There’s a new opportunity to profit every single day!

The 2024 market continues to impress investors.

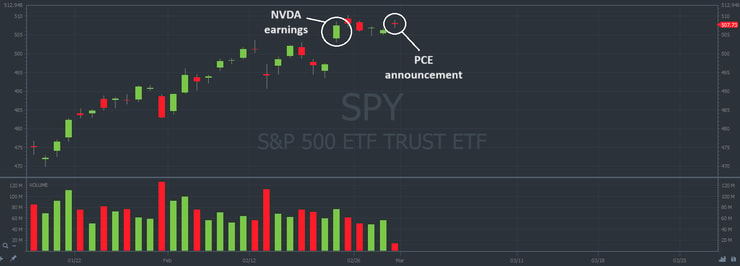

There were some worries that the FED’s preferred inflation gauge would show persistent inflation.

The data came out on February 29: Personal Consumption Expenditures (PCE) showed inflation at a 2.4% year-over-year in January. That’s down from 2.6% in December of 2023.

We’re moving in the right direction. And the market is pleased. S&P 500 ETF Trust (NYSE: SPY) shares rallied post-PCE announcement.

Here’s a chart …

When the stock market is hot, there are more opportunities for small-account traders to profit.

And as you can see from the chart above, the market’s on a bull run in 2024.

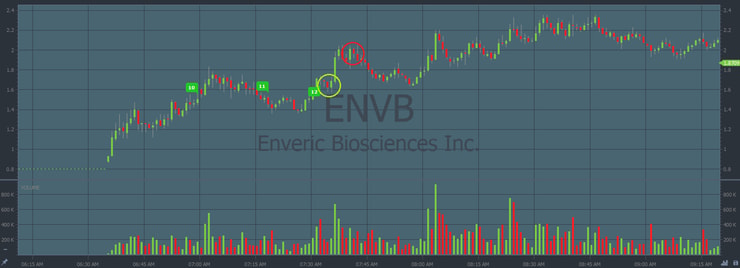

Most recently: I traded Enveric Biosciences Inc. (NASDAQ: ENVB) yesterday when it spiked 250% with bullish news about a new out-licensing opportunity with another, undisclosed biotech company.

But as you can see from my trade below … these plays move fast.

Don’t worry, there’s a way to catch these runners before they go vertical.

That’s how my millionaire students and I profit from the market’s hottest stocks.

My Trade Notes

My starting stake was $7,785:

Some people don’t think $500 is a lot of money to make on a trade.

Don’t listen to the haters.

We’re small-account traders. This is how we can build wealth in a stock market that favors Wall Street whales.

Small profits add up. I’m already at $54,000 in trading profits in 2024. And it’s still the beginning of March …

But most people don’t know how to access these runners.

You won’t hear about these plays from CNBC or Yahoo Finance. By the time you read about it in the news the spike could be over.

These are penny stocks. They can spike to insane heights but they will crash eventually. That’s why we trade them, instead of investing.

There’s no telling what will happen to ENVB today or tomorrow. The news was bullish, but the price doesn’t deserve to spike 250% …

You need to have eyes on these plays early!

I’m overseas right now so I’m trading premarket. But there are intraday opportunities too. It all depends on what works for your schedule.

For example, I missed the bigger move on ENVB during regular trading hours. Look at this intraday profit opportunity.

The price consolidated above support and rallied to new intraday highs:

The Next Runner

All of my students had an opportunity to build a position on ENVB.

StocksToTrade Breaking News alerted the play during premarket. All a trader had to do was identify support and resistance levels.

See the Tweet below:

This 2024 market is pushing stocks higher every day.

I don’t know how long it’s going to last.

But I do know: We have an amazing opportunity to build wealth RIGHT NOW.

ENVB wasn’t the only stock I traded yesterday …

These are all the trades that I made on February 29.

Make sure you’re early for the next big play: Wait for a Breaking News alert.

Then identify support and resistance to build a trade position.

It’s not rocket science, but it does take some getting used to. Lean on Breaking News until you grow proficient.

Cheers.

Leave a reply