Hey Trader. Tim Here.

Shopify (NYSE: SHOP) traded at $1762.92 back in January.

So when shares dropped to $1,000, some folks probably thought it was a steal…

…down too much and poised for a bounce.

Today, it trades at $390.

If you’re still trying to figure out how to pick bottoms in this market…STOP!

Picking tops and bottoms is a fool’s game.

I turned $12K into $7M from trading stocks. I can tell you, none of those profits came from me trying to pick bottoms.

Instead, you want to wait for a top or bottom to form.

It might seem counterintuitive and totally at odds with my #1 Supernova pattern.

But there’s a good reason.

Waiting for a top or bottom to form gives you something to trade against.

And this is CRITICAL to risk management.

Because I always say, lose small and fast.

So how can you do this without knowing where your stop and targets are?

Yes, you could just go with stiff percentages like 5%-10%.

But let me show you why you should wait for highs and lows to form.

Trading in the open

Back in March of 2020, markets were in absolute freefall.

How many traders and investors do you think tried to catch the bottom, only to watch stocks go even lower?

If you took a trade, could you tell me how wide your stop should be?

Flat percentages work fine when everything is normal. But what about when volatility increases? How do you adjust them?

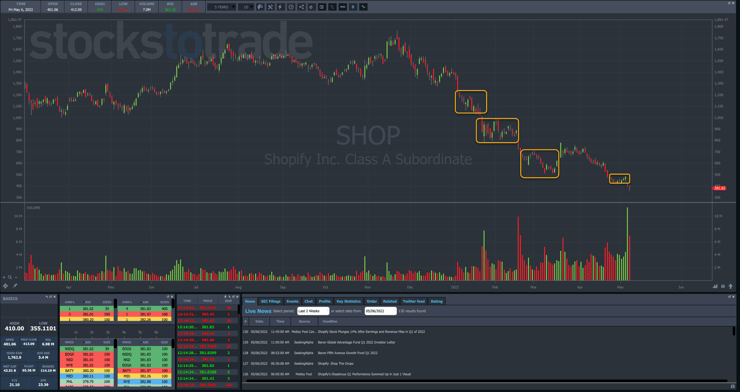

Take a look at the chart of Shopify going back a year or so.

I highlighted four different areas where shares took a brief pause before they continued lower.

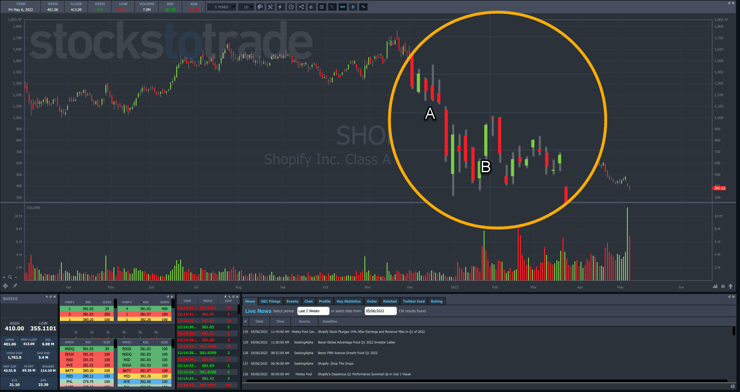

Let’s zoom in on the second one that sits right below $1,000.

You’ll notice there are two labels A and B.

Imagine you tried to buy somewhere in that first long, red candle next to A.

You might get the bottom. More likely, you’d get somewhere between the high and the low.

But while you’re in that trade, you’d have no idea how much lower price could drop.

What if instead, you waited for that first green bounce candle and then bought a retracement of that candle using the low as a stop?

That sounds a whole lot easier than hoping you got the bottom.

You see, there’s a lot more risk involved when you don’t know where the low or bottom is.

When you wait for a bounce, you can at least define your risk.

Plus, you also know that based on the chart, buyers overwhelmed sellers at least for a short while.

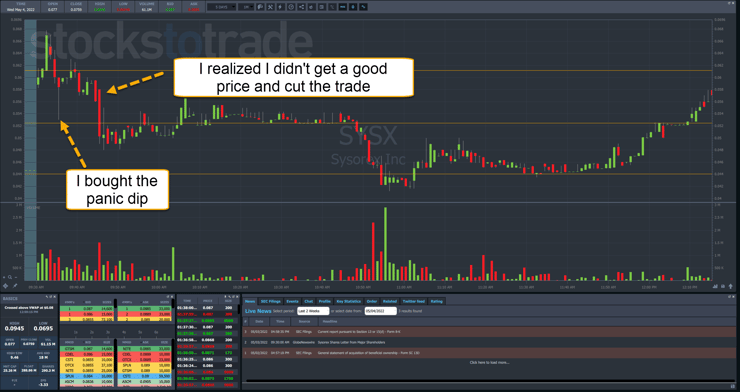

Let’s go back to a chart from one of my trades earlier last week, Sysorex (OTC: SYSX) so I can show you how this might apply in a real trade.

If you recall, I waited for the panic dip to occur before I bought into the stock.

That gave me two potential stops to use: the panic low or the low of the upper trading range.

In this particular trade, I didn’t see the bounce immediately so I cut the position for a slight gain.

Now, I mentioned that I should have probably waited for the stock to drop into the $0.04s area.

Thing is, that’s a big range.

So, how might I have found an entry point?

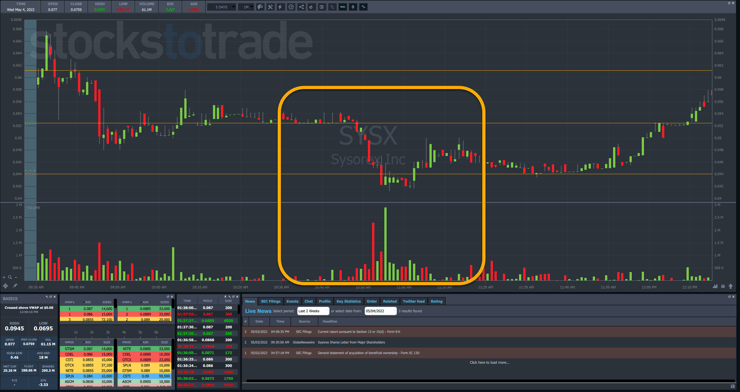

Take a look at the area below I highlighted.

What you’ll notice is that shares rang into a support line I previously identified on heavy volume and simply stopped.

That’s about as clear a signal as you can get that the stock has found a temporary low.

It could be the permanent low, but we don’t know for sure. However, since there was heavy volume and it was a previous support level, that increases the odds it becomes a low.

Knowing that, we can structure a trade using the low of that trading range as our stop.

For example, I could wait until the stock breaks higher out of the range and then buy it on a pullback, or simply buy the stock against the low.

The former tends to be easier to work with as price can spike the low a few times just to stop out longs.

Start with this pattern

My Supernova pattern is a great place to apply this concept.

It’s my #1 pattern and the same one I used to help make my first $1 million trading.

Leave a reply