When you look at the market, it’s almost one red day after another…

And as it may surprise some, I expected it to happen…

Remember I wrote this blog post nearly 2 months ago: https://t.co/qlcF19y1Np Is The Market Setting Up For A Crash? ALL OF THE ISSUES ARE STILL IN PLAY RIGHT NOW…WELCOME TO WHY THE $DIA $SPY $QQQ ARE GETTING SPANKED AND THOSE #HODLing ARE GETTING A VERY EXPENSIVE EDUCATION!

— Timothy Sykes (@timothysykes) September 26, 2023

Even when the overall market is tanking, there are plenty of opportunities for you to take advantage of…

Here are just a few examples from yesterday…

- SciSparc Ltd. (NASDAQ: SPRC) soared over 75%…

- MSP Recovery, Inc. (NASDAQ: LIFW) soared over 50%…

- ShiftPixy, Inc. (NASDAQ: PIXY) soaring over 150%…

But there is one other stock that had me jumping for joy!

If you want to be successful at trading, you need to know how to spot some of the best opportunities out there, even in a declining market…

So today, I’ll be sharing with you four things I like to focus on every single day to help put me in a better position…

Let’s dive in!

Table of Contents

Step #1 – Is It A Runner?

Time and time again I remind my students to focus on big percent gainers, yet many of them don’t.

I can’t force you to do anything, but if you want to find some of the same trades as me, this is where I start every single day.

For example, yesterday I gave a watchlist to my students…

And one of the stocks on it was ShiftPixy, Inc. (NASDAQ: PIXY)

Just take a look at this chart…

Source: StocksToTrade

It’s ugly, just like the majority of the stocks I’ve traded over the last several weeks…

But notice that yesterday it was trading at its highest level in quite some time…

And I spotted this play early in the morning simply by scanning the market for big percent gainers…

Here’s what yesterday’s chart looked like…

Source: StocksToTrade

PIXY started spiking after Tuesday’s close…

And I immediately wrote this stock down and alerted my students to keep an eye on it for a possible morning panic.

At the time I’m writing this, I didn’t trade it, and you can see that the stock didn’t have a solid morning panic for me to take advantage of.

This is a clear example of how there will be times when a big percent gainer doesn’t offer you a setup for you to take advantage of.

Like most penny stocks, this will continue to fade…

But spotting this big runner early on put me in a position to be prepared to trade it if the opportunity was right.

Step 2 – Does It Have Volume?

Let’s face it, you don’t want to trade a stock that has low volume…

It doesn’t give you the volatility you need, and it’s just a recipe for disaster.

You’ll notice that the majority of my trades are stocks that are big percent gainers and have significant volume.

Here’s another stock that was on my watchlist yesterday morning…

SciSparc Ltd. (NASDAQ: SPRC)

Source: StocksToTrade

Another big percent gainer, but noticed how I circled the volume this time…

Even PIXY had the same spike in volume, and that’s what helps give us the volatility we need.

Take a look at this daily chart…

Source: StocksToTrade

SPRC had a solid short squeeze and broke out through its previous high of day at the time I’m writing this…

But remember, we don’t like to chase these types of plays, and I should’ve taken advantage of that early morning squeeze…

More Breaking News

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- Denison Mines Stock Surge Amid Strategic Developments

- Exponent Sees Promising Growth with Dividend Increase and Upbeat Q4 Earnings

Unfortunately, I didn’t, but once again this goes to show you how spotting an early morning spiker can help you think about what strategy fits the best.

3 – Is There Volatility

The reason I like trading penny stocks is because they’re cheap, follow predictable patterns, and are volatile.

For most traders, volatility is a scary word…

But if you want to know how to take the meat of the move like me, you must learn to thrive off of it.

Earlier I mentioned you should always be looking for stocks that are big percent gainers and have high volume…

This brings me to my next point, is the stock volatile?

In order to find volatility, I scan for very specific stocks…

They need to have…

- Price below $5

- Recent news/catalyst for movement

- High volume (at least 1 million shares traded on the day)

- Proven volatility (spiking more than 20%)

- History of spiking (Always look for former Supernovas)

I want you to go back and look at PIXY and SPRC and compare it to those five bullet points I just mentioned…

But remember, even if they do fit all those boxes, it doesn’t always necessarily mean it’s a guaranteed trade, it all depends on price action.

That’s why I constantly warn my students about what I’m seeing in real time to help them avoid making a disastrous mistake.

I love fast movers, but the price action has to be right…

That’s why I take a sniper approach when I’m trading and take the shot when I have a clear aim…

And for me, that’s usually waiting for a panic dip buying opportunity.

4 – Having The Right Tools

I always ask my students if they’re prepared every day they trade…

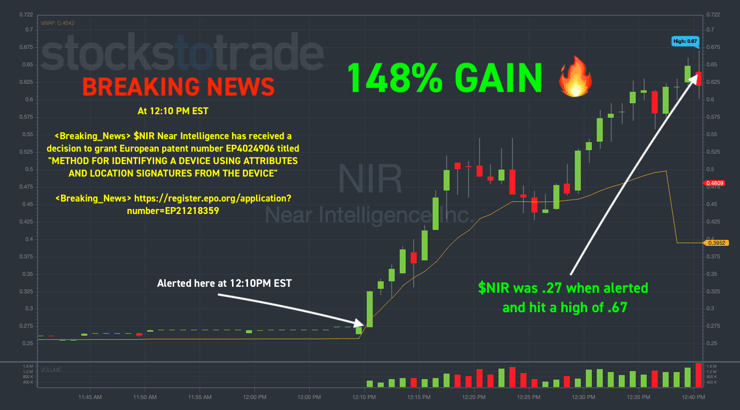

And if you were, you should’ve nailed Near Intelligence, Inc. (NASDAQ: NIR) yesterday!

Take a look at this chart…

Thanks to StocksToTrade Breaking News, I was able to lock in a 21.92% win! (Risked $2,737.50)

If you’re not using StocksToTrade Breaking News, these are the types of opportunities you’ll miss out on…

Let’s face it, you’ll never truly know what the market will throw at you…

So every day you need to be prepared, and you can do that simply by focusing on big percent gainers and keeping an eye on StocksToTrade Breaking News…

And also by taking advantage of these FREE Trading Sessions.

Keep studying and practicing…

I’ll see you all here tomorrow!

-Tim

Leave a reply