Yesterday, I highlighted an epic trade that several of my millionaire students dominated for close to $1 million in combined profits.

No question, everyone wants sick results like Jack Kellogg’s $377,795+!

Yet, I wouldn’t suggest that type of trade for folks new to the game.

Some trades are easier than others.

But you can do incredibly well with just a few, well-placed trades on simple setups.

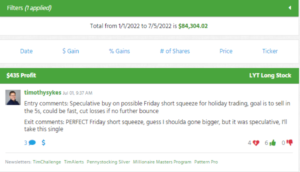

The setup I used for last Friday’s trade was one of the easiest in my library.

Some people look at my win and think,

Tim, why don’t you try and go for more?

Traders that ask this question miss an important statistic from my account…

I’m up more than $80,000 this year!

Taking obvious, easy trades where I keep my losses small netted me a healthy profit this year.

This is how I start with all the traders who join my millionaire challenge.

And I want to show you how just a few key setups can transform your profitability.

Click here to continue reading

Basic Math

I’m going to make a bold claim…

$1 million in profits is achievable with just 3 trades a week and a small account.

Don’t take my word for it.

Here’s the math behind it.

According to my stats, I win about 77% of my trades. But let’s say I win roughly 66% or two out of every three trades.

Now, let’s assume I risk $100 to make $100 on every trade with a $5,000 account, or 2%.

This first week would go something like this…

Win $100 + Win $100 – Lose $100 = $100.

This would be reasonable if I were restricted by pattern day trading.

Now, assume I keep at it, risking 2% on every trade.

With each trade, I’d gain roughly 0.667% of my account on average.

Starting with $5,000, it would take me 797 trades to turn $5,000 into $1,000,000.

At three trades per week, that would take 266 weeks or about 5 years.

That might sound like a long time. But, I know plenty of traders who have struggled for more than a decade to turn a profit.

For them, this would be incredible.

But I also want you to keep in mind that this is a very conservative take.

Ideally, I want a position that pays out more than I risk.

If instead of risking $1 to make $1 I risked $1 to make $3, I would only need 161 trades to get to $1 million, or one year at three trades per week.

I’m not saying this is easy.

Jack Kellogg actually lost a few thousand dollars his first year trading.

But he kept at it and slowly but surely became consistently profitable.

Find Your Bread & Butter

At the end of the day, there are probably less than a dozen setups I trade.

I like to think about my trades as chapters in a book.

Each trade has its basic components.

From there, I add or subtract information that helps or hurts me.

On Friday, I bought a short pullback on the one-minute chart in a strong uptrend with a squeeze setup and a coming holiday.

It’s like baking a cake.

The pullback buy is the base. The squeeze setup is an additional layer with the holiday timing as the icing.

For the mathematically inclined, assume your base setup works out 60% of the time.

Each advantage you add to that increases the win rate by 5% (hypothetically).

Now, buying into strength like that isn’t always a good strategy.

If that same stock hadn’t dropped like a rock, instead closing lower day after day in a slow bleed, I’d be more inclined to use my morning panic dip buy.

But in this case, buying a small pullback into strength made sense.

Use your trading journal to categorize the trades you take.

From there, identify the ones that you execute consistently and turn a profit.

Focus on just those and making them even better.

Once you can consistently turn a profit on that small subset, then you branch out.

Even just one great trade per week can do wonders.

That’s why the discovery of my Supernova pattern was so enlightening.

Once you understand its mechanics, this pattern offers so many different ways to trade the same stock.

And this pattern repeats over and over.

If you aren’t familiar with it, I highly recommend you check it out here.

—Tim

Leave a reply