Everyone on social media loves flashing their big wins and projecting themselves as bulletproof to trading losses.

But the truth is, losses are part of the game.

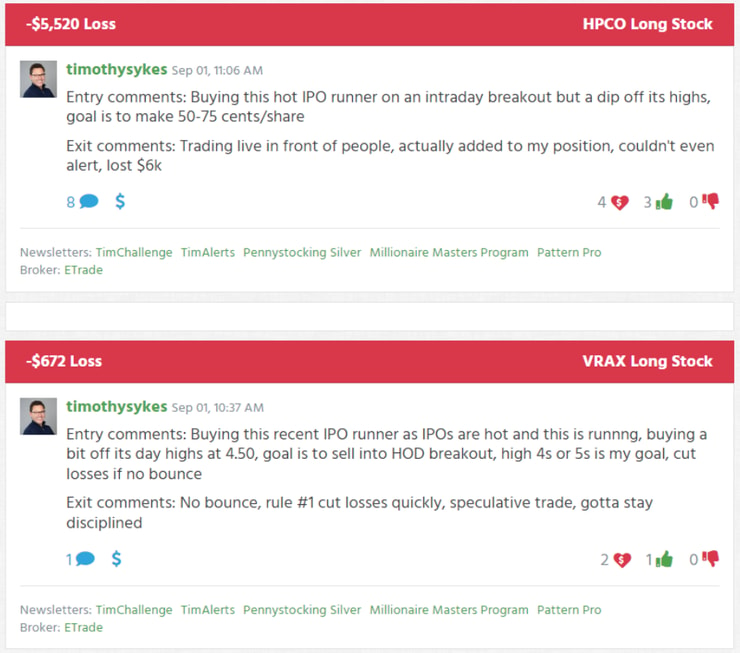

And while I consider myself an extremely disciplined trader, I occasionally will take a loss bigger than I’d like, which is what happened last week when I lost $6,000 in HPCO—my biggest trading loss of 2022.

Beating yourself up after a loss, revenge trading, or blindly following others won’t help you get those losses back.

They can ruin your trading psychology and put you in an even bigger hole.

That’s why I want to share with you my three best strategies for bouncing back after a big trading loss.

I’ve nearly recouped my losses from last week in just a few short days by applying them.

Tighten Your Belt

Hedge Funds, Algorithmic Traders, and all of Wall Street are trying to eat your lunch.

Whenever you experience a large loss—you have to be extremely careful and not let it spiral out of control.

And while I preach taking small losses, even I, after decades in this game, can slip up and take a bigger loss than I’d like. This is what happened last week when I took a $6,000 loss in the ticker symbol HPCO.

Most newbie traders will come out guns blazing…thinking they need to make up their loss immediately. Of course, this usually leads to further account destruction.

Instead of seeking revenge, you’ve got to slow things down and tighten your belt.

You see, as much as you’d like to get those losses back…

You don’t control the markets. There might not be any worthwhile opportunities to take at the time…

So instead of forcing the issue…you’ve got to be even more patient. Because the last thing you want to do is add to losses and ruin your psychology.

That’s why it’s not a bad idea to just watch the day after a bad trading day.

Or limit yourself to one trade.

When things aren’t going your way…slow down.

Review Your Strengths

Domino’s Pizza is a $13 billion business. What they did to separate themselves from the competition wasn’t making a better pizza…

Instead, they focused on their strength. They promised customers free pizza if it wasn’t delivered in 30 minutes or less.

Their edge was speed.

When you suffer a trading loss, it’s not uncommon for your confidence to be shot. That’s why I recommend reviewing your past winners and identifying your strengths.

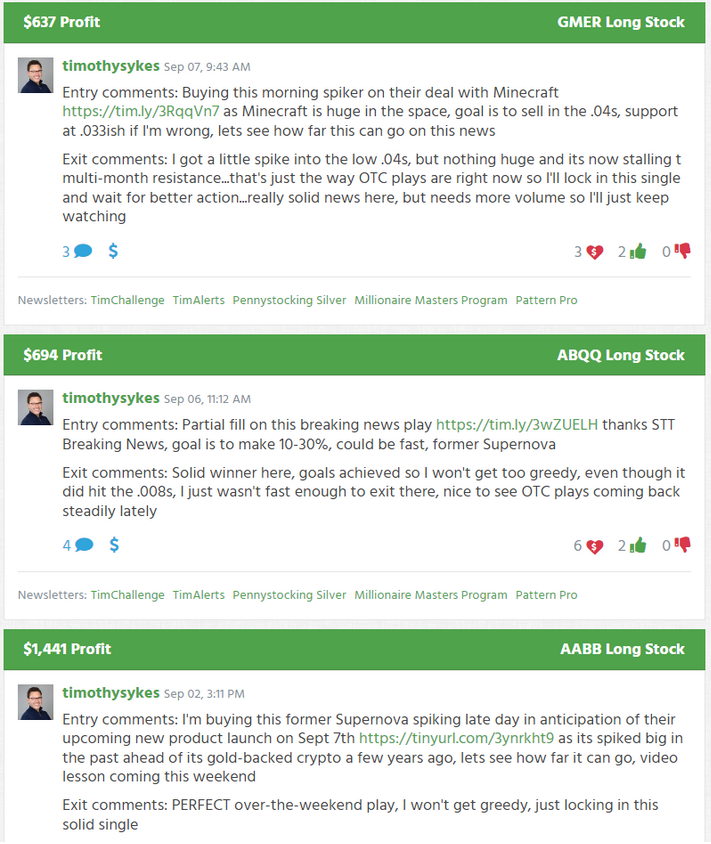

My best trades have been off of breaking news plays, buying dips on panic sell-offs in OTC stocks, and my weekend strategy.

So that means no more fooling around trading IPOs, high-dollar stocks, and non-OTC stocks.

More Breaking News

- CoreWeave Shares Soar with Nvidia’s $2 Billion Boost

- BofA Price Target Cut Casts Shadow on SoFi Technologies

- Micron Stock Faces Pressure Amid Insider Selling and Analyst Downgrade

- Bitcoin’s Plunge Triggers Decline in Cryptocurrency Stocks

If you’re in a trading hole, the best way to get out is by focusing solely on your best setups. Reviewing your strengths gives you a better idea of what you should be trading.

Trade Smaller

I’m a big believer in chipping away at big losses. That’s why I typically trade smaller after a sizable loss. This allows me to build my confidence back up slowly and gain momentum along the way.

In addition, it gives me a chance to see if I’m reading the market correctly. I want to know if my process and strategies are working. I don’t want to be worried about “what if I lose again or take another hit.”

Trading smaller lets you get your head back in the game and work out your issues.

And that’s exactly how I’ve been playing it since my HPCO loss.

Bottom Line

I am coming off my worst trading loss day of 2022. But by focusing on my strengths, playing small ball, and staying patient, I’ve cut my losses in half in just a few short days.

Taking a big loss sucks, and it can ruin your mental game and trading account if you don’t take the right steps.

While I might not be the world’s best trader…

I’ve been able to consistently make money year after year.

Furthermore, I’ve helped over 20 of my students become millionaire traders.

I don’t know anyone else who can say that.

And here’s the thing…

You don’t have to take on crazy risks and swing for the fences to make generational wealth in the stock market.

In fact, you just need to master a couple of strategies and have a solid risk management plan.

Nowadays, everyone on social media seems to brag about their big wins…but you never hear about the losses. Risk management has always been the key to my success.

And the reason why I’m still around…while so many others have faded.

If you’d like to discover more about my process, how I’ve made over $7.4 million in trading profits, and how I’ve helped so many people achieve financial freedom, then Click here to learn more about my coaching program.

Leave a reply