from trading options. He’s done this by adapting my penny stock trading strategies to options. Before he was a teacher, he was one of my best students — watching every single webinar in the Trading Challenge 2 or 3 times!

Now he’s got his own mentorship program, called the Evolved Trader. Check it out for strategy sessions, trade alerts, a great chat room, and more!

Leave a reply