While my trading techniques can work for anyone, they do especially well with small accounts

Back in December 2020, she became my first six-figure female student.

She joined my millionaire challenge shortly after high school a few years ago.

Like many of my challenge students, Mariana started with a small account.

Today, she is one of my top millionaire students, passing on the knowledge to others.

Small accounts are nothing to be ashamed of. Everyone has to start somewhere.

The problem most traders run into is they pick the wrong stocks at the wrong time.

They either grab a stock that goes nowhere or buy near the highs right before shares plunge.

Let me show you a different method to identify juicy stocks and select setups that maximize a small account’s potential in ways you never thought possible.

What’s Moving & Shaking

2025 Millionaire Media, LLCEvery morning I do two things.

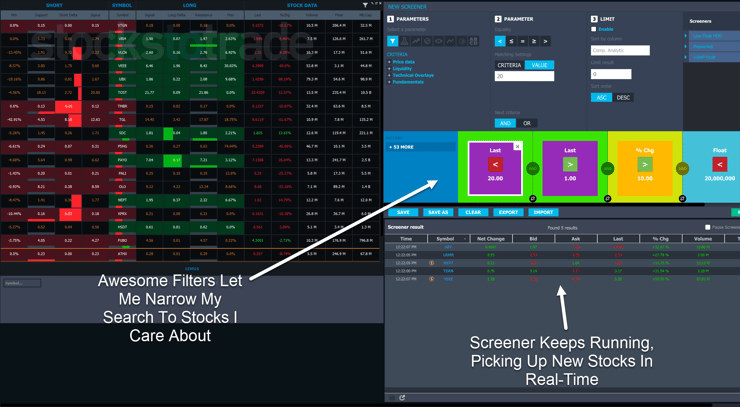

First, I run a scan using our StocksToTrade platform.

What I love about this particular screening software is that it allows me to narrow my search beyond the basics of high volume and low price.

I can also add in things like:

- Share float

- Premarket change

- # of trades

- VWAP and other useful indicators.

Plus, I can keep the screener up and running all morning so that it populates new results as they happen in real-time.

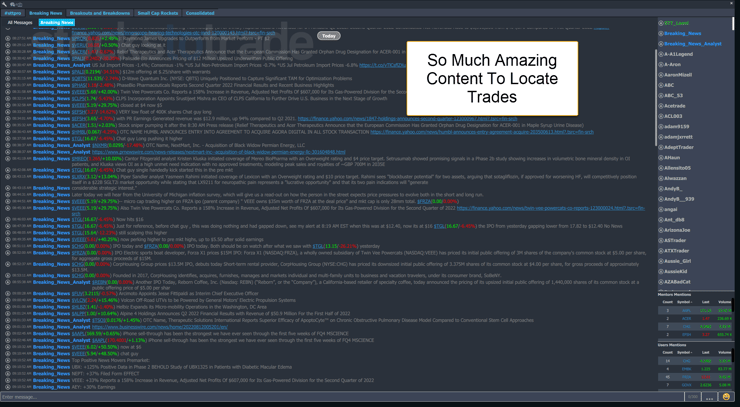

The second thing I do is turn to our Breaking News Chat Room on the StocksToTrade Platform.

Of all the tools I use, this is the single best one for finding potential plays as they’re happening.

You see, our Break News Room is run by two incredible analysts who sift through the headlines and only deliver the ones traders want to see. Plus, they offer important context as well as keep a pulse on social media and popular chat rooms.

These two tools help me quickly identify stocks with positive news catalysts and the potential for big moves.

Ideally, I want to see a stock moving +30% in premarket. The bigger the move the better.

Picking My Spots

2025 Millionaire Media, LLCOne of the easiest ways to cut risk is to give yourself something to trade against.

Let’s say I find a $0.10 OTC stock opening at $0.15. Shares immediately run higher to $0.25 before pulling back.

If I want to take a long position, there are two options: buy into the trend and hope it continues or wait for a pullback and buy for a reversal.

I like the second option for small accounts and here’s why.

Take that $0.10 OTC stock that ran to $0.25 and begins to pull back.

At that point I have three key prices:

- Prior day’s close of $0.10

- Current day’s open of $0.15

- Current day’s high of $0.25

If I’m buying a stock up 50% from the previous day, I don’t want to see it drop below the day’s low.

So, the range I would work with is $0.15 to $0.25.

Here’s an obvious truth.

The closer I can get my entry to $0.15, the lower my risk and the higher my possible reward.

Say I expect any bounce only to make it back to $0.20.

Buying at any price below $0.175 gives me a greater potential reward than risk.

However, that’s a conservative view of the trade.

I choose to trade big movers because they can run for huge gains.

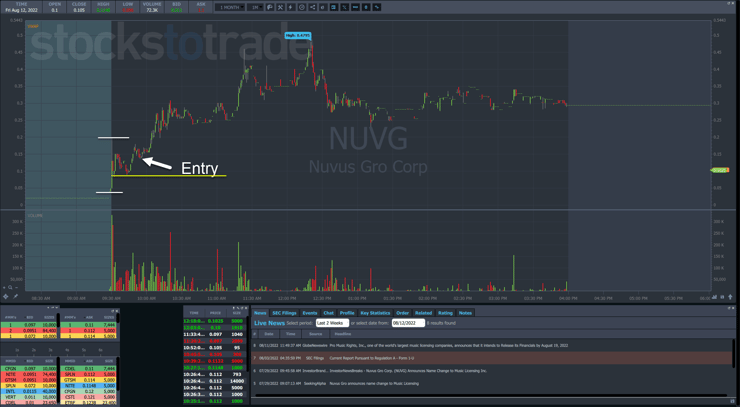

Take a look at this chart of Nuvus Gro Corp. (OTC: NUVG).

The dotted green line shows the prior day’s close.

I drew two white lines around the opening low and high and an arrow to identify my entry.

Although it’s not huge, I bought this stock on a small dip at $0.14.

With the way I trade, I would cut the position if shares didn’t start moving higher quickly.

Most of the time, that means I would only lose a small amount, if anything at all.

But let’s say I wanted to use a stop level. I don’t have to use the entire opening range.

The bottom of the prior dip works just fine around $0.10.

That might seem like a lot. However, the high of the day was $0.20. So, I had more upside potential than risk, even being conservative.

More Breaking News

- MARA Stock Surges: What’s Driving This Growth?

- Rhythm Pharmaceuticals Faces Rising Prospects Amidst Clinical Trials

- EVOK Stock: Boom or Bust?

And as you can see, trades like these have the potential for serious runs that can lead to incredible profits.

The Bottom Line

The key to growing any small account is taking smart risks.

Find the right stocks with the right setups that offer as little risk and as much reward as possible.

—Tim

Leave a reply